"That cold black cloud is comin' down

Feels like I'm knockin' on heaven's door"

So close and yet – so far.

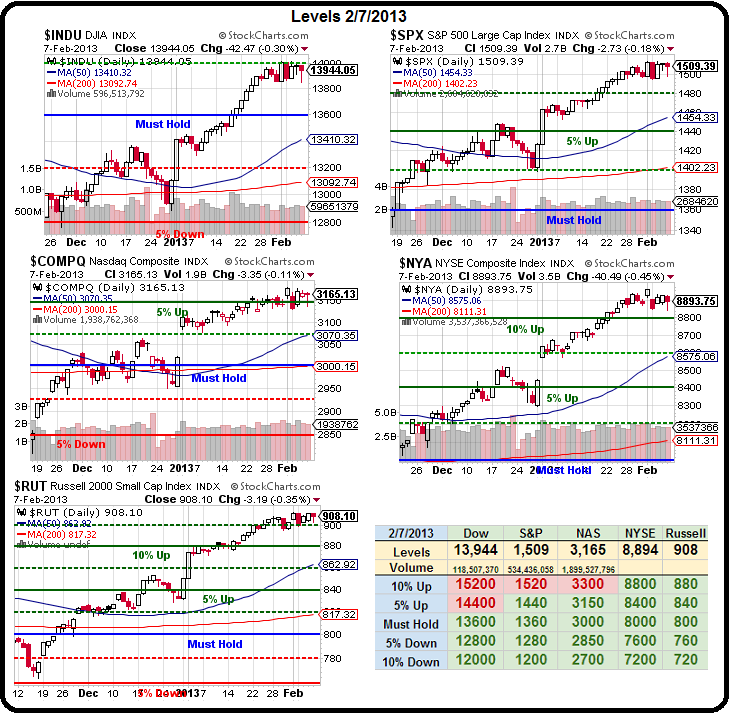

As you can see from our Big Chart, we are certainly knock, knock, knockin' on our breakouts at the 10% levels. One more score and we're officially ready to raise our stops again – but it's a long process as we'll need the Nasdaq to confirm the S&P's move up and then we'll want to see a re-test of our 5 & 10% lines from the top and THEN we'll be ready to call them our new Must Hold line.

If that sounds like tough standards – keep in mind that's exactly the logic that saved our assets back in September – the last time we had a rally that ultimately failed. I know it seems like the distant past in market terms but trust me, it happened.

In September we were skeptical and bearish (and for good reasons, as it turned out) and we had our Long Put list with plenty of short positions. Now we are hopeful and bullish as we once again attempt to prove out a new range, where S&P 1,440 and Nasdaq 3,150 etc become the bottom of a range we'll expect to go 10% higher (1,600!) at some point this year. That's IF we can get to 1,520 before we lose the NYSE or Russell, both of which currently are floating about 1% over their 10% lines. As I said to our Members this morning:

AAPL is like a coiled spring that can be released and kick the market up 1-2% on a 5-10% move higher or a full 5% on a 20% move up in AAPL – like the time they went from $85 to $200 in 2009 or the time they went from $200 to $300 in 2010 or the time they went from $315 to $400 in 2011 or the time they went from $400 to $600 in 2012 or that other time in 2012, when they went from $550 to $700… Have I mentioned that AAPL is my stock of the year lately?

It's still very much an ApplEconomy but, as we've learned from this recent rally – very much UNLIKE the previous rally – we don't need APPL to do well for the markets to do well. In fact, AAPL couldn't really have done much worse while the markets are doing so well. As you can see from this 6-month chart – we have the S&P up 10% while AAPL is down 10% and that's very impressive as AAPL makes up 4% of the S&P so their 30% drop has, by itself, cut 1.2% off the S&P, which would put us over 1,520 already.

We've already made our Egg McMuffin money this morning as I put out a 5:30 am comment in Member Chat pointing out that Gasoline Futures had fallen to $3.006 and that it was a great line to go long on as we usually get some kind of pump into the weekend. Now (8:30) just 3 hours later, we're already at $3.027 and, while that may not seem very exciting to non-Futures players – it's actually good for $420 per penny per contract or $1,050 per contract if we set our stop now at $3.025. As I often say to our Members, my retirement plan is to move to Europe and take advantage of the time zone there so I can wake up, have breakfast, make a quick futures trade and quit for the day.

We'll be doing a Live Futures Seminar for our Members this year at our Atlantic City Conference in April because, not only do the Futures make a great way to take advantage of quirky market moves early in the morning but they also allow us to react to news and adjust our portfolio balances long after the markets have closed. It's just another very useful tool to put in your trader's tool-box but, like a jackhammer – it's very powerful and shouldn't be used for every job…

We'll be doing a Live Futures Seminar for our Members this year at our Atlantic City Conference in April because, not only do the Futures make a great way to take advantage of quirky market moves early in the morning but they also allow us to react to news and adjust our portfolio balances long after the markets have closed. It's just another very useful tool to put in your trader's tool-box but, like a jackhammer – it's very powerful and shouldn't be used for every job…

Another powerful tool we use are weekly options. Earlier this week, I tweeted out a trade idea for the AAPL weekly $455 calls at $1.55 on Monday and yesterday they closed at $13.50 (up 770% in 3 days) – who needs Futures when options move like that? Of course, we took the money and ran at $6 because it was a bonus to our already long (and suffering) AAPL positions so we weren't "going for it" with that trade but we did pick up the next week DIA $140 calls for .24 on yesterdays dip for both of our virtual $25,000 Portfolios, spending $480 for 20 contracts and they closed the day at .40 ($800 – up 66% in 6 hours) but we decided to go for it on those and give the Dow another day to rise.

We hit USO Futures for another $1,000 per contract gain (getting boring at this point) and oil dipped all the way to $95.50 from my morning call to short them at $97 (right in the main post so cheapskates could participate too), so actually +$1,500 per contract for those who were greedier than we were. Our earnings play of the day in Member Chat was on CSTR and that one was also tweeted out (we're being very generous as free trials are technically over) at 3:02 with the expanded link noting:

No hidden gems in CSTR likely to turn up and the 200 DMA is going to be tough to pop at $53.40 so I think selling 5 Feb $55 calls for $1.90 ($950) against 10 April $55/57.50 bull call spreads at .80 ($800) is a $150 credit plus whatever is left on the spreads if they don't make $55 or there is $2,500 of upside coverage for the net credit so CSTR would have to pop over $60 (up 15%) before the trade is in trouble. BRILLIANT! Let's do that in both $25KPs.

CSTR did indeed miss revenues and had guidance that was actually worse than we thought so we'll be keeping that $150 credit plus whatever value is left on the bull call spreads. Even if they drop 75% to .20 – we still get another $200 for a $350 gain in one trading hour – not bad. Plenty more earnings next week and options expiration on Friday, all ahead of the holiday weekend so get ready for more fun – this week has been a blast.

Have a great weekend,

– Phil