Dow 15,000!

Dow 15,000!

As noted by Dave Fry, we may be early in calling for profit-taking but, as I said to our Members this morning – I'd rather miss the first 2.5% of the next 20% move up than blow 10% of the 20% move we've caught since Thanksgiving.

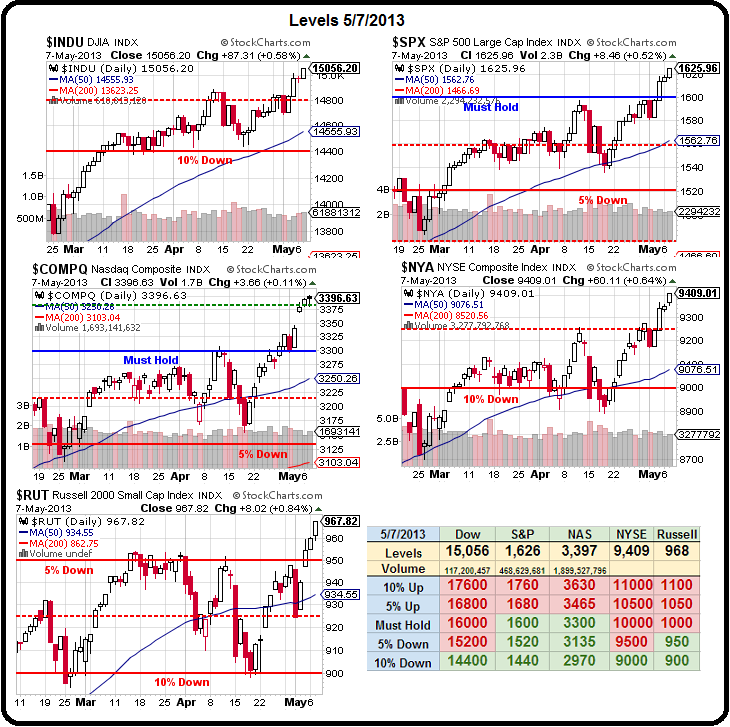

For one thing, look at those volume bars – we haven't confirmed anything yet and, in fact, if you bisect that rising channel – we're actually stuck in the lower half of it with an RSI and MACD that some might call "toppy."

A lot of traders don't understand that you can't get good prices taking gains off the table if you wait until the market reverses to start selling. That being said, in our review of our two $25,000 Portfolios and our Fas Money Portfolio and our APPL Money Portfolio – we haven't actually found anything we want to sell. We covered XLF at $19, we covered AAPL at $460, we tilted bearish in our aggressive portfolio but none of our bullish plays were taken down yet – the signs just aren't confirming it so far.

We are, on the other hand, in the process of redrawing the lines on our Big Chart (thanks StJ) and we're going with very aggressive targets if this rally is determined to convince us to keep playing.

We are, on the other hand, in the process of redrawing the lines on our Big Chart (thanks StJ) and we're going with very aggressive targets if this rally is determined to convince us to keep playing.

The Dow Futures hit 14,999 this morning (/YM) and make a great short at that spot with a stop at 15,005 for a loss of $30 per contract but it's a quick trip to 14,950 for a $250 per contract gain if the Dow Index, which is 60 points higher, re-tests the 15,000 line. Risking $30 to make up to $250 is a good way to play the Futures!

I wish I could say we deserve to be this high, but clearly we don't. CAT, for example, is up from $80 to $90 in the past two weeks, adding 85 points to the Dow despite the fact that the miners they service have fallen off a cliff and housing starts have slowed markedly. Don't get me wrong, we bought CAT at $80 – we love CAT long-term, but we certainly didn't think it would gain 12.5% in 12 sessions since. My simple comment to our Members as CAT was bottoming on 4/22 was:

There is no reason I can think of not to sell 5 2015 CAT $75 puts for $9.20 ($4,600) in the Income Portfolio. Would we like to buy 500 shares of CAT for net $66 (now $82.40) – SURE!

Those puts are already down to $6.50 for a nice 30% gain in two weeks and we'll take it but that doesn't mean we're mindlessly happy that CAT is jumping like a cat on a hot tin roof. The Fundamentals haven't flip-flopped in two weeks, the real change comes down to one statement by one man – one very powerful man – Mario Draghi. Draghi has flip-flopped and fell off the austerity wagon and is now saying the ECB will act to stimulate the EU economy. When and how much remains a mystery but he said it again Monday in Rome (he's pretty much repeating it daily at this point).

Those puts are already down to $6.50 for a nice 30% gain in two weeks and we'll take it but that doesn't mean we're mindlessly happy that CAT is jumping like a cat on a hot tin roof. The Fundamentals haven't flip-flopped in two weeks, the real change comes down to one statement by one man – one very powerful man – Mario Draghi. Draghi has flip-flopped and fell off the austerity wagon and is now saying the ECB will act to stimulate the EU economy. When and how much remains a mystery but he said it again Monday in Rome (he's pretty much repeating it daily at this point).

"We will watch all the incoming data on the euro-area economy in the next weeks and if necessary we'll be ready to take further action," Mr. Draghi said, departing from a prepared speech at LUISS university in Rome to emphasize a point made last week at the ECB's monthly news conference.

He also reiterated the central bank would not rule out cutting its deposit rate to below zero, a move that would effectively charge other lenders for keeping their money with the ECB. At present, Euro-zone banks have more than €100 billion ($130 billion) in excess reserves that they prefer to park in the deposit facility rather than lend to other banks or to clients. Cutting the deposit rate could squeeze some of that money into more active use.

"Let's poke this rattlesnake and see what it does" seems to be the new economic policy of the Central Bankers, who are staring at a whole basket of economic snakes that are, so far, not responding to stimulus. As you can see from the 1942 Dr. Seuss cartoon on the left (his old job) – this isn't a new problem – and these aren't new solutions. Which begs the question – why are we expecting different results?

"Let's poke this rattlesnake and see what it does" seems to be the new economic policy of the Central Bankers, who are staring at a whole basket of economic snakes that are, so far, not responding to stimulus. As you can see from the 1942 Dr. Seuss cartoon on the left (his old job) – this isn't a new problem – and these aren't new solutions. Which begs the question – why are we expecting different results?

In the Sunday session of our Atlantic City Conference we discussed Global Macros and how the Fed and the BOJ have turned on the fire hoses and filled our still-leaky Global bathtub back to it's 2007 levels by increasing the money supply to compensate for the lack of monetary velocity.

Clearly, the supply of money has doubled and now Draghi is indicating he's willing to add another 10% but, with the VELOCITY of money near zero, any actual increase in economic activity can quickly lead to runaway inflation long before the CBs will be able to drain the cash back from the system. Surely money is being sucked up at an incredible pace – Greece is borrowing $50Bn, Cyprus is borrowing $20Bn, AAPL is borrowing $100Bn – it all adds up after a while. Plus the US borrows its usual $100Bn per month and Japan does their share, etc. so lots of money still being sucked out of the tub – no matter how fast they fill it but what happens when and if the Companies (not Countries) that borrow money begin to spend it?

That's precisely what Draghi is trying to encourage by threatening to inflict negative deposit rates. What's the message? If you don't spend your money we're going to take it from you anyway! To the extent that investors believe that is coming, money has to go into other asset classes.

That's precisely what Draghi is trying to encourage by threatening to inflict negative deposit rates. What's the message? If you don't spend your money we're going to take it from you anyway! To the extent that investors believe that is coming, money has to go into other asset classes.

That's how we create bubbles and, right now, the stock market is taking in a lot of cash. $64Bn flowed into ETFs alone so far this year, which explains the mindless rallies we see at the end of each day. Over $1.5Tn are now held by US ETFs alone – up 50% since 2010.

Margin debt on the NYSE is back to record levels that have been strong indicators of overbought markets in the past and we just HAVE to play it a little cautious here and we will continue to do so until our new, very aggressive, Big Chart targets are hit. I don't REALLY believe it's going to happen on our first attempt but we've cleared all the old Big Chart lines (except the Dow) so, it may be premature – but here's our new Big Chart reflecting a new, more bullish range – IF THIS RALLY IS REAL – which I still am betting it's not. Should we fail 3 of our 5 -10% lines – I will be very happy to go back to our old, reliable Big Chart – which may not be dead quite yet: