Here we go again.

Here we go again.

Or, maybe not. As you can see from Dave Fry's (welcome back!) Dow chart, we're right back where we were at the June consolidation lows and maybe we'll panic down and test those spike lows but we're not as worried (yet) about a big drop as we were in June, when I sent "Hedging For Disaster – 3 More Option Plays that Make 300% if the Market Falls" to our Members.

We spiked to a low 3 weeks later, on the 24th and those trade ideas did a wonderful job of offsetting losses and putting cash in our pockets – which is exactly what insurance is supposed to do.

While others were panicking out of position on June 26th, I wrote "Wall of Worry Wednesday – Time to Climb Again?" and we took up the conrary position – especially on gold, which had fallen to $1,222.90 at the time and we decided we were ready to catch that falling knife. We were off the low by $50 but we've already exceeded our recovery goal of $1,350 and, of course, all of our miner plays are golden!

We're finished with Silver for now ($24.50) and that means we're also done with AGQ, which was $15.55 back on June 26th and now $25.50 for a very nice 64% gain in 3 months – who says I don't make straight stock picks?

Of course, the option trade idea was a bit more profitable as we went with shorting the 2015 $10 puts for $2 (now $1) top pay for the Jan $19 calls at $1.70 for a net .30 cash credit. The Jan $19 calls are now $7.70 and that puts the trade up an even $8 total of 2,667% on cash in 90 days. As I had noted in our August Trade Review – I rarely play silver, as it's so volatile – but that's no reason to not play it when it makes a clear bottom or top.

Silver itself (AGQ is a 2x Ultra-ETF) rose from rose from $18.50 to $24.50 and 32% is a pretty big move in a commodity and, of course, gold isn't up 32% from it's June 28th spike low of $1,179.40, as that would be $1,556.80. That's why we took the money and ran on silver yesterday.

Silver itself (AGQ is a 2x Ultra-ETF) rose from rose from $18.50 to $24.50 and 32% is a pretty big move in a commodity and, of course, gold isn't up 32% from it's June 28th spike low of $1,179.40, as that would be $1,556.80. That's why we took the money and ran on silver yesterday.

If we want to pursue metals, gold is clearly a fresher horse to ride at the moment.

Members who are into gold should reveiw the posts and comments from June 26th through July 1st as we rode out the panic and made a tonne of great trades – keeping our heads while others were losing theirs.

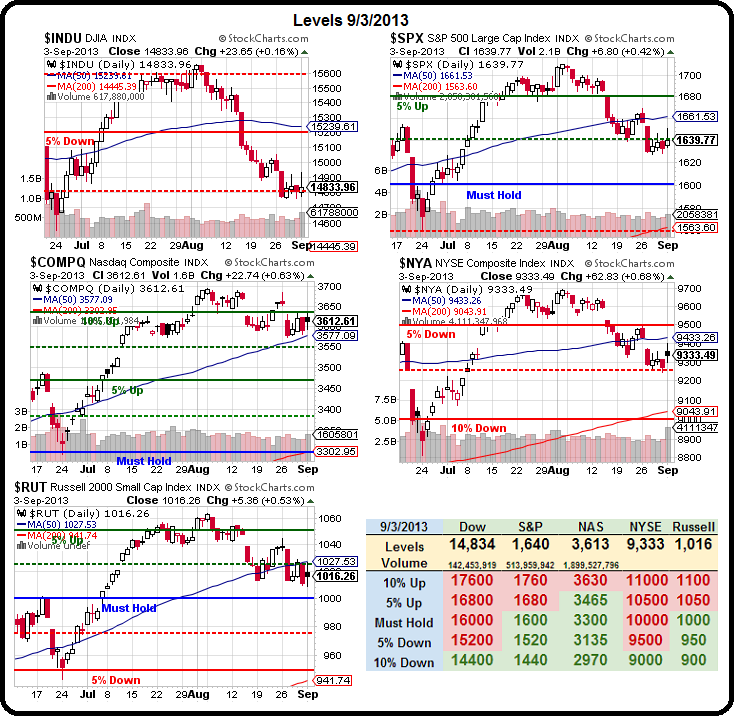

Which brings us back to today's situation: We're not in panic mode but we're certainly not bullish at these lofty levels after collecting 3 more months of data and ending up right back where we started – watching that 14,800 line (-7.5% on our Big Chart) on the Dow.

As I said to our Members this morning:

As I said to our Members this morning:

It's all about the Nasdaq, which is holding that bullish channel along the rising 50 dma. As long as it's over, the 50 dma keeps rising, of course. On the dark side, if the RUT stays under the 50 dma, then it pulls it down and once the 50 dma curves down, we have a bad signal. The Dow looks certain to pull their 50 dma into a downward slope so we need to see a big Dow recovery to get out of technical danger and any fail of the 50 dma on the Nas (3,577) is going to be a major flashing warning sign that those 200 dmas may be tested (5% drops).

AAPL may save the Nasdaq this morning as rumors are they will strike their long-awaited deal with China Mobile any day now. "Long-awaited" is the key term though, as this is no surprise and only Cramer viewers are likely to rush into AAPL on this basis. We like AAPL, but we're going to be mindful if this is the primary driver of today's rally – as AAPL is often used to "save" the market when the Banksters begin to run out of suckers to dump shares on.

AAPL may save the Nasdaq this morning as rumors are they will strike their long-awaited deal with China Mobile any day now. "Long-awaited" is the key term though, as this is no surprise and only Cramer viewers are likely to rush into AAPL on this basis. We like AAPL, but we're going to be mindful if this is the primary driver of today's rally – as AAPL is often used to "save" the market when the Banksters begin to run out of suckers to dump shares on.

As I noted above, we're not as worried now as we were in June because we expect a little support at the June lows and also because we're generally more bearish than we were in June with our other positions and, of course, because we already have hedges in place, like the Sept SQQQ $23/24 bull call spread at .40 (still .40) that we picked up on Aug 19th in our Member Chat, which I also mentioned in the next morning's post, where I added the Oct $23/26 bull call spread at $1 (now .90), which can still be paid for many times over with the sale of the AAPL 2015 $400 puts (now $32.40).

In our Member Chat that day (8/20) we also doubled down on our TZA Oct $30/37 bull call spreads in the Income Portfolio at $2. TZA is only at $27.11 despite the Russell's drop and that hedge has fallen to net $1 but $3,000 lost on the hedge is more than made up for by gains in our long positions. Again, hedges are insurance you expect to lose. At the moment, I prefer the Oct $28/33 bull call spread at $1.08 and of course we should roll our spread to the lower strike in the Income Portfolio for 0.08.

Again, this is INSURANCE and we have 60 of those spreads (now $6,480 after the roll) which pay up to $30,000 if the Russell drops far enough to trigger a $6 move in TZA, probably about a 7% dip to 944. If it doesn't happen, our longs are safe for two more months and we collect far more than $6,000 in short premium we've already sold. At this point, in fact, we're very tempted to double down again to drop our basis and rasie our protection level but, as I said, we're not that nervous – yet.

We will, of course, continue to watch our levels and, if they break, these are two excellent ways to protect yourself from a deeper downturn.