Yawn!

Yawn!

Nothing much happened over the weekend. Syria, Debt Ceiling, Taper Talk, Summers or Yellen, $110 Oil, New iPhones, yadda, yadda, yadda – and, no, we're not yadda-yaddaing over the best parts.

Let me explain how this works. The market has clearly demonstrated its inability to get over the May-July highs without a positive catalyst (assuming that would do the trick, of course) and we've been drifting along ever since as we haven't had any particularly NEGATIVE catalysts (though we are ignoring a lot of negatives) to take us down – so far.

That's created an extremely technical market and, as I've been saying since early August, we simply keep an eye on our bounce levels to see if we're going to make another run at the top or not.

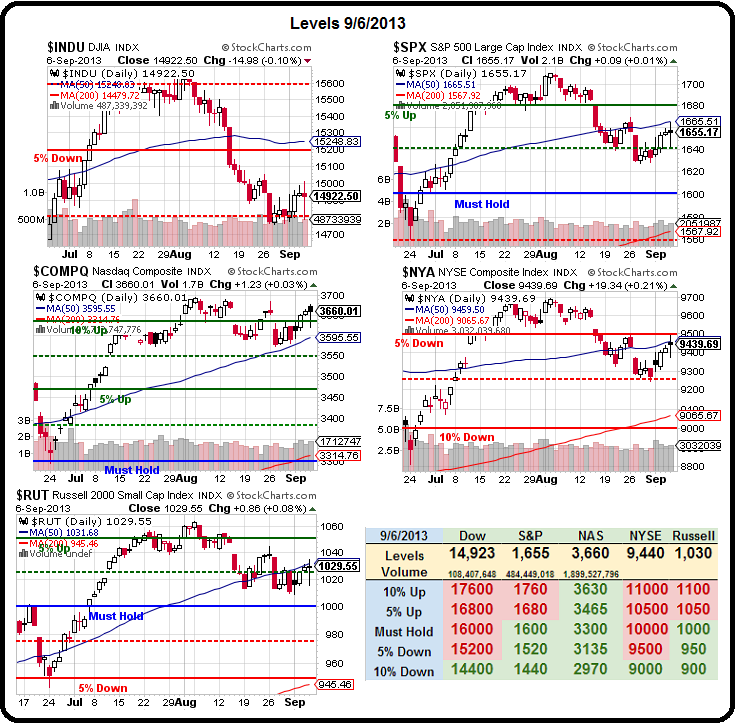

We came close on Friday but no cigars were handed out on the failed finish of the S&P, right between our weak (1,646) and strong (1,662) bounce lines at 1,655 (see Friday's post for details). The Dow failed to even make a weak bounce (14,960), the Nasdaq has been boosted over the strong bounce (3,640) by AAPL but not that impressive at 3,659 – especially with 1,300 declining stocks on Friday vs 1,204 advancing!

We came close on Friday but no cigars were handed out on the failed finish of the S&P, right between our weak (1,646) and strong (1,662) bounce lines at 1,655 (see Friday's post for details). The Dow failed to even make a weak bounce (14,960), the Nasdaq has been boosted over the strong bounce (3,640) by AAPL but not that impressive at 3,659 – especially with 1,300 declining stocks on Friday vs 1,204 advancing!

On the NYSE, 9,460 is the strong bounce line and they finished just under at 9,420 while the Russell, which is usually our super-star, failed to take it's strong bounce line at 1,030 and is still drifting right on that line in the Futures.

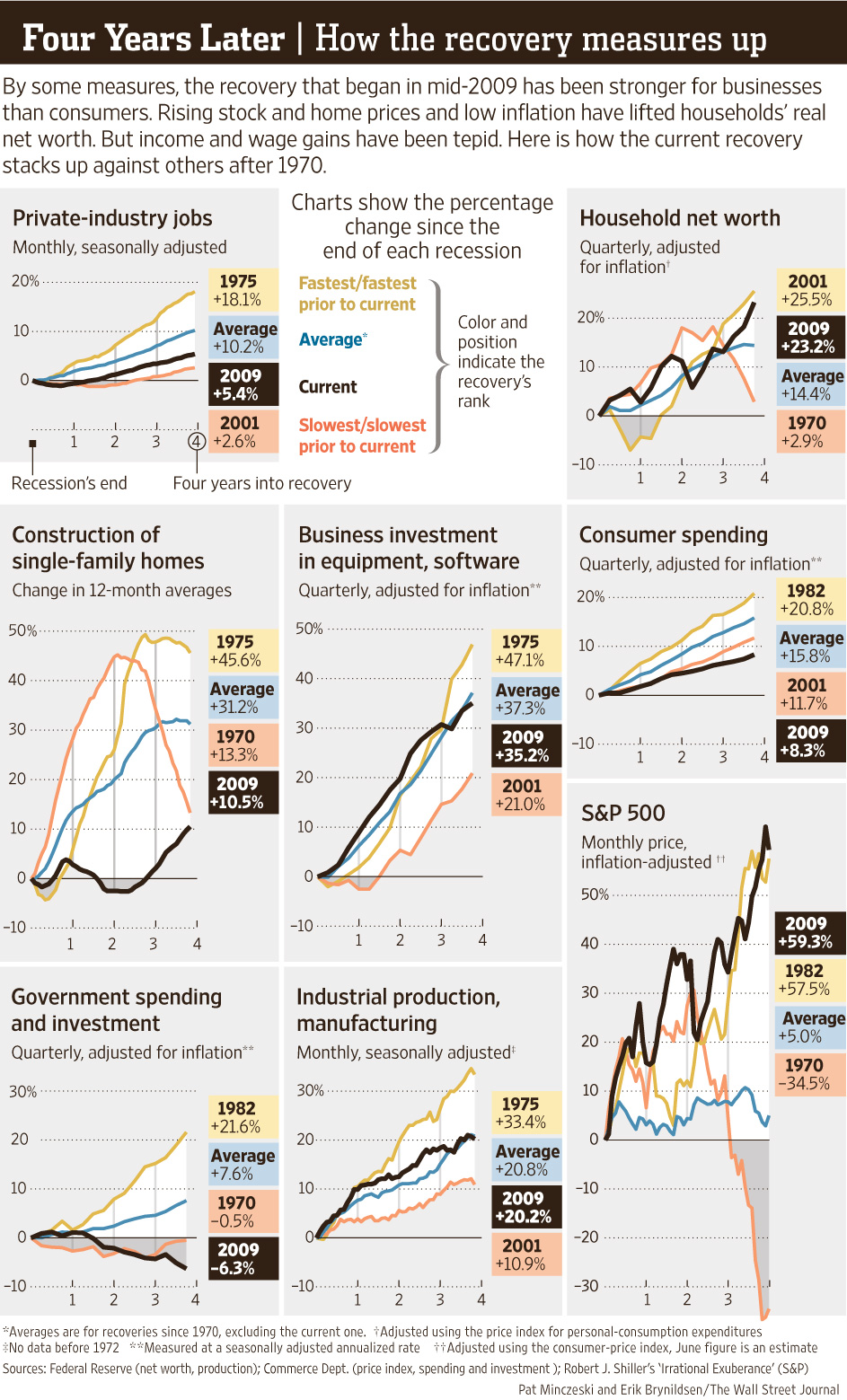

As you can see from Dave Fry's SPY chart, we went nowhere on moderate, churning volume and that's no surprise actually when you have a look at this very helpful summary from the WSJ (via Barry) that summarizes our 4-year recovery in the economy:

How can we NOT have a wishy-washy market looking at these charts? Single Family Home Construction is STILL nowhere near what a rational person would call a recovery. Consumer Spending (70% of our economy) is a DISASTER and Government Spending (20% of our economy) is 6.3% LOWER than it was when we had our crisis. We haven't simply rejected the Keynesian Economics that has led us out of other major recessions – we're activly going the opposite direction!

![[SB10001424127887324123004579061843924091318]](http://s.wsj.net/public/resources/images/OB-YV055_tokyol_D_20130907225441.jpg) Keynesians scored a victory in Japan this morning as they won their bid to host the 2020 Olympic Games and, at the same time, Japan's GDP was revised up to 3.8% from 2.6% in their initial estimate led by a MASSIVE 5.1% increase in Capital Expenditures. Of course the comps are easy as last year's Q2 was -1.2% so we're only talking 2.6% above zero, not 3.8% actual growth. Next quarter we'll see an even more impressive number as last year's Q3 was -3.8% so a China-like 7% bump is a possibility.

Keynesians scored a victory in Japan this morning as they won their bid to host the 2020 Olympic Games and, at the same time, Japan's GDP was revised up to 3.8% from 2.6% in their initial estimate led by a MASSIVE 5.1% increase in Capital Expenditures. Of course the comps are easy as last year's Q2 was -1.2% so we're only talking 2.6% above zero, not 3.8% actual growth. Next quarter we'll see an even more impressive number as last year's Q3 was -3.8% so a China-like 7% bump is a possibility.

As with the US, it's a top-down sort of growth as sentiment among Japanese consumers fell 0.6% from the previous month to 43.0 in August, a third consecutive monthly decline, the Cabinet Office said, concluding that an improving trend has hit a standstill. The office's Economy Watchers survey—a poll of those closely affected by consumer trends such as waitresses and taxi drivers—also dropped 1.1% to 51.2 in August from the previous month, marking the fifth consecutive month of deterioration.

"Expectations for 'Abenomics' … have cooled down quite sharply," said Yasunari Ueno, chief market economist at Mizuho Securities. Mr. Ueno cited a lack of growth in base salaries, energy-driven rises in consumer prices, and recently sluggish Tokyo stock markets.

In early morning Member Chat, we had some interesting articles on US Employment Data (NFP was Friday) and Business Insider points out that this one chart says it al as the actual Employment Rate — "the share of the non-incarcerated, non-military working-age population with any job — also fell and remains dead, dead in the water."

In early morning Member Chat, we had some interesting articles on US Employment Data (NFP was Friday) and Business Insider points out that this one chart says it al as the actual Employment Rate — "the share of the non-incarcerated, non-military working-age population with any job — also fell and remains dead, dead in the water."

Try to keep this in mind – what you are looking at, the S&P chart above, for example, is an ILLUSION of prosperity. It's what's being shown to you on stage to distract you from all the people running around backstage that are holding the whole thing up with wires and using lighting (econonic BS) to hide the wires (free money) and sounds (MSM) to make things seem bigger and better than they actually are in the real economy.

If you are in the top 10% and you are sitting in the first 10 rows – then you can sit back and relax, because you're getting a fantastic show and, when it's over – you can just get up and leave. If however, you are in the bottom 90%, you are either working backstage and not enjoying the show at all (and probably have to clean up after the show) or you're sitting in the cheap seats and you can barely see the show, can't understand what they are saying but it might LOOK like something good is going on up there – but you aren't able to participate.

That's showbiz!