I have been to the mountaintop!

I have been to the mountaintop!

Actually, this is our third trip to the mountaintop since early 2000 and our last two trips did not end well and, as you can see from this chart by Paragon Capital, the DJ/CS 10-year Inflation Breakeven Index (which measures changes in inflation expectations) has completely gone off the rails and that has, in the past, been a VERY STRONG SELL SIGNAL.

This time is not different yet, just like when we have a cold day in the winter and all the Climate Deniers start saying "see, there's no Global Warming because it's cold," we can't assume that we can ignore what the bond market is telling us just because the market is spiking – again.

Of course, we do need to consider that the Fed is artificially depressing bond prices and the government is artificially manipulating inflation data to depress those bond prices so, perhaps, we are getting a drastically false signal from the Breakeven Index. NFLX popped 35% in 24 hours (so far) and this is not a penny stock, folks.

Of course, we do need to consider that the Fed is artificially depressing bond prices and the government is artificially manipulating inflation data to depress those bond prices so, perhaps, we are getting a drastically false signal from the Breakeven Index. NFLX popped 35% in 24 hours (so far) and this is not a penny stock, folks.

Whether you agree with the move or not (we don't, we thought $200 tops), the fact of the matter is that plenty of people seem to think a widely held, closely followed, highly liquid stock like NFLX can be 35% underpriced and that the stock can gain $3Bn in market cap on a $7M earnings beat.

That's a very nice 428:1 reward for the extra earnings scraps! AAPL might beat by $1Bn ($11Bn vs $10Bn expected) – wouldn't it be funny if their stock jumped $428Bn this evening? The funny thing is, even if it did double overnight, AAPL would be trading at $800Bn with $40Bn+ in earnings – a p/e of under 20 vs NFLX's p/e of about 160 now (assuming the rest of the year is as good as this Q, of course).

That's a very nice 428:1 reward for the extra earnings scraps! AAPL might beat by $1Bn ($11Bn vs $10Bn expected) – wouldn't it be funny if their stock jumped $428Bn this evening? The funny thing is, even if it did double overnight, AAPL would be trading at $800Bn with $40Bn+ in earnings – a p/e of under 20 vs NFLX's p/e of about 160 now (assuming the rest of the year is as good as this Q, of course).

The problem with NFLX earnings is, of course, that they are tiny. NFLX made $15M this Q but revenues were not higher – they just spent less money. Of course, as Croy Johnson points out, NFLX has a MINIMUM of $5.7Bn of future contracts committed to studios for content already and, at $1Bn per quarter in total revenues – I hope those are very long-term deals! As noted by Dividend Pros:

In response to a question about third-party content negotiations, CEO Reed Hastings mentioned that Netflix's competitors such as Amazon and Hulu are bidding more aggressively for the same content, which has made the content acquisition costs for Netflix higher than they would otherwise be. This shows that Netflix not only faces competition for subscribers, it also faces competition for content; the increased leverage of content providers over Netflix is not a positive development and could hamper the company's contribution margins in the future.

I'm not saying to jump right in and short NFLX. We're going to be forced to because of the spread we took ahead of earnings where our short-caller is deep in the money after that pop to $215 (assuming it sticks) but, once it calms down – it's going to be a fantastic short! We're also likely to double down on our SQQQ calls ahead of AAPL's earnings tonight – just in case they crash and drag the Nasdaq with them. If NFLX can be unrealistically bullish – AAPL can be unrealistically bearish – that's the danger of trading in a bubble market.

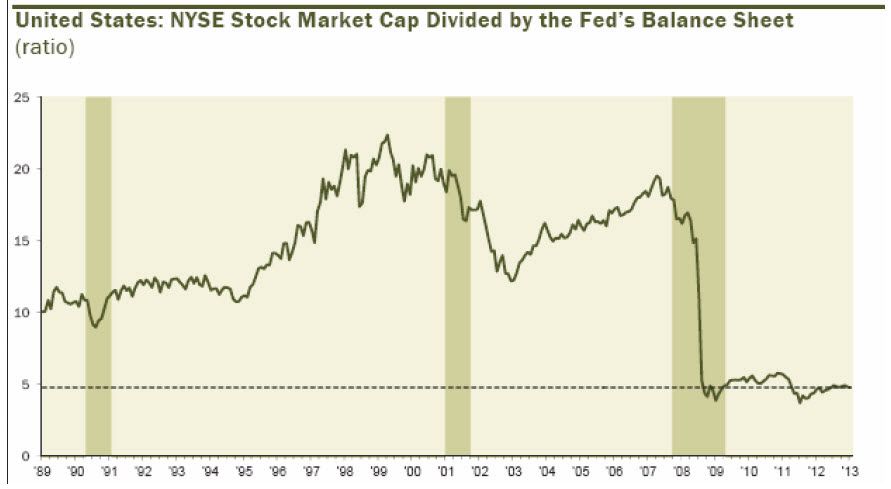

Just because we're in a bubble – doesn't mean it's going to burst. Not right away, anyhow. Japan went up for two decades before collapsing, the Bill Clinton rally lasted 8 years after Bush the First's Saving and Loan Crisis (which was due to lack of adequate regulation and controls – not to be confused with Bush the Second's Financial Crisis, which was due to lack of adequate regulation and controls) – so these things can go on for quite a while and we're only 5 years into the Fed bubble and they sure aren't done blowing yet!

Speaking of inflating – just in time for our Atlantic City Conference at Harrah's this weekend, CZR (a trade some were using to pay for the trip) is up 12% pre-market on news that it is forming a new venture to fund growth with $500M in funding from Apollo Management and TPG. It's always nice to start the week off with a winner and I look forward to seeing you in Atlantic City where I'm sure we'll find many more cool trades to talk about this weekend.

Of course, there were plenty of people with information that knew this deal was coming, just like there were many people who knew NFLX was going to put in a big beat – you can see it from yesterday's big rally ahead of earnings. AAPL has been crushed into their earnings and we'll see what the truth of the matter is there and BAC, oddly, was crushed after earnings but we bought them too (see weekend picks) and now MS agrees with us and calls them a BUYBUYBUY with a $16 price target – one Dollar better than ours.

Of course, there were plenty of people with information that knew this deal was coming, just like there were many people who knew NFLX was going to put in a big beat – you can see it from yesterday's big rally ahead of earnings. AAPL has been crushed into their earnings and we'll see what the truth of the matter is there and BAC, oddly, was crushed after earnings but we bought them too (see weekend picks) and now MS agrees with us and calls them a BUYBUYBUY with a $16 price target – one Dollar better than ours.

If you missed BAC this weekend, don't miss DBA which, as you can see from Dave Fry's chart, is testing some very strong support at $25.75. DBA, over the next two years, can benefit from an expected cyclical coffee shortage in Brazil and Argentina (maybe bad for SBUX) as well as any actual rebound in Global Consumer demand (for something other than smartphones) or even the pending emergence of the dreaded cicada bugs, who slam the East Coast next month.

Anyway, the bottom line on DBA is – it's FOOD! We keep making more people and we haven't figured out how to run our kids on something cheaper like solar or gold yet so I think we can count on FOOD being in demand for the next two years. If you go way back in history to last June (find an old person and ask them about it), you would see that DBA doesn't just recover – sometimes it explodes into a recovery. And then we wait a year or two and buy it next time it crashes. The upside on our DBA Trade Idea in "5 Inflation Fighters Set to Fly – Part 2" is 7,500% – more than enough to pay for a trip to Vegas for our next conference.

See you there,

– Phil