Now things get interesting!

Now things get interesting!

We made a good bottom call in late August and, in Part 1 of our Trade Review, we had 46 trade ideas in two weeks (the last week of Aug and the first week of Sept) and 36 of them (78%) were winners. I predicted at the close of that post that it was not very likely we'd repeat that in Part 2 and now we'll see how things went during 3 weeks where the Dow went from 14,900 to 15,700 and back to 15,200.

I never know how these things will go until I do the reveiw so this is exciting for me. These are the trades we don't track in our virtual portfolios (which are highlighted daily in our Member Chat Room) so it's a bit arbitrary to pick a certain day to see how they are doing but, as I always say during these reviews, if you use good stop and scaling disciplines, you only have to be right half the time to do very, very well.

We left on on Friday, Sept 6th with "Non-Farm Friday - It's Next Week that Matters" and we had one of our losers that day, shorting oil at $109.50 (/CL). Too bad we didn't stick with that one, right? That's OK, there were plenty more... We also had a bullish play on TSLA, of all things, the Jan $130/160 bull call spread - but that was one of many covers we used along the way up to protect our longer, short positions.

Sept 9: Monday Market Movement - Back to Waiting on the Fed Next Week

Sept 9: Monday Market Movement - Back to Waiting on the Fed Next Week

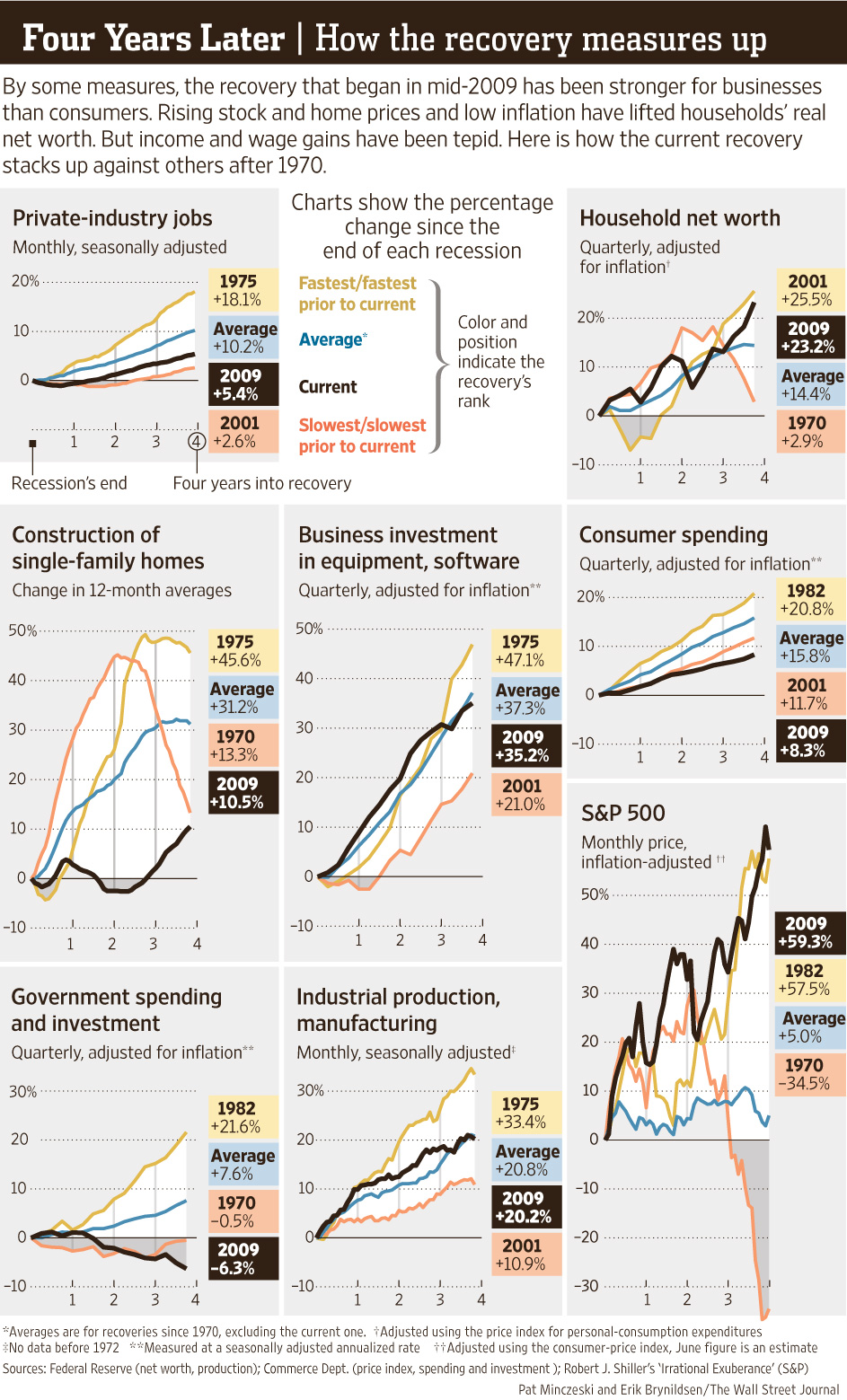

As you can see from Dave Fry's SPY chart, we went nowhere on moderate, churning volume and that's no surprise actually when you have a look at this very helpful summary from theWSJ (via Barry) that summarizes our 4-year recovery in the economy:

How can we NOT have a wishy-washy market looking at these charts?