Woops!

Woops!

AAPL's earnings were a disappointment and the stock plunged 10% overnight (not reflected yet in Dave Fry's chart). Of course, first it went up 3% during the day but we won't split hairs, their earnings failed to excite but did nothing to scare us off – especially considering that this quarter had one less week than last year's Q4 (fiscal Q1 for AAPL). That's a 7% handicap to overcome.

Nonetheless, AAPL managed to squeeze out $13Bn in profits in 13 weeks and since they've also done a lot of share buy-backs this year, those earnings represented a whopping $13.81 per what is now (briefly, I think) a $465 share. That's just for a quarter. AMZN, by comparison, HOPES to earn 0.27 per $268 share this Q and MAYBE, if all goes well, $1.73 for the year or about 2 weeks of AAPLs earnings for the whole year. And, for that, you are expected to pay what is now much more than 50% of AAPL's stock price.

IBM was just rewarded for reporting $15.25 in earnings per $200 share for the entire year and that's in-line with XOM, who earns $9 per $90 share and GE, who make $1.80 per $22 share. NFLX jumped 40% overnight because they earned 26 CENTS for the quarter. Now a share of NFLX is $140 for earning what AAPL does EVERY 12 HOURS.

You can read the rest of my commentary on AAPL from my tweets (with special links my Member Chat commentary) here and here. As AAPL was (and still is) my One Trade for 2013 and the only one that's still cheap as both TSLA and CIM have really taken off since I mentioned them last Tuesday – it's only fair to share our ongoing adjustments with the public as well. This is a good time to remind people that last year's "One Trade", BAC, also had a nice pullback before really taking off later in the year.

As I said on TV last Tuesday: "AAPL can go down to $400 from here ($485 that day) but, if you are a long-term investor, so what?" So the entry on the One Trade is still valid and, if anything, today should be a good day to sell puts as an initial entry on new positions but, as I noted in the pre-market Alert to Members – we have to wait and see how the pricing works out in the morning but our official entry was $485 so $465, or even $450, is nothing to freak out about.

As I mentioned in yesterday's post, our longer-term positions were covered ahead of earnings with longs on SQQQ, the 3x ultra-short on the Nasdaq and the Nasdaq is down 1.5% pre-market (where we're playing the /NQ Futures long over the 2,725 line) and that will push SQQQ up 4.5%, from $36 to $37.50 – which doesn't seem like much but our hedge is March $36 calls at $2.15 and they should be about $3.15 at the open, up 46% on a 10% drop in AAPL – that's how you hedge!

We also sold the AAPL April $555 calls for $16.70 in yesterday's afternoon Member Chat – just in case AAPL's earnings were less than stellar so, between that $16.70 sale in our $25,000 Portfolio and the 20 contract hedge in SQQQ, we'll see how much of the drop in the AAPL July $450 calls, which were $77.25 yesterday, will be offset by the hedges.

And what do we do with the profits from our hedges? Roll the long contracts to an even better position, of course! That's how we ended up in the July $450s in the first place – AAPL keeps getting cheaper and we keep taking advantage…

Two of our virtual portfolios (the Aggressive $25,000 Portfolio and, of course, AAPL Money) are now pretty much all AAPL so it's time to move into the call-selling phase of our plan. In the case of the $25KP, for example, we're in the long position (July $450 calls) for net around $100 so our job, between here and July, is to sell about $10 a month worth of calls to whittle that net down and then, anywhere over $480 that AAPL finishes in July will be our profit. As I noted above, we already sold $16.25 in calls yesterday and we also hedged with the SQQQ play and now we can sell some puts and some more calls – but first we'll see how the morning looks once the market opens.

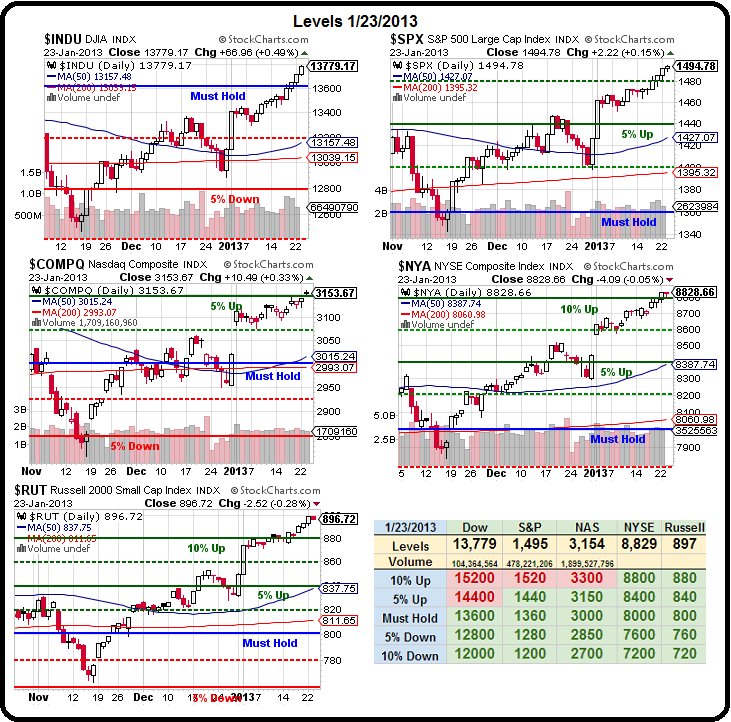

Meanwhile, the other indexes (than the Nasdaq) are holding up quite well in pre-markets and that's a very bullish sign. Figure AAPL is 20% of the Nasdaq so a 10% drop is a 2% handicap on that index and the Nas is only down 1.5% so that means that, DESPITE AAPL's disappointing report – people are still buying the rest of the index. That's a lot more faith than we thought the market would have and we'll see how things hold up today but we're well over our lines now and the Big Chart doesn't look worried at all, does it?

Meanwhile, the other indexes (than the Nasdaq) are holding up quite well in pre-markets and that's a very bullish sign. Figure AAPL is 20% of the Nasdaq so a 10% drop is a 2% handicap on that index and the Nas is only down 1.5% so that means that, DESPITE AAPL's disappointing report – people are still buying the rest of the index. That's a lot more faith than we thought the market would have and we'll see how things hold up today but we're well over our lines now and the Big Chart doesn't look worried at all, does it?

Still, yesterday's headline was "S&P 1,500 or Bust, $555 or Bust on AAPL" and we clearly aren't making that $555 line in the near future, which means 1,500 on the S&P is doubtful, which means my warning on Tuesday that we may have come too far, too fast and need to consider taking our winnings off the table still stands.

So let's watch our levels very carefully. It's a given that the Nasdaq won't hold 3,150 but they'd better hold 3,100 and, while we expect the S&P to struggle to get over 1,500, we really don't want to see a failure at 1,480 (the 7.5% level).

Yesterday's earnings play for our $25,000 Portfolio from Member Chat was on FFIV and, in that one, we may have been too conservative as we bought 4 of the April $100/110 bull call spreads for $3.30 ($1,320) and sold 3 of the weekly (tomorrow) $100 calls for $2.90 (870) to pay for most of it, leaving us with a $450 net on the $4,000 worth of spreads ($1.13 per long position). FFIV popped to $103.50 on their results and that means we'll owe our short callers $3.50 back if the gains hold up. Hopefully, we'll get an even roll to the Feb $105s, which were $2.80 at yesterday's close and then we'd be $2,000 in the money on our longs before we have to pay the callers back their first penny – that's a nice adjustment.

It's all about adjustments today and we'll see where we end up with AAPL but plenty more earnings to play with and we have oil inventories at 11 and we're still shorting /CL Futures off the $96.50 line ($96.40 was just tested at 8:10) and we had a nice dip yesterday to $95, which is a $1,500 per contract gain on the shorts. We also discussed shorting gasoline (/RB) off the $2.85 line and that's down to $2.835 this morning and that may not sound like much but gasoline pays $420 per penny, per contract so that tiny, little move was good for $630 per contract – and the Egg McMuffins are paid for!

Look for AAPL to make lows before 10 and then we'll see where that buy line is but $450 should hold.