Good golly, what a mess!

Good golly, what a mess!

As you can see from Dave Fry's S&P chart, even yesterday's PATHETIC volume was too much for the bulls to maintain the illusion of strength. What little volume there was had 50% more decliners than advancers on the NYSE, led lower by energy stocks (as we expected) as oil collapses below that $95 line (as we expected).

It can also be seen in the bond market as TLT, for example, tumbles back to weakening support at $103.50. We used to like going long on this line as recently as August but now we're done as the macro environment is getting less note-friendly as inflation rears it's ugly head everywhere but US Government data. As Dave notes:

Long-term Treasury Bonds (TLT) for example have been teetering on serious support. This is the result of the Fed potentially losing control over the market as investors fret over tapering. Without the Fed’s buying there is little in the way of a safety net to offer support. Sure, they won’t begin tapering in big chunks, but markets are forward looking and many will just get out of the way.

Small Caps (IWM) have been the most sensitive to Fed monetary policies, responding positively to dynamic QE but are more fearful of tapering than perhaps other sectors. This is demonstrated by the chart below courtesy of ZeroHedge showing the severe drop in shares outstanding recently. Obviously, there’s a dangerous and serious divergence between price and shares outstanding.

Wow, that's crazy-looking, right? As I keep warning people, the Banksters are propping up the MoMos and paying off their MSM talking heads to keep the sheeple buying while they are dumping every share they own. No wonder we added SQQQ shorts yesterday, as well as VXX longs (the Dec $19/21 bull call spread at $1, offset by the sale of the $20 puts for 0.95 for net .05 on the $2 spread) in our Member Chat Room yesterday morning. That was our first trade idea for the morning yesterday – not bad considering I was in a Las Vegas hotel room scrambling to get the wifi working!

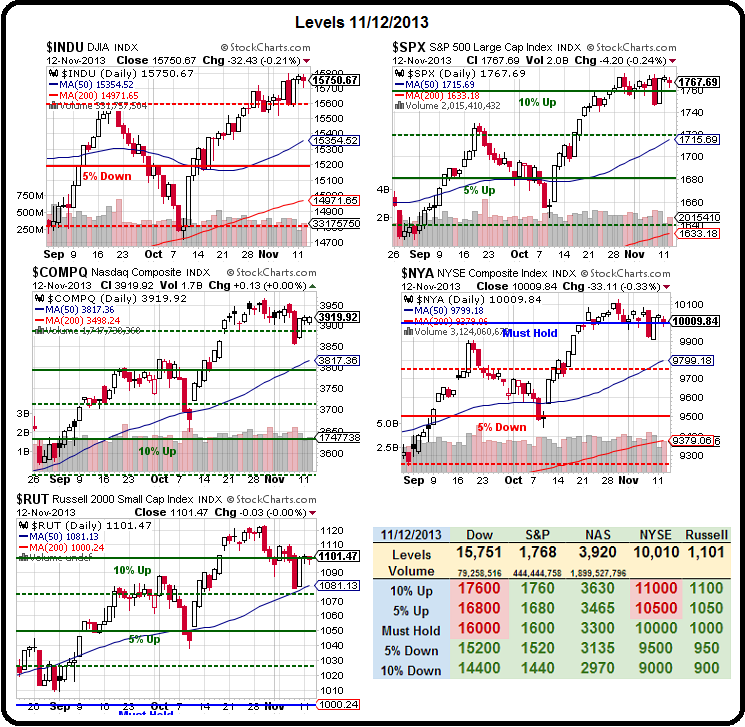

This morning, we re-upped (or downed) our /NKD Futures shorts at 14,600 and we got our Dow cross below 15,700 (/YM) and 1,100 on the Russell (/TF) for some nice Egg McMuffin money already this morning. Those were the target levels I reminded our Members at yesterday's close and 1,100 has been the 10% line (top of the channel) on our Big Chart all year – there's nothing unpredictable going on here and nothing unprecidented either – it's just normal market movement, slightly overdone to the upside.

This morning, we re-upped (or downed) our /NKD Futures shorts at 14,600 and we got our Dow cross below 15,700 (/YM) and 1,100 on the Russell (/TF) for some nice Egg McMuffin money already this morning. Those were the target levels I reminded our Members at yesterday's close and 1,100 has been the 10% line (top of the channel) on our Big Chart all year – there's nothing unpredictable going on here and nothing unprecidented either – it's just normal market movement, slightly overdone to the upside.

S&P 1,760 (/ES) is another shorting line we have as is Nas 3,650 (/NQ) – all are failing this morning. Oil, on the other hand, we are playing UP from the $93 line into inventories (10:30). That strategy did not work at $94 but, as we discussed in our Futures Trading Seminar in Las Vegas this weekend – that's why we pick those solid support lines to go long at – it we break under then, even just a little, we can quickly stop out with a small loss and wait for the next support opportunity.

With one week to go on the NYMEX December contract cycle, there are still 200,000 open orders for 200M barrels of oil to be delivered to Cushing, OK, which is kind of full and couldn't possibly take more than 20M barrels next month. So, in one way or the other, 180M barrels of fake, Fake, FAKE orders need to be dumped in order to maintain the completely artificial shortage of oil supplies in the US. Including today, that's 30M barrels of oil per day that have to get dumped into other months or cancelled (at a cost) or we will have stupendous builds next month and prices would plunge:

|

Click for

Chart |

Current Session | Prior Day | Opt's | ||||||||

| Open | High | Low | Last | Time | Set | Chg | Vol | Set | Op Int | ||

| Dec'13 | 93.07 | 93.54 | 92.93 | 93.49 |

08:34 Nov 13 |

– |

0.45 | 40846 | 93.04 | 200224 | Call Put |

| Jan'14 | 93.57 | 94.12 | 93.46 | 94.03 |

08:34 Nov 13 |

– |

0.51 | 17598 | 93.52 | 273703 | Call Put |

| Feb'14 | 93.88 | 94.43 | 93.74 | 94.31 |

08:34 Nov 13 |

– |

0.53 | 9124 | 93.78 | 101000 | Call Put |

| Mar'14 | 94.02 | 94.60 | 93.90 | 94.36 |

08:34 Nov 13 |

– |

0.50 | 11558 | 93.86 | 106905 | Call Put |

With almost 700,000 open orders in what is soon to be the front 3 months, I'm going to be liking a short on oil ($94, if we're lucky) or USO ($34, if we're lucky) or SCO long ($35, if we're lucky) assuming it peaks out around 10:30's report. Assuming oil goes to $85 (9.5%) between now and January, SCO should go up almost 20%, to about $42. That makes for some very exciting long opportunities and the Dec $33/37 bull call spread is just $2 and has the potential, without an offset, to make 150% if SCO simply goes up $2 (6%), which would take a 3% drop in oil to $91.20.

You could put 6% of your heating oil money into a trade like that and the only way SCO loses the $2 investment is if oil drops more than 3% but, if oil goes up 3%, you make 15% back on your 6% investment. That's hedging 101.

You could put 6% of your heating oil money into a trade like that and the only way SCO loses the $2 investment is if oil drops more than 3% but, if oil goes up 3%, you make 15% back on your 6% investment. That's hedging 101.

We already have our 5 New Trade Ideas that make 500% if the Market Falls from last week's posts, so no need to go over those again, right? The time to buy aggressive hedges like that is when the market is at or near the top going up, not AFTER it starts falling. As I said last week, when a rally begins to get overdone, you should begin to put about 1/3 of your additional gains into short positions. That way, you still make 66% of whatever move up remains but, on the way back down, the 33% you set aside for short positions can grow to 150% and lock in those gains for you!

Speaking of locking – Oil just hit $93.57 so shame on anyone who doesn't lock in $500 per share on our Futures longs (/CL) with a stop at $93.50 (or $93.45, actually as we don't mind a bounce off the line if it doesn't break), there should be resistance at $93.75 so a .10 stop there and then it's clear sailing to $94.50, which was where we expected to be at 10:30 today. Anything less than that is all the more reason for our SCO play.

We also like playing UUP up (Dollar ETF) on the $22 line and we added some speculative calls to the Short-Term Portfolio this morning. One trade idea we're already loving, also in our Short-Term Portfolio but nowhere near as speculative, is our SBUX Jan $85 puts that we bought for $6.10 back on October 31st. We have shorted SBUX several times this year, waiting and waiting and waiting for the arbitration decision on the KRFT lawsuit.

We also like playing UUP up (Dollar ETF) on the $22 line and we added some speculative calls to the Short-Term Portfolio this morning. One trade idea we're already loving, also in our Short-Term Portfolio but nowhere near as speculative, is our SBUX Jan $85 puts that we bought for $6.10 back on October 31st. We have shorted SBUX several times this year, waiting and waiting and waiting for the arbitration decision on the KRFT lawsuit.

Finally, yesterday, the decision came down and it wasn't the $1Bn+ we were expecting – it was $2.7Bn! Incredibly, SBUX is only down to $79 pre-market but $2.7Bn is TWO years worth of income AND the termination of the KRFT distribution deal means less SBUX sales in supermarkets going forward so there will still be time to short these guys this morning if they maintain such an irrational level.

There will be a CC at 9am and perhaps investors think there may be an appeal but no, there will not, this is a done deal that wipes out all of the cash that SBUX has managed to build up in their bank account since the company's founding in 1985. Even Cramer understands this is bad for the company. Will they still pay their $1.04 dividend? That cost them $500M last year so I will guess not. Will they continue to buy back $300M of their own stock each year? Again, no. Will they float a bond or float more shares (dilutive) in order to avoid draining their accounts and forcibly cashing in all of their investments? Yep.

Don't get me wrong, if SBUX crashes, we will be BUYBUYBUYing them, but not for the current p/e of 35 – that's for sure! It's not pretty when companies that are priced to perfection have imperfect results. The market is priced to perfection as well – we'll see how the rest of the week goes for that too!