We're off to a weak start.

We're off to a weak start.

Not that it matters ahead of our GDP report but Asia was off just a bit but Europe is down 1% as the BOJ offered no new candy at their meeting this morning. The Nikkei fell from 14,100 (in giddy anticipation of more free money) all the way back to 13,900 but only down net 1%. Our own indexes were up in giddy anticipation of a 2.8% GDP number but, as we discussed in Member Chat (and I tweeted the comment for the general public):

GDP – I think we got weak Durable good, less exciting jobs, lower Corporate Revenues and Sequestration should lower Government spending and even oil was cheaper so another downer. Makes it very hard to imagine that we'll hit the very high expectations of 2.8% from 0.4% last Q. This is the main reason I can't let go of our beaten-up shorts yet.

Are we really going to flip from 0.4% to 2.8%. Last Q1 was 2% and Q3 was our best at 3.1% so it's asking a lot. The big move up was nonresidential investment (apartments) which bumped 13.2% and, by itself, added 1.28% to the GDP. Personal consumption sucked and should continue to suck and I doubt exports will save us (to who?).

We'll see shortly but this is not a market that's pricing in a bad GDP number and the data we've been seeing for the past two months doesn't really build the case for it. Of course, sometimes the GDP goes up due to one big metric move – especially the counter-intuitive inventory builds and all those unsold items on store shelves due to poor retail sales could lead us to a pretty big build in inventory. Inventory builds are considered bullish as we still labor under the myth that markets are efficient but they're not efficient when companies can build inventory on sub-2% loans – that doesn't give you a real picture of selling pressure, does it? Inventory is also a factor of farmers re-filling their silos after last summer's drought. Without the EXPECTED 1% boost from farm inventories alone – growth would be under 2% at best.

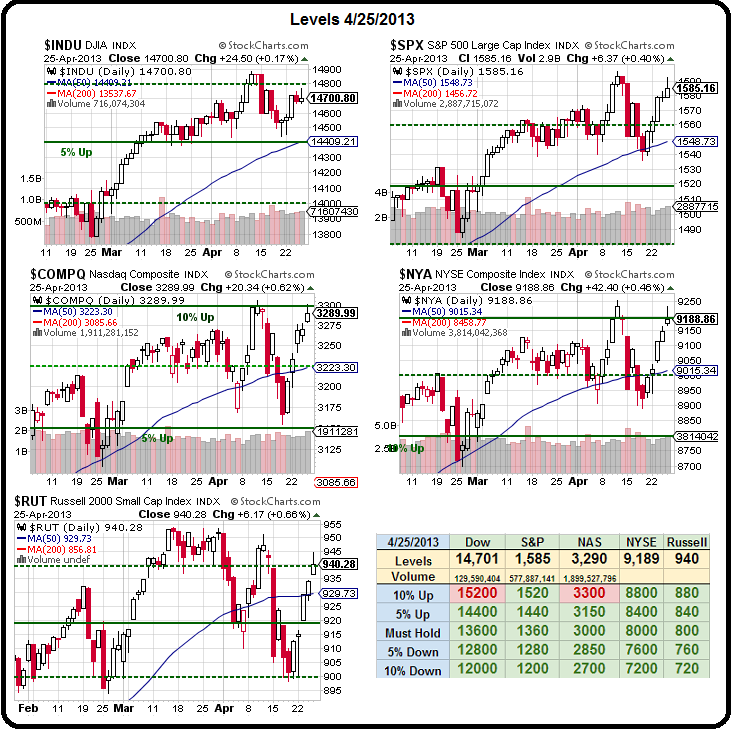

That's why we're skeptical and that's why we've been hanging on to our bearish hedges, even as we get yet another re-test of our market tops. The Nasdaq hit our 3,300 target and the NYSE hit 9,200 and the Russell hit 940 – as expected in yesterday's post but all were quickly slapped back, indicating that at least a few SellBots have lined up at our 5% zones.

That's why we're skeptical and that's why we've been hanging on to our bearish hedges, even as we get yet another re-test of our market tops. The Nasdaq hit our 3,300 target and the NYSE hit 9,200 and the Russell hit 940 – as expected in yesterday's post but all were quickly slapped back, indicating that at least a few SellBots have lined up at our 5% zones.

As you can see from Doug Short's chart on the left, the S&P also ran into a lot of sellers as it once again attempted to close in on 1,600, which it failed rather harshly back on the 12th – exactly two weeks ago. Our little tweet crash may have been hunting for buy stops on Wednesday and it found them right where we shot up that morning. If GDP is a miss, we'll get a real chance to see how solid 1,560 (12.5%) support is.

8:30 update: Miss! Just 2.5% but mitigated by a big consumption number – up 3.2%. So, mixed but no reason to punch us over the highs – other than possibly the possibility that this will lead to even more QE. Don't forget to subtract 1% for inventories and the US is growing at less than 1.5% and Japan is flat and Europe is negative so, Globally – there's nothing to get too excited about. Oil is the easy short here (/CL) at $93.25 because you can't fake demand but the Dollar is swooning back to 82.50 (on hopes of more Fed easing) and holding up commodities and our indices – FOR THE MOMENT.

Be very careful out there.

The CAC is at 3,800 and the FTSE is at 6,400 and the DAX is at 7,800 and we don't usually watch European lines but those are all good ones and they'd better hold or our indexes are not likely to. We should also watch AMZN (we're short), who didn't miss (.18 vs. .09 expected) but also didn't have enough razzle-dazzle in their conference call to explain why a $275 stock only makes .19 in a good quarter). Revenues were in-line and they are hoping to rock it next Q – guiding all the way to .22 per share in earnings! I know when I lend someone $275 for a year – I'm just thrilled when they use it to make a whole Dollar so – go Amazon!

North American growth at Amazon was up 26% from last year but, unfortunately, International growth was down 16% (is it still called "growth" when it's negative?). Forex was not AMZN's friend, of course and keep that in mind for next Q if the Dollar heads over 83. On the whole, I consider this a good report for them, damaged by factors not in their control but, if Europe and Asia snap back and America keeps growing – this company could earn up to $2 per $275 share in 2014! It's not that I don't think AMZN is a great business – it's just that $275 is ridiculous this early in the decade…

Moving on to other news: China's Politburo Standing Committee has warned that the country needs to "guard against potential risks in the financial sector" but still "cement its domestic economic growth momentum." Concern has increased about rising loans in the shadow-banking industry and the "explosive" expansion in municipal debt. China "isn't going to pursue the old way of stimulus to push up growth at the expense of long-term structural reform," says Citigroup economist Ding Shuang.

Samsung had rockin' earnings with a 42% growth in profit as selling smartphones is way, way more profitable than selling TVs and other do-dads (and the TV segment goes down and down, by the way). Although they did not gain market share against our beloved AAPL, the market is growing so fast there's plenty for everybody. Maybe people will realize this now and begin buying AAPL off that $400 line…

Samsung had rockin' earnings with a 42% growth in profit as selling smartphones is way, way more profitable than selling TVs and other do-dads (and the TV segment goes down and down, by the way). Although they did not gain market share against our beloved AAPL, the market is growing so fast there's plenty for everybody. Maybe people will realize this now and begin buying AAPL off that $400 line…

NFLX got a huge upgrade from Lazard to $325 from $250 and if NFLX is worth $325, then AMZN is worth $500 as NFLX's entire operation is a giveaway under AMZN Prime. I guess AMZN will begin producing their own shows soon so they can get their p/e punched up from 275 to over 700 like NFLX. Oh dear – I'm having 1999 flashbacks again – this is the same conversation I was having with people 14 years ago (and I was wrong to be bearish – all the way until March of 2000, when I was tragically right).

9:15 update: See, oil just failed $93 and those /CL futures are up $250 per contract already with a stop at $93. That's not bad for 45 minutes work, is it? Just another way the PSW Investor Conference in Atlantic City this weekend pays for itself – looking forward to seeing you there – time to hit the chat room.

Have a great weekend,

– Phil