Wheeeee, what a ride!

Wheeeee, what a ride!

The Russell is one of our key shorts (using TZA calls) and you can see on Dave Fry's chart how resistance at the 950 line has not been futile so far. If it does pop – it's a clear signal for us to run with the bulls again but so far, it's going pretty much the way we thought as we had QE from the Fed in November and QE from the BOJ in December and they were both good for 100-point runs on the RUT but now what?

On the S&P we've gone from 1,400 to 1,600 so also 100 points twice but 100 on the RUT is a much bigger percentage than 100 on the S&P – hence both the RUT's relative outperformance and relative danger of a precipitous fall should some of the bad stuff (and here's a dozen items to mull over) be realized.

So, what next? Our formula dictates that $1Bn of stimulus buys one S&P point for one month and the Fed is pumping in $85Bn a month (1,485) and the BOJ is contributing $75Bn a month (1,590) and, as long as that keeps coming, we should be able to maintain these levels but that assumes that 1,400 is justified without the support. So earnings do matter – we need to see that stocks today are not worse off than they were when the S&P was trading at 1,400 – where we were last year at this time.

There's the rub. So far, earnings have not been spectacular, with only 56.9% of the reporting companies beating earnings and an atrocious 44.1% beating on Revenues or, to put it more accurately, 55.9% of the companies MISSED or were just in-line on revenues compared to last year, when the S&P was 14% lower.

There's the rub. So far, earnings have not been spectacular, with only 56.9% of the reporting companies beating earnings and an atrocious 44.1% beating on Revenues or, to put it more accurately, 55.9% of the companies MISSED or were just in-line on revenues compared to last year, when the S&P was 14% lower.

What then, are our mitigating factors? Well, there's all that FREE MONEY the CBs keep pouring in. And what have companies been doing with all this cash? Have they been hiring workers? NoNoNo – that's what small businesses do. Big Businesses buy back their own stock and pay dividends to the top 1% so they can pay what is still a 15% tax on dividends rather than capital gains on the stock appreciation. Even AAPL is playing that game now – becoming the biggest dividend-paying stock of all time with $12Bn going out at a 15% rate, costing the Government $2.4Bn a year in uncollected taxes. Go Capitalism!!!

So the economy is looking good for the Investing Class, our portfolios are up, we're able to collect all this low-tax money and our companies are taking themselves private thanks to cheap loans from the Fed which creates an artificial scarcity of shares as we unload our long-term Capital Gains on the sheeple who chase the 4-year rally. Can it be a 5 or 6-year rally? Sure it can, as long as the Fed doesn't run out of fresh ink and paper and as long as nothing catastrophic happens in Europe or Asia. As you can see from this Russell Investment chart, the US is in a very non-exciting recovery – but a recovery nonetheless:

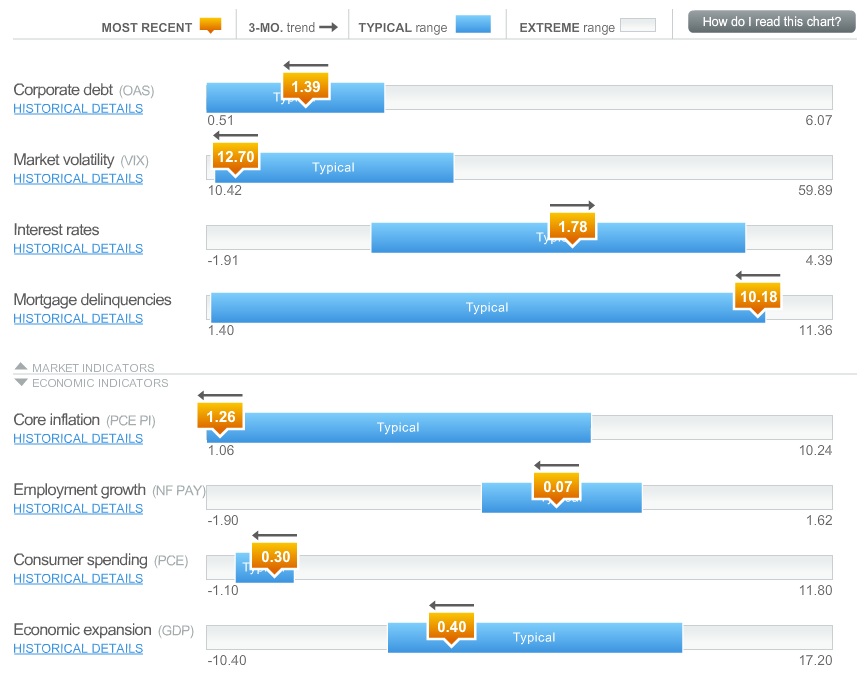

Click for full interactive graphic

Source: Russell Investments

After pounding the table on materials stocks all month I'm thrilled to see the materials sector picking up again. Basic Materials actually led us higher with a 2.66% gain in yesterday's trading and we even went long on Gasoline Futures (/RB) for some very nice gains in the morning. As I said back on Monday, the 15th, when we flipped bullish on oil at $86.50 – "I'm not fickle, that's just the way we play the Futures." It's not too late to pick up our "5 Inflation Fighters Set to Fly" (and Part 2) but oil is not one of them as we still don't like the long-term view. We did make a quick gain this morning on a short play but oil jumped back up again and is looking to re-test $92 as the Dollar is pounded down to 82.50 – which is, of course, boosting stocks and commodities.

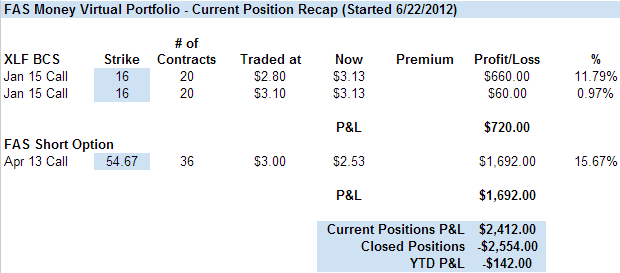

That Monday (15th) our FAS Money Portfolio looked like this:

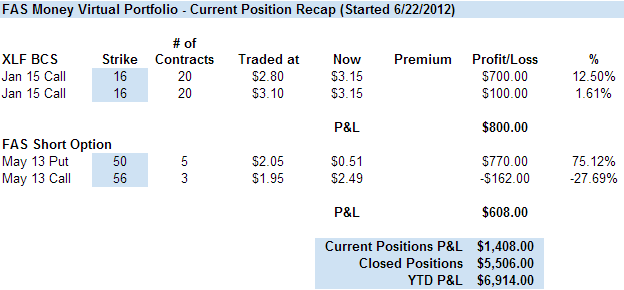

Yesterday, our FAS Money Portfolio looked like this:

What a difference 10 days can make in the options markets! More than any of our other virtual portfolios, FAS Money sticks to the core principle of BEING THE HOUSE and we just keep selling premium, week after week, month after month because we only have to hit our target once to make spectacular returns while the people we sell to have to be right every time and, even when they are right – we force them to play again. That's an even better deal than a casino has – we can force our gamblers to play and we can make them quit when they're behind – but only if we ourselves learn to exercise some discipline.

On our own plays – we need to do the opposite and not let ourselves get pushed out of fundamentally sound positions simply because they move against us with the market. The 15th was the day of the Marathon Bombing and my comment to Members regarding the crash in the Materials market was:

Overall, I still think this whole materials crash is coordinated into Q1 earnings so all the metals seem weak and the companies are forced to give cautious guidance and downgraded outlooks and that will give the big boys a lot of time to accumulate them at bargain prices so, when inflation hits, it will be GS, JPM, et al who own the controlling interest in companies like ABX, when their 140M ounces of gold are selling for over $2,000 an ounce. That's how the game is played folks….

Look at Glencore – taking over Xstrata for $30Bn to become a $250Bn/year commodities giant but not even public – just a bunch of top 1%'ers taking over the global supplies while the sheeple stampede out of the markets.

It only took 8 days for that statement to be proven correct as GS announced they had covered the gold short into the panic they had started by announcing their short position in the first place. What does it mean when a Bankster says they have "covered" a short. It means that they bought the gold already and NOW they are telling you about it and NOW they are upgrading their outlook because last time they told you they didn't like gold AFTER they SOLD it at the top so that you would panic out and sell them your gold cheap so they could COVER their position. Good samaritans one and all, right?

It only took 8 days for that statement to be proven correct as GS announced they had covered the gold short into the panic they had started by announcing their short position in the first place. What does it mean when a Bankster says they have "covered" a short. It means that they bought the gold already and NOW they are telling you about it and NOW they are upgrading their outlook because last time they told you they didn't like gold AFTER they SOLD it at the top so that you would panic out and sell them your gold cheap so they could COVER their position. Good samaritans one and all, right?

Yet people PAY to follow these crooks (alleged)! It's amazing. People pay to follow me too and while GS was saying SELLSELLSELL, I was saying BUYBUYBUY that Tuesday, pounding the table on ABX (who had great earnings last night) at $18, saying:

As we can see, Barrick is the clear-cut leader, and can count on more than enough cash to keep operating without the need to lend money if the earnings are not up to expectations. Having $5 billion in liquid money is a strong statement of Barrick's ability to operate adequately its assets and fund its projects without relying too much on its capex.

We also grabbed MT at $11.92 in our Income Portfolio (now $12.43) and NAK at $2.20 (now $2.56) and I made a very strong case for NOT dumping Materials stocks as the market crashed that afternoon. It's hard to be a Fundamental Investor because you have to buy while others are selling. It goes against human nature to panic with the herd and, even in our own chat room, a lot of people still freak out when positions move against them – especially newer Members, who haven't learned to ride out the storms yet.

We also grabbed MT at $11.92 in our Income Portfolio (now $12.43) and NAK at $2.20 (now $2.56) and I made a very strong case for NOT dumping Materials stocks as the market crashed that afternoon. It's hard to be a Fundamental Investor because you have to buy while others are selling. It goes against human nature to panic with the herd and, even in our own chat room, a lot of people still freak out when positions move against them – especially newer Members, who haven't learned to ride out the storms yet.

On Wednesday, in the morning post, I called a bottom on DBC at $25.50 (now $26) and, in Chat, we took the money and ran on our TZA longs into that dip and shifted to a more Conservative spread as we felt the downturn (2.5%) was overdone. We even made a very aggressive long play on TNA calls with a net $38.50 target (TNA closed Friday at $39, now $42) and that afternoon we got a so-so Beige Book from the Fed, which tempered our enthusiasm for non-material stocks into earnings. We even did a bullish play on USO, taking the June $29.50/31.50 bull call spread at $1.20 – that one is already at $1.60 (up 33%) with USO at $32.50. Our earnings play on AAPL was a huge winner as we played for the flatline:

Here's a fun play with AAPL – you can buy the May $400 put and calls for $41 and sell the Friday $400 puts and calls for $11 and then sell the next week $400 puts and calls, currently $32.50. If all goes well, you collect more than you spend and you can't lose as you're covered on both ends.

AAPL finished at $390.53 on Friday, killing the short $400 calls and leaving $9.47 on the short puts, those were rolled to the current week's $400 puts and calls at $35 (as volatility spiked up) and now they are down to $9.50 while the May $400 puts and calls are still $24 so $41 was spent, $11 was collected, $9.47 was spent, $35 was collected for net $4.47 out of pocket and the trade can be cashed today for net $14.50 – a 320% return on cash in 7 days!

Sell premium, Sell Premium, SELL PREMIUM – if you fail to gain anything else from following our trades – please let this one thing sink in. No one knows what a stock is going to do day to day but we do know, FOR A FACT, that all premium will expire worthless over time.

Sell premium, Sell Premium, SELL PREMIUM – if you fail to gain anything else from following our trades – please let this one thing sink in. No one knows what a stock is going to do day to day but we do know, FOR A FACT, that all premium will expire worthless over time.

It's fun to be right, but it's a lot more fun to make money consistently.