“There is no real direction here, neither lines of power nor cooperation. Decisions are never really made – at best they manage to emerge, from a chaos of peeves, whims, hallucinations and all around assholery. ” – Pynchon

What madness!

It's a fun kind of madness, especially when we can make a quick 36% cashing in the EWJ calls we discussed in yesterday's post and $1,000 per contract on the oil shorts we also discussed in yesterday's post. What do we care if the markets are fixed as long as we UNDERSTAND how they are fixed and are able to play along with the fixers?

Gravity's Rainbow is a novel about V2 Rockets (and other weird stuff) and the title refers to the parabolic trajectory the rockets take. What's most significant for current market watchers is that the rockets are targeted from the ground, shot in a certain direction with a certain amount of thrust – and then, near the top, the engines cut out and gravity takes care of the rest.

Where the rocket lands is predictable but not certain, following a probability theory known as a Poisson Distribution. In other words, you give the rocket a push in the general direction of your enemies, but you're never quite certain where they'll end up. This leads to a lot of angst among some of the more sensitive rocket men but a sense of fatalistic determinism from most of them. Very much like our Federal Reserve's efforts at stimulus or, as Pynchon said:

“A market need no longer be run by the Invisible Hand, but now could create itself-its own logic, momentum, style, from inside. Putting the control inside was ratifying what de facto had happened-that you had dispensed with God. But you had taken on a greater, and more harmful, illusion. The illusion of control. That A could do B. But that was false. Completely. No one can do. Things only happen, A and B are unreal, are names for parts that ought to be inseparable…”

That is what we have now and that is what the Federal Reserve seeks to impart to us tomorrow – the illusion of control. As we can see recently, there are clearly some doubts creeping into the market participants, which leads to wild intra-day swings – based on the rumor of the moment.

That is what we have now and that is what the Federal Reserve seeks to impart to us tomorrow – the illusion of control. As we can see recently, there are clearly some doubts creeping into the market participants, which leads to wild intra-day swings – based on the rumor of the moment.

As illustrated on Dave Fry's SPY chart, the moment of the day yesterday was a story in the Financial Times claiming the Fed was "likely to signal tapering move is close." The article makes a few good points but, on the whole is simply DISCUSSING the possibility of tapering in the context of the Fed's stated goals and even makes the very valid point that:

To add still more accommodation even as the labour market improves – which is how the Fed regards adding $85bn-a-month to its stock of assets – is like the fire brigade pumping faster even as the fire goes out. At some point the extra water does more damage than the remaining flames. But that does not mean the Fed is going to turn off the water and let the building catch fire again.

This market is far from weightless – as illustrated by yesterday's big dip on a small rumor. There are literally TONS of worries still dragging us down but, so far, we've been able to overcome those concerns with $85Bn of monthly Federal Reserve thrust, recently accompanied by another $75Bn/month from the Bank of Japan. Recently, we pushed another 5% higher on the expectation that the ECB will also begin to add some fuel but, so far, all we're getting from the ECB's Draghi is a lot of hot air – an example of which was this morning's comment:

This market is far from weightless – as illustrated by yesterday's big dip on a small rumor. There are literally TONS of worries still dragging us down but, so far, we've been able to overcome those concerns with $85Bn of monthly Federal Reserve thrust, recently accompanied by another $75Bn/month from the Bank of Japan. Recently, we pushed another 5% higher on the expectation that the ECB will also begin to add some fuel but, so far, all we're getting from the ECB's Draghi is a lot of hot air – an example of which was this morning's comment:

The European Central Bank has numerous tools, whether they be "standard interest rate policy and non-standard measures," that it can "deploy if circumstances warrant," Mario Draghi says in a broad reiteration of commitments the ECB made last month. "We have been able to regain better control of monetary conditions in the euro area economy," which is important for being able to boost the economy with the "appropriate monetary policy."

There's that illusion of control the Fed Banksters want you to buy into. Everything is fine even though it doesn't look fine because they COULD fix it if they wanted to. What then, are we to believe? That they don't actually WANT to fix things yet? This is such utter BS but, amazingly, people have been swallowing it for so long they've actually acquired a taste for it. Please Mr. Central Banker, lie to me some more and tell me everything is going to be all right so I can invest without fear and sleep soundly at night – like I used to do in 2007…

There's that illusion of control the Fed Banksters want you to buy into. Everything is fine even though it doesn't look fine because they COULD fix it if they wanted to. What then, are we to believe? That they don't actually WANT to fix things yet? This is such utter BS but, amazingly, people have been swallowing it for so long they've actually acquired a taste for it. Please Mr. Central Banker, lie to me some more and tell me everything is going to be all right so I can invest without fear and sleep soundly at night – like I used to do in 2007…

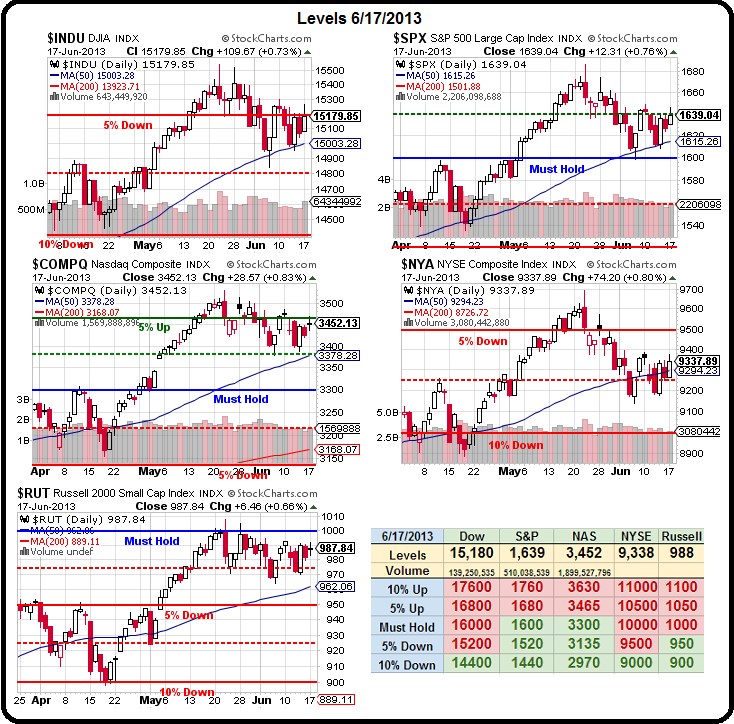

Unfortunately, we did have the nightmare of 2008 and we saw what the other side of a parabolic arc can look like and that, unfortunately, is what is likely to happen when the Fed cuts the fuel supply to our market rockets. Why? Very simply because we haven't built up any kind of base below for our markets to land on. There's no jobs, no infrastructure, no velocity of money (see Friday's post) to create a base of commerce for our valuations to soft-land on. There's just the harsh reality of technical support levels (200 dmas) that are, at best, 10% below our boosted levels:

Those 50 dmas (blue lines) may well hold up – but only as long as investors have confidence that those thrusters are still firing. Any rumor that they MIGHT cut out, however, leads to the kind of behavior we saw yesterday – the rapid withdrawal of funds from the various index rockets – before gravity takes hold and they all blow up in our faces.

Let's be very careful out there!