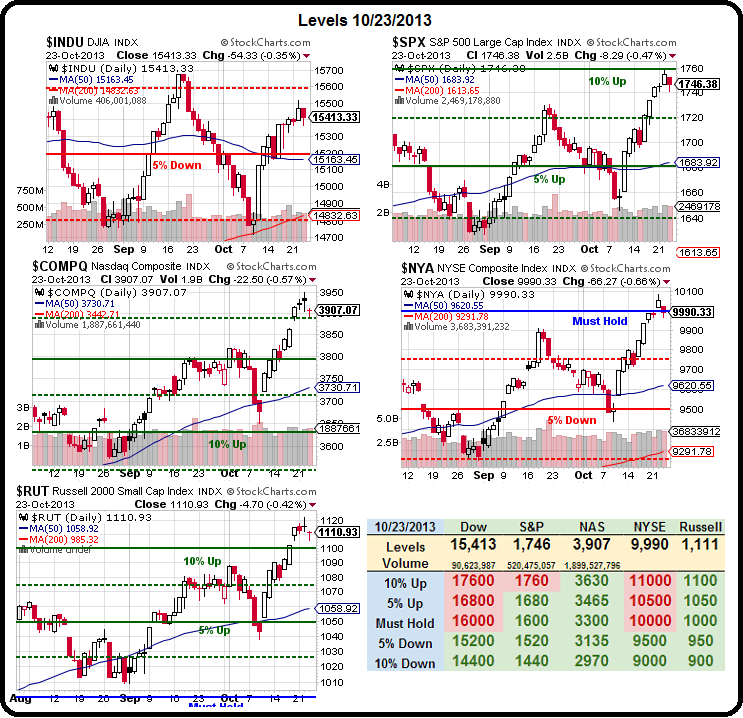

As you can see from our Big Chart, we are once again possibly forming those "spitting cobra" patterns I warned you about back on May 31st, with the S&P at 1,654, when I said:

Big Chart – I don't like that pattern one bit. That's a spitting cobra pattern and usually they strike to the downside (and, before you ask, yes – I made that up). Still, very logical for the M to form down to the 50 dmas – especially as those 50s are right on major lines for the S&P, NYSE and the RUT and we know the Dow is too silly to worry about and the Nas is ruled by 10 stocks and 5 of them are AAPL so they also give funny readings but the 3 that are broad and hard to control are all lining up perfectly for a 2.5% drop.

The drop off came hard and fast after that and, less than a month later, the S&P was down to 1,560, down 5.7% on a slight overshoot, leading us to flip back to bullish. As I said last week to our Members in Chat:

The drop off came hard and fast after that and, less than a month later, the S&P was down to 1,560, down 5.7% on a slight overshoot, leading us to flip back to bullish. As I said last week to our Members in Chat:

Just because we are long-term bullish doesn't mean we have to always have bullish positions – even in companies we love. Sometimes, they just get overbought and we cash out and wait for the next pullback or sometimes, like NFLX or GOOG, they get so ridiculously expensive that we actually cash our longs and flip short on them.

I already warned our Members this morning that the pre-market rally in the Futurres was FAKE (because all the indexes were moving up almost identically, like a lazy person was trying to make an impression) and we had a nice 2nd opportunity to short (with very tight stops over the line) the S&P (/ES) at 1,750, the Nas (/NQ) at 3,350, the Dow (/YM) at 15,400 and we're still wating for the RUT (/TF) to cross 1,110, back to the channel that led Wombat to make this comment yesterday:

Phil – Thanks for the /TF – been riding the channel all morning + $800 – not bad for sittin on my arse.

A few weeks from now, these picks will be featured in our October Trade Review and you'll say "damn, why is it I always see these things too late?" As I often say, I can only tell you what's going to happen and how to play it, the rest is up to you!

A few weeks from now, these picks will be featured in our October Trade Review and you'll say "damn, why is it I always see these things too late?" As I often say, I can only tell you what's going to happen and how to play it, the rest is up to you!

Now, let's get into WHY I'm still looking to go short – despite the general atmosphere of irrational exuberance:

- First of all, oil continues to collapse DESPITE the Dollar collapsing to the point where the Euro (which still has SEVERE problems of its own) now costs us $1.38 – the most since November 2011, before Greece was the word. Of course, we called for oil to collapse ages ago and now it's collapsing – so what? Well, so the reason it's collapsing is because there's an oversupply DUE to weak demand and weak demad is causes by several factors, one of which is a WEAK Global Economy. If the Global Economy is weak, why would the markets be so strong?

- Second of all, the Dollar continues to collapse. Back in early May, we had a blast shorting the Nikkei into their earnings spike because, as I said at the time, the earnings were based on a weak currency boosting the export and sales numbers for big companies that moved the index. The fact of the matter was that the economy was weak and the gains were unsustainable – even with the MASSIVE amount of money printing the BOJ was engaging in (almost 3x ours, proportionately).

- Third of all, Europe is not "fixed". That was made very obvious today as the PMI pretty much flatlined from Sept to Oct (51.3) and Services fell sharply from 52.2 to 50.9 (almost contraction) and Composite Output fell from 52.2 to 51.5. France is still in contraction (49.4) and, this morning, Unilever (UL), which is Europe's version of GE, reported a 6.5% drop in revenues – the company's worst performance since Q4, 2009.

Keep in mind this is all happening against a backdrop in which the Fed is dropping $85Bn a month on the markets and the BOJ $75Bn a months and the PBOC $30Bn a month in infrastructure spending (much of it unneccessary and wasteful) and Europe hard to say because they use hidden mechanisms but just the Big 3 are already putting $2.28 TRILLION a year into the Global Economy (5%) and the US barely has 2% growth, Japan has no growth (inflation-adjusted), Europe has 0.2% growth and China has 7.5% growth (if you believe the official statistics).

Keep in mind this is all happening against a backdrop in which the Fed is dropping $85Bn a month on the markets and the BOJ $75Bn a months and the PBOC $30Bn a month in infrastructure spending (much of it unneccessary and wasteful) and Europe hard to say because they use hidden mechanisms but just the Big 3 are already putting $2.28 TRILLION a year into the Global Economy (5%) and the US barely has 2% growth, Japan has no growth (inflation-adjusted), Europe has 0.2% growth and China has 7.5% growth (if you believe the official statistics).

Of course I have a 4th, 5th, 6th, 7th – 20th of all, but you get the idea. Any one of these things would be a reason to question record-high stock market valuations – taken together, we are very clearly overpriced and not pricing in the risk of another economic collapse AT ALL.

The narrative of the bulls is "the Fed will save us" but have they actually saved us at all? It has, after all, been 5 years now. All the Fed has done is masked the symptoms, they haven't cured the disease, yet stocks are priced as if we're ready to run the marathon.

The narrative of the bulls is "the Fed will save us" but have they actually saved us at all? It has, after all, been 5 years now. All the Fed has done is masked the symptoms, they haven't cured the disease, yet stocks are priced as if we're ready to run the marathon.

The Fed is doing EXACTLY what the BOJ did to Japan, only at a slower pace so, like the frog that jumps out of boiling water but sits happily until it dies in water that is raised slowly, in the US we have a soon-to-be dead frog economy.

Just because our Government doesn't count Food or Fuel as part of inflation, doesn't mean we have to be idiots and go along with the obvious lie. Consumer prices in September were up 9.84%, outpacing wage increases by 8% in a month when essentially no jobs were created (we need 150,000 a month just to keep up with population increases).

Just because our Government doesn't count Food or Fuel as part of inflation, doesn't mean we have to be idiots and go along with the obvious lie. Consumer prices in September were up 9.84%, outpacing wage increases by 8% in a month when essentially no jobs were created (we need 150,000 a month just to keep up with population increases).

As you can see from this short-term Credit Chart from Zero Hedge, we decoupled from reality last week in a big way as stocks flew higher despite very clear signs of a consumer slowdown. Of course, the Government shut-down probably played a major role in this but it's still lost revenues for Q4. Even if those paychecks are made up to furloghed workers, they're not likely to double up on restaurants and movies, for example, to catch up, are they?

As I've been saying since our mid-September spike – cash, Cash, CASH and, when in doubt, CASH!!! is the way to play right now. If you have long-term positions, assume the market can drop 5-10% overnight on you and that means a simple insurance hedge like TZA Dec $20/24 bull call spreads at .90 and you can offset 41 of those with the sale of a single AAPL 2016 $400 put for $41.20 and the worst thing that will happen to you is you end up owning 100 shares of AAPL for $400 (23% off) while 40 $4 spreads at no cost gives you $16,000 of downside protection. Even if you don't do an offset, it's still a 344% upside potential on the straight spread if the Russell falls 7% (1,032) and sends TZA 21% higher ($24.38).

Keep a sharp eye on the Dollar (79.20) – its weakness is masking a very ugly market – at the moment…