And we're back!

This is a continuation of yesterday's post, which laid the background for our inflation premise and discussed F as our first trade idea. That means we'll need 4 more to round this set off and the chart on the right, from Bespoke, illustrates another premise we've been touting since the Fall – BUY AMERICAN.

F is American, of course and one of the reasons we like them is that most of their revenues come from domestic auto sales and domestic financing. As you can see from the chart, there's a pretty strong correlation between NOT relying on Europe and Asia and market performance this year.

This is why we also like domestic Materials plays, like CLF, who do over 68.5% of their business in the US. Yes, International demand as well as International pricing for iron ore does leave them at the mercy of overall global demand but that's already happened and CLF is already down from $96 in 2011 to $74 last year and $40 at the beginning of this year — all the way to $17.63 at Friday's close, the lowest it's been priced since March of 2009.

This is why we also like domestic Materials plays, like CLF, who do over 68.5% of their business in the US. Yes, International demand as well as International pricing for iron ore does leave them at the mercy of overall global demand but that's already happened and CLF is already down from $96 in 2011 to $74 last year and $40 at the beginning of this year — all the way to $17.63 at Friday's close, the lowest it's been priced since March of 2009.

We already took a stab at CLF at net $19.90 in our Income Portfolio on 2/26 and added another round (through short put sales) at net $13.50 on 3/27 and, if we can double down again at net $10 – we probably will but for now, and as a new trade idea – I'm very happy with our recent sale of the 2015 $18 puts, which are now $5.25 for a net entry of just $12.75. As with Ford, this is a margin-efficient sale with a net margin of just $3,551 to collect $5,250 for selling 10 contracts. Doing nothing else on this trade can return up to 147% on margin in 20 months (Jan 2015) and all CLF has to do is struggle back over $18 – from $17.63 today (2%).

Figuring out ways to make 147% on 2% stock moves is what options trading is all about! And what's our worst case here? We are obligated to own 1,000 shares of CLF at $18 per share ($18,000), less the $5,250 we were paid to accept that obligation so net $12,750, which is 27% below the current price. Now we can get fancy, let's say we're happy to pay $15 for CLF – that leaves us $2,250 to play with, right? We can use that money to pick up 6 of the 2015 $15/25 bull call spreads for $3.45 ($2.070) and that leaves us with $180 to buy a year's subscription to Stock World Weekly AND gives us an upside potential for another $3,930 in gains (above the $5,250) if CLF should finish all the way up at $25. Even if CLF "only" makes it to $18 – we get $1,800 of our $2,070 back from our $15 calls while the short $25s would expire worthless.

Figuring out ways to make 147% on 2% stock moves is what options trading is all about! And what's our worst case here? We are obligated to own 1,000 shares of CLF at $18 per share ($18,000), less the $5,250 we were paid to accept that obligation so net $12,750, which is 27% below the current price. Now we can get fancy, let's say we're happy to pay $15 for CLF – that leaves us $2,250 to play with, right? We can use that money to pick up 6 of the 2015 $15/25 bull call spreads for $3.45 ($2.070) and that leaves us with $180 to buy a year's subscription to Stock World Weekly AND gives us an upside potential for another $3,930 in gains (above the $5,250) if CLF should finish all the way up at $25. Even if CLF "only" makes it to $18 – we get $1,800 of our $2,070 back from our $15 calls while the short $25s would expire worthless.

Now we're talking a very serious return of $9,180 against that $3,551 in margin and $2,070 in cash (but it wasn't even our cash!) so that's 163% back on $5,621 cash + margin if CLF makes it to $25 or $3,180 at $18 or, worst case, we own 10,000 shares of CLF for net under $15 ($15,000). Again, a very nice way to stay ahead of inflation with a big kicker in any kind of improvement in the global economy.

I'm not advocating you put your whole portfolio into trades like this, this is like our "5 Trade Ideas that Can Make 500% in an Up Market" – it's an upside hedge, especially if you are worried you are too bearish or simply not aggressive enough.

For example, if you have a $100,000 portfolio that's socked away in 30-year notes that pay 3%, allocating $5,621 of the money to a trade like this can boost your total returns by 5% a year – more than double your rate of "safe" return. If CLF does fly higher on inflation over 2 years – you're REALLY going to want that extra 5%! And you don't have to get 10 shares of CLF – you can buy one or two contract on a few different ones to spread the risk – and the love!

Speaking of love – who doesn't love Banksters? BAC was our "Stock of the Year" for 2012 and it did, in fact, turn out to be the stock of the year. When asked if I still liked BAC this year back in a January interview – I said not so much at $12 but I do see $15 over time. Now that we've consolidated between $11 and $13 for 4 months – I'm willing to get back on the wagon at $11.66. $11.66 is just 85% of tangible book ($13.46), so a good place to start with any stock and the bank is buying their own shares and, of course, they have written a massive property loan portfolio down to nothing and will gain magnificent amounts of book value if the housing market continues to inflate (up 10% from last year – keeping pace with REAL inflation).

1,000 shares of BAC cost $11,660 and you can sell 10 of the 2015 $10 calls for $2.81 ($2,810) and 10 of the $12 puts for $2.06 ($2,060) and that drops your net to $6,790 – 41.7% off the current price and, if you get called away at $10 (14% BELOW the current price) with the stock above $12, your profit in 20 months would be $3,210 – 47.2% profit. If the stock is below $12 and you are assigned another 1,000 shares at $12, your break-even is $9.395, 19.5% below the current price. We could get fancier, but it's a nice return and BAC is a fantastic long-term hold as they'll probably crank up the dividends at some point. Currently they are just .04.

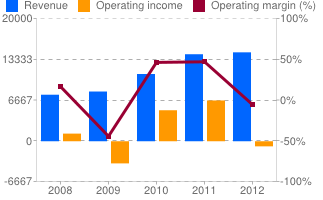

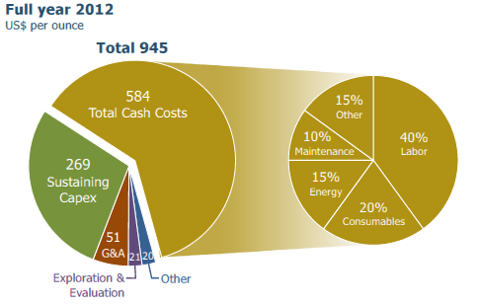

"As good as gold" is no longer a good thing to say if you are trying to convince someone of the value of something but even BitCoins climbed back to $136 last week and finished at $120 – more than double their panic low of $50. We've discussed ABX many times over the past month and the general silliness of the gold market (and BitCoins for that matter) so I won't get into merit discussions here, but ABX is my favorite miner and, at $18.17, have a market cap of just $18Bn for a company that made $3.6Bn in 2010 and $4.5Bn in 2011.

"As good as gold" is no longer a good thing to say if you are trying to convince someone of the value of something but even BitCoins climbed back to $136 last week and finished at $120 – more than double their panic low of $50. We've discussed ABX many times over the past month and the general silliness of the gold market (and BitCoins for that matter) so I won't get into merit discussions here, but ABX is my favorite miner and, at $18.17, have a market cap of just $18Bn for a company that made $3.6Bn in 2010 and $4.5Bn in 2011.

I don't know about you but if you tell me you have a machine that spit out $5 bills twice in the last 3 years but last year needed $1 to keep running and didn't pay off – I think I'd be willing to pay the buck and see what happens next year. Not so much the typical ABX investor, who fled like rats off the proverbial sinking ship and have dropped the stock from $50 in 2011 to bottom out at $17.50 last week.

We've been catching those ABX knives for a while and, if you want to join in the pain, the 2015 $15 puts can be sold for $2.65 and the 2015 $20/30 bull call spread is $1.90 so you keep .75 in your pocket for a net $14.25 entry on ABX (an additional 21.5% discount) and this is super margin-efficient with just $1.55 in margin on the short puts. Obviously, this is a more speculative play but, off a net credit of .75, at $30 you can make an additional $10 for $10.75 or a 1,433% return in less than two years if ABX retakes HALF of what it lost in the past two years.

We've been catching those ABX knives for a while and, if you want to join in the pain, the 2015 $15 puts can be sold for $2.65 and the 2015 $20/30 bull call spread is $1.90 so you keep .75 in your pocket for a net $14.25 entry on ABX (an additional 21.5% discount) and this is super margin-efficient with just $1.55 in margin on the short puts. Obviously, this is a more speculative play but, off a net credit of .75, at $30 you can make an additional $10 for $10.75 or a 1,433% return in less than two years if ABX retakes HALF of what it lost in the past two years.

So a single-contract ABX spread would cost you $155 in margin, $190 in cash and you obligate yourself to buy 100 shares of ABX for net $14.25 ($1,425) and the upside on the trade is as much as $1,075, 312% of your cash and margin. It's not an all or nothing trade either – even at $25, you would clear $575 in profits – not bad for setting a little money aside for a couple of years.

For our final trade idea – let's go for a real inflation hedge – food. DBA is an agricultural basket and plentiful supply in the US and depressed Global demand has this ETF of Sugar, Cattle, Corn, Soybeans, Cocoa, Coffee, Hogs and Wheat trading at $25.97 – that's 27% below the 2011 high of $35.58.

Did your food get 27% cheaper over the last two years? No, this is another silly sell-off, like gold, that has no basis in reality and is the result of manipulation by the Banksters who are busy cornering the commodities markets by driving everyone else out before they turn around and raise all their inflation targets – after they get their fill of shares, of course.

Again, it's an article for another day but suffice to say DBA bottomed out at about $22 in 2008 and traded between there and $27 until the summer of 2010 (call it 18 months) but then zoomed up to $35 before journeying back down. Sure it's a scam but it's a scam we can all benefit from and we can sell MCD 2015 $75 puts for $2.25, which has a rough margin of $7.50 but don't tell me I have to convince you McDonald's is a good deal at $75. We can then use that $2.25 to buy the DBA 2015 $26 calls for $2.15 and that puts us effectively in DBA at net $25.90, a bit lower than it is now – so we benefit from 100% of the upside from here and, if we don't – then McDonald's input costs (Sugar, Cattle, Corn, Coffee, Hogs, Wheat) are cheaper and they should be doing just fine – making this a fabulous pair trade.

Anything over DBA $33.50 is going to give you a 100% return on margin and that would be a 7,500% return on cash (the dime) so another fun one to play and an excellent hedge against inflation. Think about it every time you get yourself an Egg McMuffin.

So that's the first 5. We'll identify more this week in Member Chat and, of course, it's earnings season and, with 20% of the S&P 500 clocking in – we're beginning to get a handle on earnings plays so make sure you have some cash on the sidelines to make some fast money while we wait for these slow, boring plays to make us doubles and better over the longer run.