DD, EAT, FCX, JNJ, TRV and VZ.

DD, EAT, FCX, JNJ, TRV and VZ.

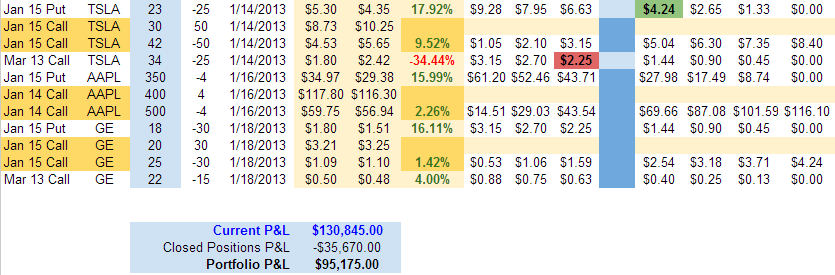

That's just before the bell. We're hoping FCX misses so we can put it in our virtual Income Portfolio (see yesterday's update), which is now up so much (19.7% in 7 months) that we should really consider cashing out, because the chances of matching that performance for the next 7 months is statistically unlikely and our goal was to use a $500,000 account to make $48,000 a year in a conservative portfolio that would be low-touch and suitable for someone who is retired and looking to draw an income.

Since $95,175 is almost 2 year's worth of our earnings goal in our first 7 months and, since we're only 50% invested so far (never had a chance to go full), we could just shut it down, take the cash and reward ourselves with a nice cruise or whatever it is old people do when they make bonus money.

And that's what it is – bonus money. It's not NORMAL to make money this fast – especially in our conservative portfolios and that makes me very, very nervous and should make you nervous too. Markets go up AND they go down – where's the down? It took us two weeks to fully review the Income Portfolio positions for Members and, since I started back on the 7th, we jumped from +$58,660 to + $95,175 and that's up $36,515 on less than $250,000 invested ($480K in margin) in just two weeks – that's 14.6% by itself and THAT'S NOT NORMAL! Certainly not with a hedged portfolio.

And that's what it is – bonus money. It's not NORMAL to make money this fast – especially in our conservative portfolios and that makes me very, very nervous and should make you nervous too. Markets go up AND they go down – where's the down? It took us two weeks to fully review the Income Portfolio positions for Members and, since I started back on the 7th, we jumped from +$58,660 to + $95,175 and that's up $36,515 on less than $250,000 invested ($480K in margin) in just two weeks – that's 14.6% by itself and THAT'S NOT NORMAL! Certainly not with a hedged portfolio.

One of the reasons we're out-performing is the low VIX (Dave Fry's chart, left), which is at multi-year lows. Since we concentrate on selling premium (being the house) and not buying it (being the sucker), a falling VIX is very much to our advantage in a portfolio where we've sold a lot of long-term volatility. That, of course, can be a temporary situation and paper losses can disappear as fast as they appear.

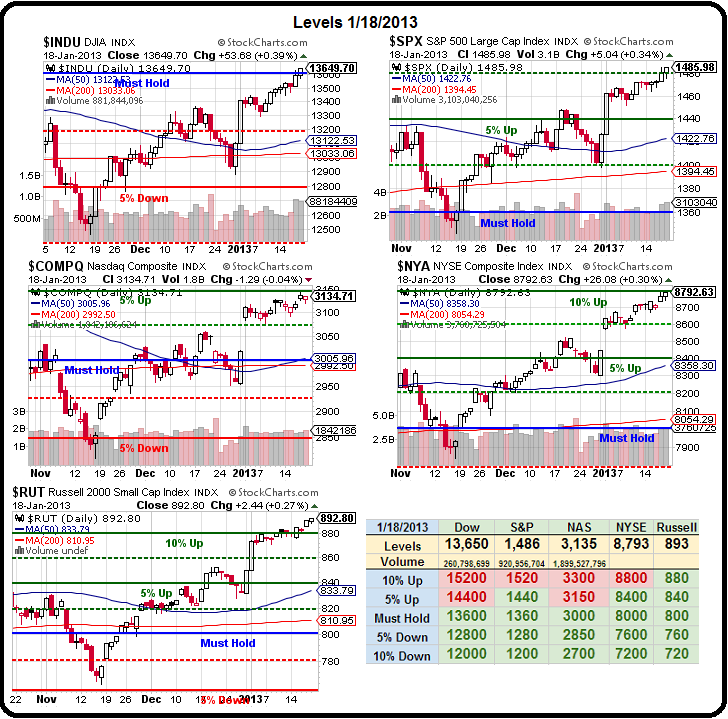

To some extent, we attempted to lock some of our gains in by selling more calls and improving our TZA hedges (and adding an SQQQ hedge as well) but it's no substitute for good, old-fashioned profit-taking and, if we can't hold our tippy-top levels (the technical term) on our Big Chart – we need to strongly consider cashing out and taking that cruise and we'll come back to port when the market settles down.

To some extent, we attempted to lock some of our gains in by selling more calls and improving our TZA hedges (and adding an SQQQ hedge as well) but it's no substitute for good, old-fashioned profit-taking and, if we can't hold our tippy-top levels (the technical term) on our Big Chart – we need to strongly consider cashing out and taking that cruise and we'll come back to port when the market settles down.

One of the hardest things for traders (and gamblers) to learn how to do is quit while they're ahead. Depending on which way earnings blow this week – this may be one of those times. Short-term, if the market falters, we'll have a blast on the way down – but that's not what our Income Portfolio is about and cash may be better than trying to ride these positions down. And then think of how much fun we'll have bottom-fishing again on the dip!

Meanwhile, we're going to raise the bar and say we've got to hold 13,600 on the Dow, 1,480 on the S&P, 3,100 on the Nas, 8,600 on the NYSE and 880 on the RUT. Those are harsh upward adjustments, but that's because we'd like to keep our ridiculous gains so 3 of 5 of those fail and we're going back to cash – there will always be plenty of new trades to make tomorrow if we have cash in our pockets – especially when it's 20% more than we started with!

I am still long-term bullish on the market but we have to consider the possibility, maybe PROBABILITY, of a bearish correction. As you can see from Dave's NYSI, we're not quite overbought yet but only one of the last 6 times did we wait to be overbought before correcting – the market doesn't always give such clear signals.

I am still long-term bullish on the market but we have to consider the possibility, maybe PROBABILITY, of a bearish correction. As you can see from Dave's NYSI, we're not quite overbought yet but only one of the last 6 times did we wait to be overbought before correcting – the market doesn't always give such clear signals.

Dow components TRV and DD reported good earnings already this morning (8:30) but VZ disappointed BUT they had hurricane charge-offs and lots of up-front payments made to AAPL and other smart-phone makers on strong sign-ups so perhaps a buying opportunity there and JNJ also had nice earnings but the 2013 outlook is disappointing so they are trading down a bit.

That's 13% of the Dow reporting this morning and nothing, on net, to ruin things at 13,600 so far. IBM is a Dow heavyweight and reports this evening but so does Google and AAPL reports tomorrow so, what else really matters this week? Amazingly, with about 30 hours to go before earnings, AAPL is STILL trading at just $500 a share.

In theory, they will earn roughly $13.42 per share (current estimate) and that estimate is down from $15.45 that was expected when they gave their last earnings and much lower guidance back in October and the stock is down 15% from there (around $600) and down 28% from the $700 high in September. We thought $700 was too much at the time but we thought $555 was "just right" and that's still our target for after earnings and $14 a share (small beat) divided by $555 is 40 and divide that by 4 quarters (assuming they do no better in 2013) and we have a p/e of 10.

Paying 10x the current earnings for a company that earned $14Bn in 2010 and $25Bn in 2011 and $41Bn in 2012 (year ends September for AAPL) with an anticipated $12Bn to kick of Q1 of 2013 – even with the harsh analyst downgrades – is pretty cheap. Yes, there are 940M shares x $13.42 per share = $12.6Bn dropped to the bottom line in the first 90 days of their FY 2013 and you can buy this WHOLE company, which also happens to have $120Bn of cash sitting on their books and no debt – for $470Bn at $500 per share. Take back the cash (and you don't even need to raid the pension fund) and it costs you net $350Bn to make $12Bn a quarter. Quick – get me some LBO guys pronto!

Paying 10x the current earnings for a company that earned $14Bn in 2010 and $25Bn in 2011 and $41Bn in 2012 (year ends September for AAPL) with an anticipated $12Bn to kick of Q1 of 2013 – even with the harsh analyst downgrades – is pretty cheap. Yes, there are 940M shares x $13.42 per share = $12.6Bn dropped to the bottom line in the first 90 days of their FY 2013 and you can buy this WHOLE company, which also happens to have $120Bn of cash sitting on their books and no debt – for $470Bn at $500 per share. Take back the cash (and you don't even need to raid the pension fund) and it costs you net $350Bn to make $12Bn a quarter. Quick – get me some LBO guys pronto!

No, I'm not kidding – really you can do that! There's One Trade we won't be cashing our of our Income Portfolio – our AAPL 2014 $400/500 bull call spread at $58.05, against which we sold 4 2015 $350 puts for $34.97 for a net of $23.08 on the $100 spread. If all goes well, this trade makes 333% on cash and just $11,762 in net margin on the put side for our 4 contract trade idea in the Income Portfolio.

This was our "One Trade" for 2013 that I talked about on BNN (along with 2 other great trade ideas) last Tuesday (image above from TV spot), when we caught the dead bottom (we hope!) on AAPL at $585. The next day, we added it to our Income Portfolio at slightly worse prices as it recovered back to $500, which it pretty much held the rest of the week. Still – $500? Are they freakin' kidding me???

Fortunately, if you are sick of me banging the table on AAPL – there's a good chance it ends tomorrow as earnings should either pop us back to realistic prices or really burst my bubble and make the decision to cash out of this entire rally a very easy one.

Meanwhile, hope springs eternal and we have a low-data week (and a short one) so the focus will be on earnings with 82 S&P companies reporting earnings this week, which will make or break our index lines. Nothing much to do this morning but sit back and watch our levels – and contemplate our exit strategy – just in case…