I like not having a point sometimes.

I like not having a point sometimes.

Last Wednesday I did a random post and it's kind of nice to just write stuff down and not have to worry about making a point. It also gives me a chance to put up some interesting things that might not "fit" otherwise but I think are worth discussing. There's not much going on in the market at the moment and we went over a massive amount of stuff in Member Chat between last night and this morning, so plenty to read over there if you want to know about today's markets.

Thing number one is thanks to Manix at SeekingAlpha for reaffirming my faith in Social Discourse. I mentioned yesterday that my post on Income Inequality has sparked a spirited debate on SA and, as our Members are well aware, I'm not a big fan of people who like to debate using Fox talking points and zero facts, so I can get a bit testy with them. It made me feel very good that at least one person reading over at Seeking Alpha gets that as Manix commented:

Phil supports his opinions with facts and if he disagrees with someone else's opinion, he'll disintegrate it with …. facts. That doesn't prevent that someone else from presenting a counter-argument that is also fact-based, but I rarely see such rebuttals …

for obvious reasons.

Let's face it: Phil doesn't suffer fools lightly. If someone writes an opinion that doesn't deserve to stand on its own merit, Phil will make sure that readers will see why he thinks it lacks merit. Few 'wrong-headed' opinions will be left unscathed, less they gain some sort of traction. After all, this is HIS column. Disagree with his views all you want, but be prepared to give a cogent argument for them, less you be taken out to the woodshed for posting nonsense.

That's great, I'm done now and can die in peace because that will make a fine eulogy! Anyway, it's generally like Sodom and Gomorrah in these public chat rooms (which is what led me to start a private site in the first place) but every once in a while I do find a righteous man out there, and it renews my faith in people and makes me feel like it's still worth trying to do my little bit to change the World and not just going 100% private on our site.

Of course the real angels here are our Members, who support this nonsense (in exchange for a few tips and lessons, of course) – ESPECIALLY our Conservative Members, who chose to spend the 25% of the time reading things they disagree with reading my political rants – they are certainly not the kind of Conservatives I'm generally angry at because at least they are willing to listen, and to share their point of view – and I do really appreciate that as I too need to put in my 25% every day!

In fact, the first article in our Education Archives is not an article on stock or options trading but "Rational Debating 101," as it's very hard to teach people anything if they don't know how to have a proper discussion in the first place. Speaking of teaching people, we've started working on our Book Project, but I think I may have jumped ahead and finished the section on Buy/Writes this morning as I came up with a very good example (using ABX) to illustrate why this is, by far, our favorite strategy. If non-Members are interested, they can follow the link from this morning's Twitter feed (@philstockworld), where we occasionally feature comments from Member chat.

Twitter is useful for our Members who are on the road and I try to tweet out important things, like our fantastically profitable oil trades of last week, as well as the occasional trade idea (as we have dozens, and can spare a few) and Greg and I have been discussing the idea of building an App for Members (and you can now add Philstockworld's public feed to Flipboard), as those too have nifty alert systems we can make use of and, of course, it would be nice to come up with a good mobile format for our site – especially the Member Chat, which is hard to keep up with on the road (I know as I'm often on the road myself).

Twitter is useful for our Members who are on the road and I try to tweet out important things, like our fantastically profitable oil trades of last week, as well as the occasional trade idea (as we have dozens, and can spare a few) and Greg and I have been discussing the idea of building an App for Members (and you can now add Philstockworld's public feed to Flipboard), as those too have nifty alert systems we can make use of and, of course, it would be nice to come up with a good mobile format for our site – especially the Member Chat, which is hard to keep up with on the road (I know as I'm often on the road myself).

Ha! I found a flaw in this format – I just had to remind myself that the point of this post was not to have a point so it's time to move on to other topics!

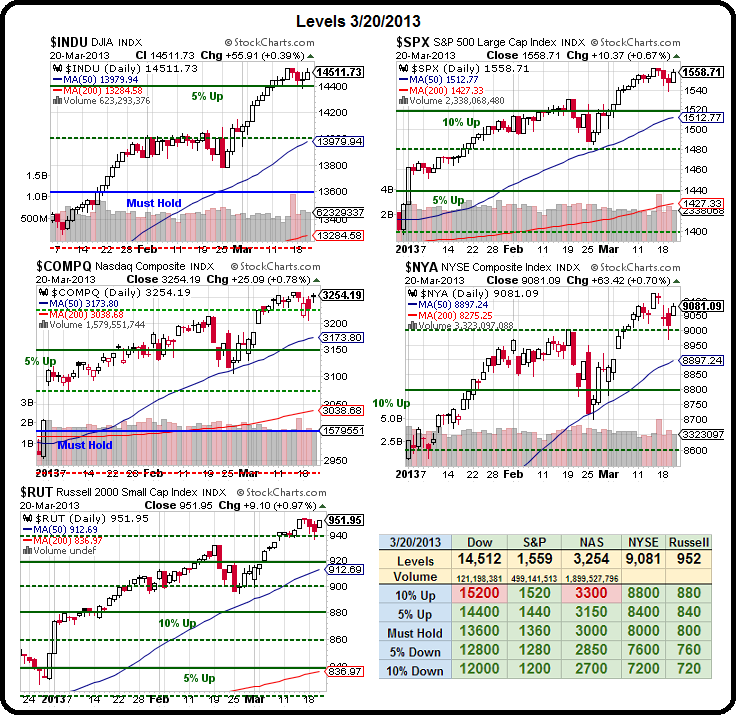

So I was having dinner at Brushtroke (very over-rated) with Ron from Opesbridge, LP and we were discussing whether or not the market had room to "pop" from here. Back on March 7th (see Dawn!) we had reviewed our Dow components in an attempt to calculate a realistic pre-earnings top for this run and we decided 15,200 was the highest we could see the Dow going without some additional Fundamental justification through either better than expected earnings or substantial improvements in the Global Economy.

That was the logic (in analyzing each component) that led us to short XOM at $90 and JNJ at $79 (though JNJ is over at the moment). The Dow was just under 14,300 on the 7th and our near-term goal was to get over 14,400, so mission accomplished there but 14,421 yesterday means we're barely holding it together at the 5% level we predicted we'd be in way back in 2009 – so let's not get too impressed by the extra 22 points…

That was the logic (in analyzing each component) that led us to short XOM at $90 and JNJ at $79 (though JNJ is over at the moment). The Dow was just under 14,300 on the 7th and our near-term goal was to get over 14,400, so mission accomplished there but 14,421 yesterday means we're barely holding it together at the 5% level we predicted we'd be in way back in 2009 – so let's not get too impressed by the extra 22 points…

What Ron and I talked about, in the same context, was the reality of how high the markets could possibly go. Though 15,200 sounds very high, it's up just 5% from where we are now and is, in fact, the exact top or our expected Big Chart range for the Dow. That and 3,300 for the Nasdaq (up 1.5% from yesterday's close), would finally get us to flip truly bullish for another leg higher from here – rather than cautiously playing this as if we're at the top of a range and likely to get a correction.

So our other big sticking point is $60Tn, which is roughly the global market cap of all equities, with about $40Tn of that listed on US indexes (and, of course, stocks are listed on several indexes at once). That's about where we topped out in May of 2008 but, more to the point, it represents about $10Tn worth of gains over the past 6 months. Doesn't that seem like it might be a bit extreme to you? Did $10Tn flow into the market? Of course not. In fact, even if you front-load all of the Fed's promised $85Bn a month and let the banks lever it 10x and put ALL of that money into the market – you still can't get there from here.

As I noted on our Dow analysis – you can get close. You can get to the very top of our Fundamentally set trading range (15,200) without violating the laws of Stock Market Physics, but I would challenge you to tell me where that next $1Tn levered 10x is going to come from? Surely not from Europe. I mentioned going long on China in yesterday's post – that's one place bulls need to count on but emerging markets are not carrying their weight at the moment and Japan is just trying to tread water so I still think the markets need to take a little rest here – if not sit down for a genuine pullback.

As I noted on our Dow analysis – you can get close. You can get to the very top of our Fundamentally set trading range (15,200) without violating the laws of Stock Market Physics, but I would challenge you to tell me where that next $1Tn levered 10x is going to come from? Surely not from Europe. I mentioned going long on China in yesterday's post – that's one place bulls need to count on but emerging markets are not carrying their weight at the moment and Japan is just trying to tread water so I still think the markets need to take a little rest here – if not sit down for a genuine pullback.

We already shut down last June's Income Portfolio as it made 2 years worth of target profits in 9 months and now our new, month-old Income Portfolio is up a virtual $6,725 in less than 30 days ($4K per month is goal) this is silly folks – if this is how the markets work then we'd all be buying $1M homes by simply putting $100K in the market and having our profits pay off the mortgage each month. Perhaps that's why housing is roaring back, with the Jan FHFA Housing Price Index up 5.5% since last year. That's a nice bonus on our free Million-Dollar homes – a $55,000 gain in value in a single year!

The last time homes rose more than 4%, let alone 5.5% in a year was way back in Q3 of 2006. Of course, working back from there we had 10.58% in 2005, 9.97% in 2004, 7.57% in 2003, 7.21% in 2002 and you have to go all the way back to 1997 to find another quarter where homes DID NOT rise 5% per year. Have I mentioned how much I like real estate lately?

That's what we need to get the next leg of the rally going but 1997 was almost a full decade into recovering from the first Bush's Savings and Loan Crisis (the GOPs 2nd most recent attempt at destroying the Economy) and the gains were steadily accelerating – as were wages and jobs under Clinton, who was into his 2nd term at the time. Granted Bill Clinton did not have a hole as big as Obama's to have to climb out of before he could get the economy going – but it did get going pretty well at the time, and the S&P was already up from 451, when Clinton was sworn in in January of 1993, to 757 in January of 1997 and wouldn't stop for ANOTHER 100% gain, at 1,527 in March of 2000.

That's what we need to get the next leg of the rally going but 1997 was almost a full decade into recovering from the first Bush's Savings and Loan Crisis (the GOPs 2nd most recent attempt at destroying the Economy) and the gains were steadily accelerating – as were wages and jobs under Clinton, who was into his 2nd term at the time. Granted Bill Clinton did not have a hole as big as Obama's to have to climb out of before he could get the economy going – but it did get going pretty well at the time, and the S&P was already up from 451, when Clinton was sworn in in January of 1993, to 757 in January of 1997 and wouldn't stop for ANOTHER 100% gain, at 1,527 in March of 2000.

So we COULD just be in the early stages of a massive rally but even Clinton's 238% rally in 8 years had some set-backs (like Bush II winning the election in 2001!) but here we are again, right at 1,558 on the S&P after just 12 years of enduring that disaster and we're back on track – but we need TIME to justify these levels and, so far, we're up too far, too fast and we should be cautious here until and unless we get some very good earnings reports.