And away we go!

And away we go!

We're off to a fantastic start in our big earnings week with both IBM and GOOG giving us nice reports yesterday (Dave Fry's QQQ chart). I sent out an early Morning Alert to Members already on positioning our earnings plays and I even tweeted it, in case you are interested in a full review. Our IBM play from yesterday's Morning Alert for our $25,000 Portfolio (see virtual portfolio tab for all tracking) was slightly bullish, buying 5 of the July $190/200 bull call spreads for $5.25 ($2,625) and sell 3 March $200 calls for $2.60 ($780) and 3 July $180 puts for $4.70 ($1,410) for net $435 for the $2,500 worth of long spreads.

IBM is tracking $204 pre-market which means, so far, we can look forward to a full $2,500 on the bull call spreads with the short puts expiring worthless and owing the short callers, at the moment, 300 x $4 back for $1,200 so net $1,300 of our $2,500 potential realized if we flat-line here, but a lot can happen between now and March – and then to July so we're not sweating that one.

GOOG;/Itrade – Big deal on GOOG is going to be mobile search. Doubt there is much growth in desktops. Earnings are on the 22nd (next Tuesday) and don't forget Monday is a holiday so I kind of like the June $665/700 bull call spread at $21, selling the next week $725 calls for $15.50 for net $5.50 and the plan would be to roll those Tuesday (hopefully picking up some premium crush over the long weekend) and sell Feb calls to cover, hopefully for another $5 to make a net free spread. If GOOG has good earnings, we can deal with it by rolling and if GOOG has bad earnings, the caller goes worthless and it's a free(ish) spread and we can salvage what's left or sell puts and roll down if we think it bounces back. Let's do 3 of these in the $25KPA as it will be a good thing to follow along.

Savi asked in Member Chat yesterday if we should buy back the short calls and my response at the time was:

Savi asked in Member Chat yesterday if we should buy back the short calls and my response at the time was:GOOG/$25KPA, Savi – I had decided not to but may change my mind. They are still $9 and, if we buy them back, we raise the net on our $35 bullish spread to $28 AND leave it unprotected with GOOG not even at the top of the spread. If we leave the short $725s in place, we have a net on our $35 spread of $6 with $29 of upside before we have to pay back the weekly $725 callers and, of course, we have 6 months to roll them AND we can easily buy more longs and roll the callers to 2x and our break-even is $754 and StJ says GOOG only averages 6.7% (moves on earnings), which is $746 so we have many, many ways to win by leaving the spread as is whereas, if we pull the short calls – we only have one way to win – and we win a lot less.

As I said in yesterday's Morning Alert to Members, it's Apple $555 or bust on earnings later and that's very true in our AAPL-bullish $25KPA and AAPL Money Portfolios – we'll press our SQQQ hedges this morning but an insurance pay-off would be a bitter pill to swallow if AAPL misses! Google just reported quarterly earnings of $10.65 and popped to $735 a share (up 5%) and AAPL is about to report earnings expected to be $13.41 per share (26% more) and trades at $500 (32% less) – go figure…

As I said in yesterday's Morning Alert to Members, it's Apple $555 or bust on earnings later and that's very true in our AAPL-bullish $25KPA and AAPL Money Portfolios – we'll press our SQQQ hedges this morning but an insurance pay-off would be a bitter pill to swallow if AAPL misses! Google just reported quarterly earnings of $10.65 and popped to $735 a share (up 5%) and AAPL is about to report earnings expected to be $13.41 per share (26% more) and trades at $500 (32% less) – go figure…

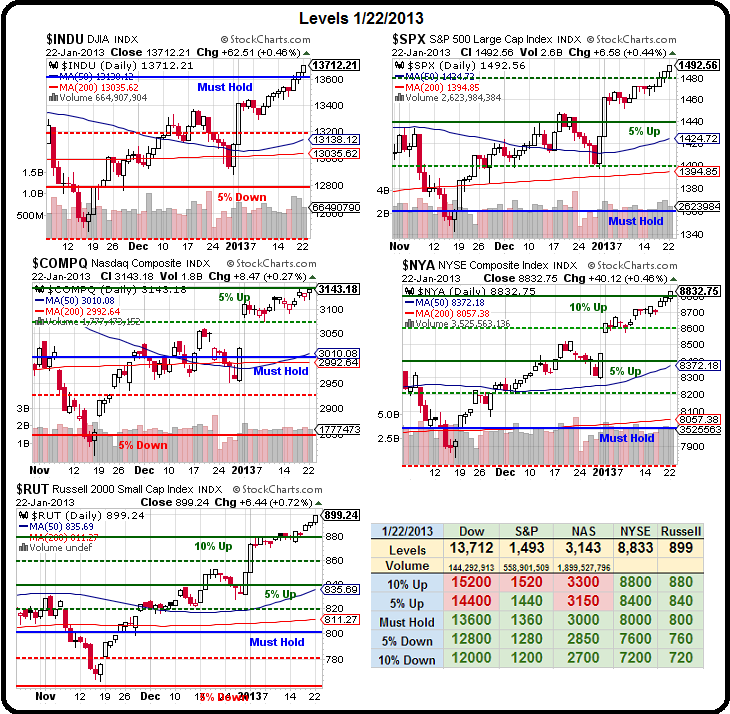

Yesterday we set our aggressive levels at:

- Dow 13,600 (Must Hold)

- S&P 1,480 (7.5%)

- Nasdaq 3,100 (2.5%)

- NYSE 8,600 (7.5%)

- Russell 880 (10%)

And we're well above them all now so all we have to do is not blow it, and I'm not seeing anything in the news to do that and, so far, earnings aren't too disappointing either (expectations were low) and, more importantly with all the stock buybacks recently (2.6% of the S&P in 18 months) those EPS targets get a lot easier to beat when there are less shares to distribute those earnings to. Another 3% drop in the S&P share count is expected this year – that's a built-in 3% beat for the S&P, since analysts rarely take share adjustments into account when posting their outlooks. This can go on for a while if AAPL (or Congress today) doesn't kill it: