What is going on with these indexes?

What is going on with these indexes?

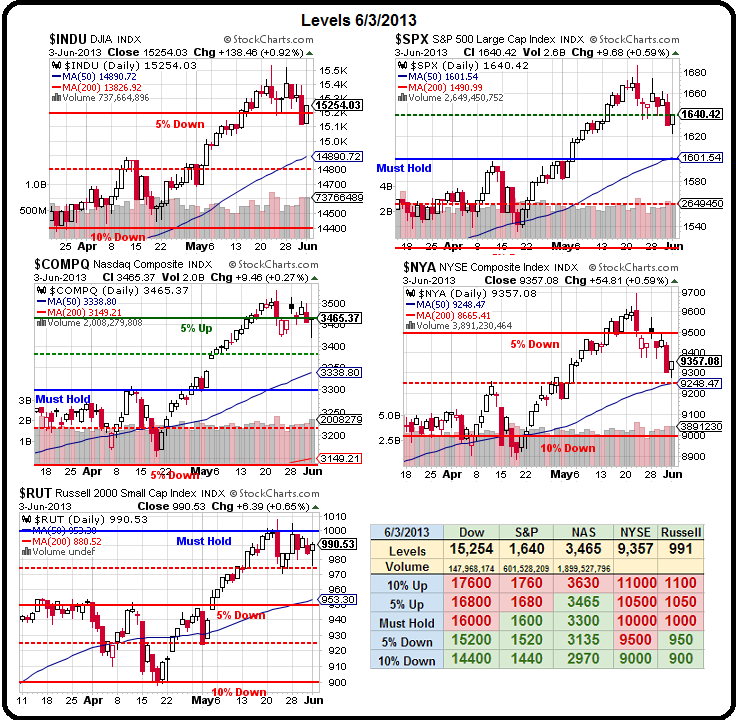

Last week, I said "975 is bust" on the Russell and, yesterday, we hit 975 on the nose before turning back up. Is this bullish, or shadows of breakdowns to come? Clearly the Fed is still very much in the game so buying the f'ing dip is still the logical way to play the market but any hint that the Fed may stop, or even slow, the FREE MONEY train is going to have a dramatic impact on investor confidence since, without the Fed, what do we have?

- We have a Euro-Zone in it's longest recession ever (6th consecutive quarter of contraction) with their GDP out tomorrow.

- Euro-Zone Unemployment is at an all-time high 12.2% with youth unemployment in Greece at 62.5% and Spain 56.4% (buy TASR ahead of riot season!).

- Australia is falling apart.

- India has its slowest growth in the 21st Century.

- Japan (say no more).

- China is not much better.

- Global Cash Flow is falling off a cliff, despite the stimulus.

- US Real Wages continue to decline for bottom 90%.

We also have the dreaded "Hindenberg Omen" that has predicted 20 of the last 3 market crashes but I'm more concerned with the fundamental issue of Margin Debt hitting a new all-time high at $384.3Bn – $3Bn higher than July of 2007 and THAT indicator has correctly predicted pretty much every correction pretty much ever.

We also have the dreaded "Hindenberg Omen" that has predicted 20 of the last 3 market crashes but I'm more concerned with the fundamental issue of Margin Debt hitting a new all-time high at $384.3Bn – $3Bn higher than July of 2007 and THAT indicator has correctly predicted pretty much every correction pretty much ever.

What's really scary is this chart of the so-called "smart money" flying for the exits last month. We are included in that group, of course, as we also took the opportunity to "sell in May" and now, in June, we're simply waiting to see if we were right or if we pulled up our tent-poles before the show was over.

It's not like we're missing things though. Just last week, in Stock World Weekly, we have a bullish play on FDX as well as a short play on TSLA and a bullish play on TZA (which is market bearish, of course).

The FDX trade idea is still good but the TSLA idea was buying the 2015 $110/90 bear put spread for $14 and selling the 2015 $130 calls for $21 for a net $7 credit and now that spread is still $14 but the $130 calls are just $17 for a very quick $4 gain in a week on that combo.

The TZA hedge was the October $30/37 bull call spread from the weekend post and that one is still $1.90 and the short Oct $24 puts are still $1.05 and I still like that spread for net .85 with a $6.15 upside potential (723%), especially as TZA is currently $30.94, so we start out .94 in the money.

The TZA hedge was the October $30/37 bull call spread from the weekend post and that one is still $1.90 and the short Oct $24 puts are still $1.05 and I still like that spread for net .85 with a $6.15 upside potential (723%), especially as TZA is currently $30.94, so we start out .94 in the money.

We're having the usual Tuesday pre-market run-up – the only question is whether or not it will last. Europe has been trending down all morning from their +1% open and is now up a bit less than half a point but our Futures have creeped up 0.25% and, as I said to Members in our Morning Alert:

Not much going on today but we have the 3 Fed speakers today (Raskin, George, Fisher) starting at 12:30 to knock us around. Australia's GDP comes out tonight and 2.7% is expected and, if they miss that, Asia should sell off. Europe PMI tomorrow and Q1 GDP for them AND Retail Sales over there so if there's a cliff to dive off, we'll have it pre-market along with our own ADP, Productivity Report and Factory Orders & ISM after the bell at 10. THEN we have oil inventories and then they Beige book so not much going on today and then, tomorrow, things go from zero to crazy.

Even yesterday, we were able to find bullish trade ideas we liked for INTC and AAPL. We've merely flipped from being generally bullish with bearish hedges to generally bearish with bullish hedges and, so far, it's doing well for our new Short-Term Portfolio, where we're just trying to stay in cash and grab those short-term opportunities as they present themselves. As noted by Dave Fry:

Even yesterday, we were able to find bullish trade ideas we liked for INTC and AAPL. We've merely flipped from being generally bullish with bearish hedges to generally bearish with bullish hedges and, so far, it's doing well for our new Short-Term Portfolio, where we're just trying to stay in cash and grab those short-term opportunities as they present themselves. As noted by Dave Fry:

The San Francisco Fed’s John Williams floated another taper trial balloon suggesting the Fed could begin slowing asset purchases this summer with QE ending by year end. In the afternoon the Atlanta Fed’s dovish Dennis Lockhart discussed tapering QE and suggested now wasn’t the time.

Then he added a powerful caveat saying it wasn’t a certainty Bernanke would retire in January. That was red meat for bulls. Let’s put it this way, there will be plenty of Fed talking heads on the speaking circuit jawboning markets one way or another. (Tuesday will feature Raskin, George and Fisher with the latter two more hawkish). Talk is what they do since it’s the easy button but it will only get them so far as June 19th, which is the next Fed meeting, and actions speak louder than words.

Bill Gross and his partners are weighing in on the Fed with Gross grousing: "Carry" is the "beating heart" of financial markets and Central Banks – by compressing yields –are killing it. "Our global financial system at the zero-bound is beginning to resemble a leukemia patient with New Age chemotherapy, desperately attempting to cure an economy that requires structural as opposed to monetary solutions … Investors should look for a pacemaker to follow a less risky, lower returning but more life-sustaining push."

Bill Gross and his partners are weighing in on the Fed with Gross grousing: "Carry" is the "beating heart" of financial markets and Central Banks – by compressing yields –are killing it. "Our global financial system at the zero-bound is beginning to resemble a leukemia patient with New Age chemotherapy, desperately attempting to cure an economy that requires structural as opposed to monetary solutions … Investors should look for a pacemaker to follow a less risky, lower returning but more life-sustaining push."

Let's face it – it's ALL about the Fed for the next couple of weeks and it's likely to be a wild ride. Let's stay on our toes…