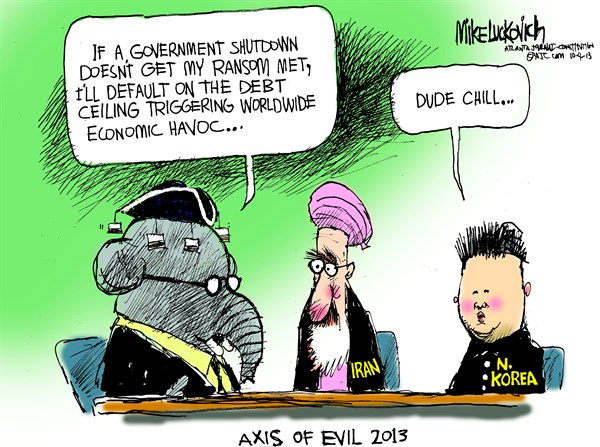

Day 8 of the Economy Held Hostage.

Day 8 of the Economy Held Hostage.

The bickering continues but a Washington Post/ABC poll released Monday found that while the public's ratings for the President and both parties in Congress remain very negative, disapproval of Republicans has grown in the past week with 70% of Americans now disapproving of how Republicans in Congress are handling budget negotiations, up from 63% last week. That's up 10% (of 63%) in a week, so we're just a few weeks away from 100% of the country being sick of these guys.

A Pew Research poll also released Monday found that 38 percent of Americans blame Republicans more for the shutdown, while 30 percent blame Obama, and 19 percent blame both sides. A third poll by CNN/ORC found that majorities of Americans are angry at everyone involved with the shutdown: Sixty-three percent say they're angry at Republicans, 57 percent say they're angry at Democrats, and 53 percent say they're angry at Obama.

Few Americans on either side of the aisle, however, want to see their party compromise. In the Pew Research poll, 77 percent of Republicans, but just 18 percent of Democrats, said that Obama should agree to a deal that includes changes to his health care law. In contrast, 75 percent of Democrats and only 14 percent of Republicans said that GOP lawmakers should agree to a deal that makes no changes to the health care law.

Few Americans on either side of the aisle, however, want to see their party compromise. In the Pew Research poll, 77 percent of Republicans, but just 18 percent of Democrats, said that Obama should agree to a deal that includes changes to his health care law. In contrast, 75 percent of Democrats and only 14 percent of Republicans said that GOP lawmakers should agree to a deal that makes no changes to the health care law.

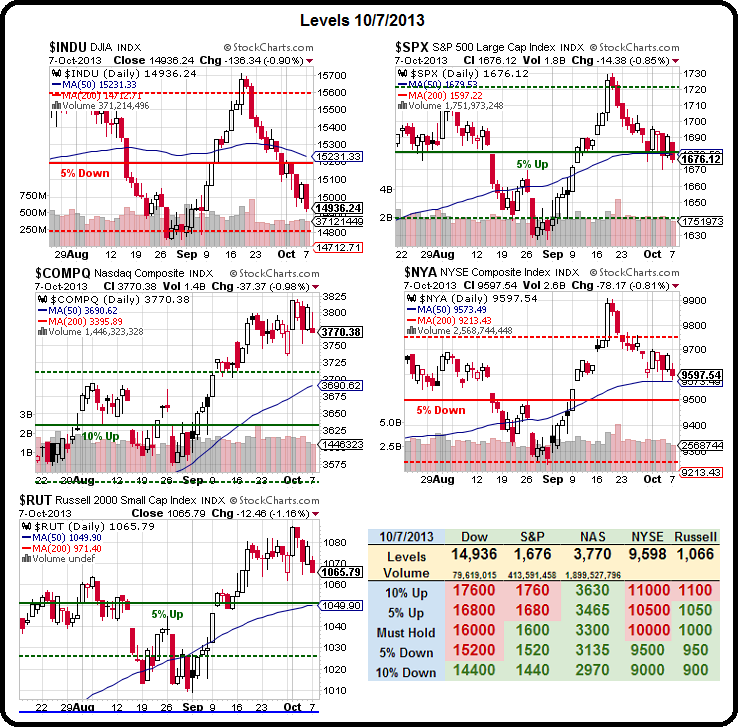

Meanwhile, all this bickering is quietly pushing our market indexes off a cliff with the Dow already failing the 50 dma at 15,200 and heading down to test the 200 dma at 14,800 (sorry, news from the Future again). The S&P is riding it's 50 dma at 1,680 but failed it into yesterday's close while the NYSE stopped just above the 9,575 line it needs to hold. This is, of course, no surprise to any of us devotees of the 5% Rule™, as we cashed out at the top but now we're in the zone (down 5%) where we can't be too sure which way things will go:

We're still a bit over the low re-tests we're looking for at Dow 14,950, S&P 1,670, Nasdaq 3,740, NYSE 9,500 and Russell 1,068, but not too bad for levels we predicted 3 weeks ago – before the market even topped. Keep in mind our 5% Rule™ is not TA, it's just math – we only use charts to illustrate the otherwise boring numbers but, if you look back in our archives, you'll see that for years I simply wrote down the numbers and it worked just as well.

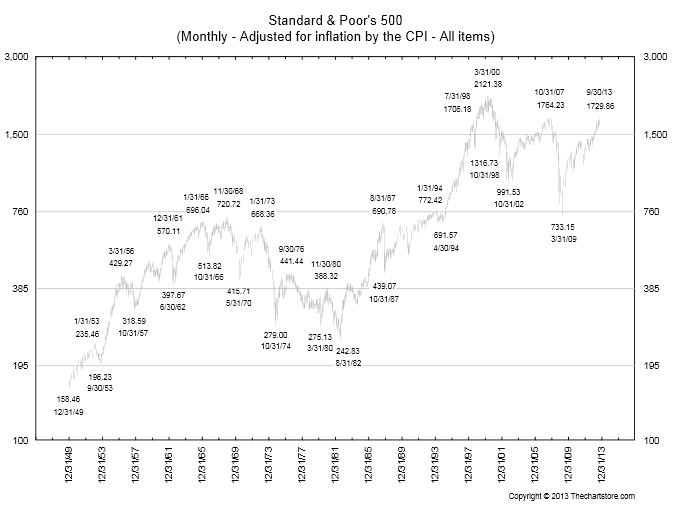

The TA, in fact, is even more scary – especially if you take out the Dollar's changing value as a variable. That gives us an inflation-adjusted view of the S&P that shows a classic "head and shoulders" pattern and those do not end very well as we move into the "knees and toes" phase.

The TA, in fact, is even more scary – especially if you take out the Dollar's changing value as a variable. That gives us an inflation-adjusted view of the S&P that shows a classic "head and shoulders" pattern and those do not end very well as we move into the "knees and toes" phase.

Yes, I'm sorry, I don't take TA very seriously – it's just a Rorschach Test that lets investors read whatever they want from fairly random patterns that gives them some sense that they can predict the future. As Fundamental Investors, the main use we have from TA is to be able to predict what the sheeple who follow it will be herding into – it's A factor, not THE factor.

What we do take seriously are macros (like Government Shut-Downs) and EARNINGS, which begin today with AA and YUM reporting after the bell. As this is a stock market newsletter, why not try to make a little money off of those picks?

What we do take seriously are macros (like Government Shut-Downs) and EARNINGS, which begin today with AA and YUM reporting after the bell. As this is a stock market newsletter, why not try to make a little money off of those picks?

AA can hardly earn LESS money than it earned last Q3, which was a scant 0.03 per $7.97 share and expectations are indeed that they will earn a whopping 0.06, on the way to an anticipated 0.29 for 2013, which puts the p/e at a very un-sexy 27.4. Even if they double up next year, that's still a p/e of 14ish so 8 is very generous for AA.

Meanwhile, the 2016 $7/10 bull call spread is just $1.15 and because the net Delta on the spread is just .28, you can expect to lose (or win) just .28 for each Dollar the stock moves. We can offset that risk very nicely by selling the January (2014) $8 calls for .42, which some of you sharp people will notice is more than .28, so we are very confident that we'll win to the downside and, if AA surprises us and goes up, we still have a $2 advantage on the spread to cover the gains and 2 years to "roll" the caller along. Let's add 40 of those spreads to our Income Portfolio because, if all goes well, we can make $1,600 per quarter playing this out and, worst case, we cover AA by buying 4,000 shares of the stock under $10, get called away and we're left with the profitable spread. Not a "can't lose" trade like our CZR trade, but close!

YUM is a lot trickier. They are trading not too far away from their all-time high at $71.43 and they are agressively priced with earnings this year expected to come in at $3.06, which is LOWER than last year's $3.25 and, last year, YUM dove from $73.65 to $62.14 in Q4, but that was after a solid earnings run from $64.50. YUM's p/e is 23.34 and, if all goes well, next year it's expected to be 18.89 and, did I mention CHINA!!! – you always have to mention CHINA!!! when you talk about YUM because CHINA!! gets investors all excited.

It's hard to wrap our heads around but KFC is "upscale" dining in China – more like a restaurant meal for them than the fast food it is to us. With 39,000 restaurants in 115 countries, YUM (also Taco Bell and Pizza Hut) has passed MCD's 34,480 but MCD has 4 more countries and, to be fair, they spun off CMG, which is not worth $45Bn on it's own (although we're short at $430).

Anyway, back to YUM – they had a food scare in China in Q1 but we like them long-term and wouldn't mind being "stuck" with the stock and the 200 dma should be strong support at $69 while the 50 dma offers some overhead resistance at $72.25, which means we can play them bullish by selling the Jan $70 puts for $3, which obligates us to own them at net $67 and we can pair that with the Jan $70/72.50 bull call spread at $1.30 which leaves us with a net $1.70 credit and the $2.50 bullish spread that's starting off at $1.43 in the money with a total upside of $4.20 if YUM makes it over that 50 dma and holds it through Jan.

Anyway, back to YUM – they had a food scare in China in Q1 but we like them long-term and wouldn't mind being "stuck" with the stock and the 200 dma should be strong support at $69 while the 50 dma offers some overhead resistance at $72.25, which means we can play them bullish by selling the Jan $70 puts for $3, which obligates us to own them at net $67 and we can pair that with the Jan $70/72.50 bull call spread at $1.30 which leaves us with a net $1.70 credit and the $2.50 bullish spread that's starting off at $1.43 in the money with a total upside of $4.20 if YUM makes it over that 50 dma and holds it through Jan.

We can do 5 of these in our Short-Term Portfolio and see how it goes and, if YUM fails us, then we're obligated to buy 500 shares of the stock at net $68.30 BUT we should be able to roll the short Jan $70 puts to the 2015 $57.50 puts (now $3.40) and those can be rolled to the 2016 $50 puts (now $3.52) so, what we're really saying is that we're willing to make a long-term commitment (in our Long-Term Portfolio) to YUM at net $48.30, which is 32% below the current price but, if all goes well, we simply capture the nice upside and move on to the next earnings trade!

Be sure to catch our FREE on-line seminar tonight (6pm EST) with Option Monster's Dr. Jon Najarian (sign up HERE) where we'll discuss more trade ideas like this and roll through some other ways we can teach you to BE THE HOUSE – Not the Gambler!