It's been a long time since we were worried about a steep drop.

It's been a long time since we were worried about a steep drop.

We have some very successful hedges already as I've been pounding the table on all week and the DIA June $148 puts I mentioned Thursday at .60 closed at $1.04 (up 73% in 2 days!) while the DIA Aug $147 puts I suggested rolling to went from $1.72 to $2.50 – so, "only" up 45% but up .78 rather than .44 and, with 100 contracts, that's a $3,400 difference! The longer-term TZA October $30/37 bull call spread did little, going from $1.90 to $2 but now, if we take the DIA profits on 100 calls off the table with a $7,800 profit, that knocks $2.60 of each of the 30 TZA spreads and drops the basis to a net 0.70 credit with an upside of 3,000 x $7 or $21,000 (1,100% with the credit).

That's how we play the option insurance gain. We take the quick, directional profits off the table and leave the long-term hedges, that pay the big bucks, on the table, in case the market suffers a sustained downturn and, if not, it's very cheap insurance and we'll easily be able to stop out the now $2 spread before it hits $1 for a profitable exit, ready to reload for the next round of insurance plays.

Since there is so much money in this kind of insurance, we don't need to pull the DIA puts immediately off the table. We can set a stop on 1/2 $2.30 and a stop on the other half at $2 and we lock in a gain of no less than $4,300, that still leaves us with a net of .47 on the $7 TZA spreads, still with a potential gain of $19,590 if the Russell falls 5% to 934. Note that there's no margin requirements to this kind of trade – these simple hedges can be applied to any portfolio (in proportion, of course!).

Since there is so much money in this kind of insurance, we don't need to pull the DIA puts immediately off the table. We can set a stop on 1/2 $2.30 and a stop on the other half at $2 and we lock in a gain of no less than $4,300, that still leaves us with a net of .47 on the $7 TZA spreads, still with a potential gain of $19,590 if the Russell falls 5% to 934. Note that there's no margin requirements to this kind of trade – these simple hedges can be applied to any portfolio (in proportion, of course!).

You know I am a big fan of taking cash off the table in either direction, let's not be greedy and look at ways to "roll" our downside profits into new protective plays so we can set SENSIBLE stops on our in the money short plays (very similar to our Mattress Strategy). I hate to have to repeat these warnings over and over again but days like yesterday make it all worth it. As ZeroXZero said in Member Chat at yesterday's close:

Phil/ Thanks to your obsessive bearish anxiety over the last few weeks, I made money on the long side this month, phased gradually to bearish, came in net short today and managed to make money both long and short all week, ending today [and each day this week] in the green. I don't know how you do it, but thank you.

And that's why I do it (thanks ZZ, by the way)! I know a lot of you are here just for the stock picks but my secret goal is to make you all better traders… Keep in mind that Friday was the biggest market decline we've had since April, as noted on Dave Fry's charts of the SPY – so adding a layer of protection here doubles our returns if this is the first leg of a major sell-off, or it gives us a smaller hedge that we can roll up later while we take our bigger hedges off the table. As I have to say WAY too often to Members – It's not a profit until you cash it in!

Hedging for disaster is a concept I advocated during another "recovery," in October of 2008, where we made our cover plays to carry us through a worrisome holiday season and into Q1 earnings – "just in case." That "just in case" saved a lot of portfolios! The idea is to take disaster hedges using high-return ETFs that will give you 3-5x returns in a major downturn. That way, 10% allocated of your portfolio to protection can turn into 30-50% on a dip, giving you some much-needed cash right when there is a good buying opportunity. At the time, I advocated SKF Jan $100s at $19. SKF hit $300 around Thanksgiving and those calls made a profit of over $280 (1,400%), so putting even just 5% of your virtual portfolio into that financial hedge would give you back 75% of your portfolio when you cash out.

Keep in mind these are INSURANCE plays – you expect to LOSE, not win but, if you need to ride out a lot of bullish positions through an uncertain period, this is a pretty good way to go. I already made my call to cash out on shorter-term bullish position but we still need to protect our long-term plays, like the ones we keep in our Income Portfolio. To some extent, they are self-hedged and well in the money but we still prefer to have a little extra insurance, to take us through uncertain times.

Keep in mind these are INSURANCE plays – you expect to LOSE, not win but, if you need to ride out a lot of bullish positions through an uncertain period, this is a pretty good way to go. I already made my call to cash out on shorter-term bullish position but we still need to protect our long-term plays, like the ones we keep in our Income Portfolio. To some extent, they are self-hedged and well in the money but we still prefer to have a little extra insurance, to take us through uncertain times.

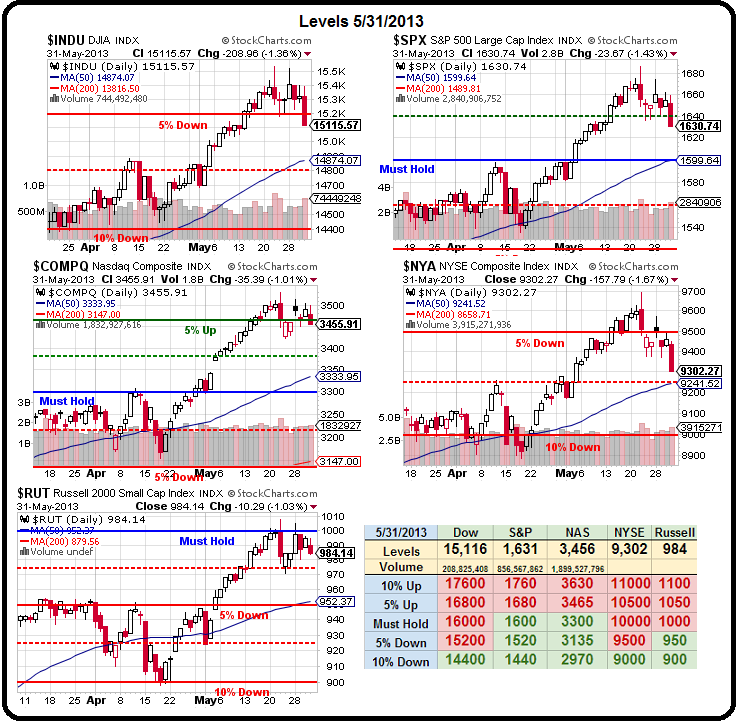

The Russell has been unable to break our 1,000 target and the Dow has failed to make our 16,000 Must Hold level and the NYSE has not been close to 10,000 and, as I warned just this Thursday morning, ahead of Friday's 200-point drop, the Dow had no real support all the way to 15,200. As it turned out, we bottomed out at 15,115 down just about the requisite 2.5% from our week's high.

While we're not expecting a huge correction (because the Fed is still very much in the game) – but it's not like we haven't had some decent ones. You can see on the weekly SPY chart that our last two 15% market runs had 50% retracements and here we are at the top of a 20% dun-up and waiting for our first retracement. Even in an epic bull market – retracements do happen. Fibonacci discovered that in 1175 and those who forget the past yadda, yadda…

As far as hedging goes, if you are 50% invested and 50% in cash and you are worried about losing 20% on the stock side in a major sell-off, then the logic of these hedges is to take 20% of your cash (10% of your total) and put it on something that may triple or better while the other positions lose. If things go down, your gains on the hedge offset most of the losses on your longer positions. If things go up, you can stop out with a 25% loss, which will "only" be a 2.5% hit on your total portfolio but it means we are breaking through resistance and your upside bets are safe and doing well. That is not a bad trade-off for insurance in this crazy market. Also, be aware that these are thinly traded contracts with wide bid/ask spreads and you need to use caution establishing and exiting positions.

As we are now, we were very keyed on watching the top of the April range for support, which were at the time: Dow at 14,800, S&P 1,600, Nasdaq at 3,300, NYSE 9,250 and Russell 950. These are all levels that give up all of Q2 gains and are roughly the 50 dmas, but things can get far worse if we have another crisis of confidence, like we did last year (when Europe had a crisis) or the year before (when Europe had a crisis). It's still too early to bargain hunt because that was a mistake we made in 2008 – looking for floors that never came – so we need to be judicious in our bottom-fishing expeditions.

As we are now, we were very keyed on watching the top of the April range for support, which were at the time: Dow at 14,800, S&P 1,600, Nasdaq at 3,300, NYSE 9,250 and Russell 950. These are all levels that give up all of Q2 gains and are roughly the 50 dmas, but things can get far worse if we have another crisis of confidence, like we did last year (when Europe had a crisis) or the year before (when Europe had a crisis). It's still too early to bargain hunt because that was a mistake we made in 2008 – looking for floors that never came – so we need to be judicious in our bottom-fishing expeditions.

Keep in mind that these are 2nd stage hedges as we already have TZA hedges from higher levels (Russell 1,000, now 984) we have a Fed Beige Book next Wednesday and NFP on Friday and Fed speak could turn the market right back up but, we do need something, in case it doesn't. That being the case, here’s a few ideas to help ride out a larger downturn as well as to protect our eventual buys:

- DXD July $35 calls at $1.20, selling July $38 calls for .55. This is a net .65 entry on a $3 spread so your upside is 361% at $38 (DXD is now $37.65). If the Dow ends up holding 15,000 and moves back up, there’s a good chance you can kill this cover with a small loss as a $3 move on DXD is about 10% and that would be about a 5% move up in the Dow to new highs at 15,750 before the July $35s lose half their value (which is still more than you paid for the total spread). You need $35.65 (+2.8%) to get your money back and that's a 1.4% drop in the Dow to 14,900, so you are well-protected for any dip below that line.

- TZA is still our favorite hedge and you can pick up the Oct $30/37 bull call spread for $2 and you can sell the Oct $24 puts for $1.05 for net .95 on the $7 spread, giving you 736% of upside potential and, best of all, with TZA at $31.76, you are starting out .71 in the money (67%)! TZA drops $7.76, to $24 if the Russell goes up 8% plus these ultra-ETFs tend to decay over time but owning TZA for net $25.05 is not a bad portfolio hedge and the Russell would have to be net up 8% to 1,062 in October for this to happen and, if so, your longs should be doing well.

When you are entering a trade like this, assume you will have TZA put to you at $25.05 and allocate how much you are REALLY willing to own. Say that’s $12,500, which would be 500 shares and that means you can make this trade with 5 contracts at a net cost of $525 plus (according to TOS) $1,215 in margin. This play returns $3,500 if TZA rises 16% (Russell down 5.5%) and holds $37 through the October expiration. This hedge then, does a good job of protecting $100,000 worth of existing positions against a 5% loss for $5,000 (hopefully, you already have buy/writes that protect you from a 20% drop, so we're good for 25% total downside) – plus some margin you'd better have laying around anyway!

When you are entering a trade like this, assume you will have TZA put to you at $25.05 and allocate how much you are REALLY willing to own. Say that’s $12,500, which would be 500 shares and that means you can make this trade with 5 contracts at a net cost of $525 plus (according to TOS) $1,215 in margin. This play returns $3,500 if TZA rises 16% (Russell down 5.5%) and holds $37 through the October expiration. This hedge then, does a good job of protecting $100,000 worth of existing positions against a 5% loss for $5,000 (hopefully, you already have buy/writes that protect you from a 20% drop, so we're good for 25% total downside) – plus some margin you'd better have laying around anyway!

SDS July $37 calls at $3.30, selling July $41 calls for $1.40 and selling something you do want to buy on a market drop like KO Jan $35 puts for 0.90. Here we are in a $4 spread for net .90 with the possibility of making $3.10 (344%) if SDS hits $41 (up $1 or 2.5% or down 1.25% on the S&P to 1,609). We may have KO put to us for net $35.90 at that level (now $40).

Of course, we can roll the puts down to the 2015 $30 puts (now $1.30) – which is a pretty good entry on KO (25% off)! Remember, the premise is that it's not likely to have KO go below $35, let alone $30 if the S&P is rising so your expected cost of insurance is that .90 – although you can stop the bull call spread out long before that happens. If you are willing to own $15,000 worth of KO at around $30 in 2015, it's reasonable to take 5 of these hedges, which return $2,000 if the S&P falls just 1.25%. The margin on 5 short KO Jan $35 puts is just $1,500 according to TOS – so not tragic if forced into the long-term short puts.

Another nice thing about this trade, in a vacuum, is that – IF we have a catastrophic failure that forces you to buy 500 shares of KO for $30 – there's a pretty good chance you will have collected that $2,000 from the SDS spread and that means you are buying 500 shares of KO for net $13,000 – just $26 per share!

Another nice thing about this trade, in a vacuum, is that – IF we have a catastrophic failure that forces you to buy 500 shares of KO for $30 – there's a pretty good chance you will have collected that $2,000 from the SDS spread and that means you are buying 500 shares of KO for net $13,000 – just $26 per share!

Another way to hedge SDS if you are not margin constrained is by selling SPY puts. SPY Jan $122 puts are $1 so a net of 0.90 on the above spread and you KNOW the puts are rollable and, of course, the SPY puts CAN'T go in the money until AFTER you make $5.27 per spread. What you are playing for here is that the S&P will drop 1.25% but not 25% (and, assuming a roll, 35%).

I'm sure some of our more savvy traders have already realized that once SPY drops 10%, we can simply add more hedges and at 15%, more hedges and at 20%, even more hedges to protect against getting too burned on the short puts. Layering in our Disaster Hedges is always a good plan. After all, that's what these hedges are as we've already got plenty of hedges like this from when the market was 15% higher!

The great thing about this kind of play is that, if the S&P goes up, the insurance is half price as the short puts expire worthless. You can even stop out the July $37 calls at around $1 and you end up with something in your pocket as a reward for all your hard work.

Keep in mind that this is insurance, not betting. These are hedges that are meant to perform for you if your upside bets don't work out and will hopefully not cost you too much money when your upside plays go well. If your upside plays are sensibly hedged, like our buy/writes that pay at least 10% a quarter in a flat to up market, then this kind of sensible insurance is all you should need to offset reasonable dips in the market. It doesn't mean you don't need stops.

Keep in mind that this is insurance, not betting. These are hedges that are meant to perform for you if your upside bets don't work out and will hopefully not cost you too much money when your upside plays go well. If your upside plays are sensibly hedged, like our buy/writes that pay at least 10% a quarter in a flat to up market, then this kind of sensible insurance is all you should need to offset reasonable dips in the market. It doesn't mean you don't need stops.

As with all of our protection plays, if we become more confident that the market will NOT collapse, then we simply take them off the table with a small loss and that makes us more bullish but having a few hedges like this in your portfolio can do a lot to cushion the blows from any major market sell-offs.

I cannot remind you enough though that these are insurance plays and they are not ideal for rolling or adjusting and you should EXPECT to lose money if the market heads higher – much the same as you expect to have "wasted" your life insurance premium for the prior year every time you celebrate another birthday….

As with life insurance, it may make you feel good to walk around with $50M worth of protection in case you get hit by a bus but – is it realistic? Look at your portfolio and think about what kind of protection you REALLY need. If you have $100,000 worth of May buy/writes that are good for a roughly 15% dip in the market, then you don't really need ANY protection against a 15% drop. If the market drops 25%, then you will lose 10% on what you have now. If the market drops 40%, then you lose 25%. We all learned how valuable it can be to simply stay even in a major market drop as opportunities abound then so simply putting 5% away on hedges that will pay 25% back when the market drops 40% will let you cash out with 100% of what you have now and go shopping – that's all insurance needs to do!

Disaster hedges are a good exercise in managing your portfolio but, unfortunately, like Auto insurance, you just pay and pay and pay until you have that accident. So safe driving!