Put another Trillion on the fire!

What the hell, it's not our money. We spent "our" money 20 years ago – this is our children's money and their children's money we're dipping into and, by the time we get to great-great grandchildren – well, I'm going to want a paternity test before I start cutting back on my excess just to keep them from being broke, right? Who's with me?

Clearly Uncle Ben and the Fed agree, as they throw another $21.5Bn per week into the mix – hoping to get a reaction like kids tossing Mentos into a fountain. Turns out you need quite a lot of them to get a reaction but the Fed seems to have an endless supply of breath mints. As noted by The Burning Platform last Summer:

Bennie and the Inkjets went all in yesterday at 12:30. This Princeton professor who has never held a real job in his entire life actually proclaimed that buying hundreds of billions of toxic mortgage backed securities from the insolvent Wall Street bankers that own the Federal Reserve, will benefit the average American. He proudly stated that he will hold interest rates at 0% until at least 2015. This means that senior citizens can plan ahead and stock up on cat food to eat, because they will be paid nothing on their savings for at least the next three years. Ben’s claim to help home buyers is a bold faced lie. Mortgage rates were already the lowest in history. Interest rates are not the problem. Debt is the problem. Insolvency is the problem. Spending money we don’t have is the problem. Debasement of the currency is the problem.

For those of us paying attention to yesterday's action, the markets are getting stranger and stranger. Yes the S&P logged another up day but all of the day's low volume came in the last 15 minutes and it was ALL downhill into the close. We had noted a similar pattern on Monday, though less pronounced and this kind of fake, Fake, FAKE market behavior is just the kind of thing that leads us to get to CASH ahead of the holidays.

For those of us paying attention to yesterday's action, the markets are getting stranger and stranger. Yes the S&P logged another up day but all of the day's low volume came in the last 15 minutes and it was ALL downhill into the close. We had noted a similar pattern on Monday, though less pronounced and this kind of fake, Fake, FAKE market behavior is just the kind of thing that leads us to get to CASH ahead of the holidays.

We won't be alone getting out of the market, China's ultra-rich have been moving money out of the country to the tune of $450-650Bn and that amount is on pace to double over the next 3 years. When you have to move that much money, you end up doing stupid things with it – like buying a case of wine for $476,000 or $28M paintings – anything that gives you an excuse to do a cash transfer out of the country.

We don't HAVE to do stupid things with our money, we can just get to cash and all we risk is missing out on what? A 5% gain between now and early January? 10%? The way this market is moving, maybe, but we had 5 MORE Trade Ideas that can Make 500% on Monday so you can get to 98% cash and put 2% into the aggressive trades and they'll make 10% if the market goes up BUT, if the market should do the unthinkable and go lower – won't you be happy to have cash on the side?

I'll be happy to get right back into things after New Years' – if all is still chugging along but, just in case, I'd rather spend Christmas worrying about whether or not we have enough beer, rather than whether or not the Markets are collapsing while we're closed for the Holidays. I do not like to be doom and gloomy and I'm not predicting doom – I'm simply saying DOOM IS POSSIBLE – so why don't we act just a tiny bit cautiously?

I'll be happy to get right back into things after New Years' – if all is still chugging along but, just in case, I'd rather spend Christmas worrying about whether or not we have enough beer, rather than whether or not the Markets are collapsing while we're closed for the Holidays. I do not like to be doom and gloomy and I'm not predicting doom – I'm simply saying DOOM IS POSSIBLE – so why don't we act just a tiny bit cautiously?

Check out this chart of Margin Debt to GDP – that's what a bubble looks like folks. People are borrowing money to buy equities but the underlying economy is not supporting their enthusiasm – it's a very simple, very fundamental problem. As you can see from 1999 and 2007 – we can still move up for a quarter or two but clearly we are now at the point where wise men may consider taking a little off the table.

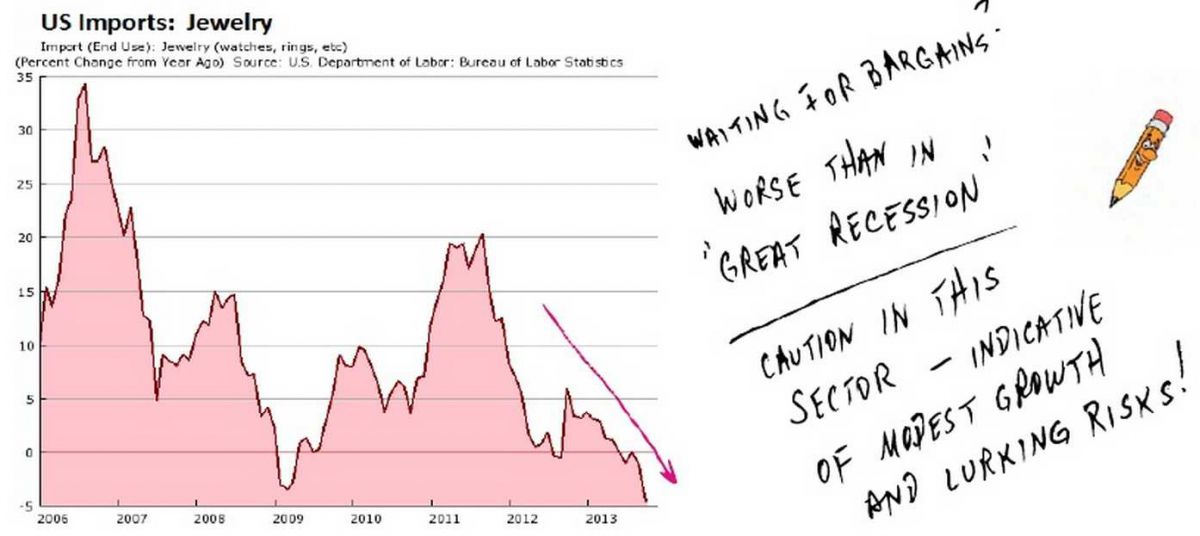

I tweeted out this morning a link to the very excellent Punchline Report and I urge you all to read it but here's one of the key charts (with annotation) that struck me as very scary:

How many signs are we going to ignore? ZLC is selling $1.88Bn worth of jewelry this year and they sold $1.86Bn in 2012 and $1.74Bn in 2010 and, while they did make $10M this year instead of losing $27M last year, does that REALLY justify a 300% increase in market cap – from $120M (p/e 12) to $485M (p/e 48)? This is typical of the insanity that's gripping the markets. ZLC is a great short at $15, by the way, but just an example…

China!!! is always the answer to any retailer's woes but we discussed the pullback in luxury spending yesterday and this morning there was a note from Bloomberg that the borrowing costs for Chinese Corporations are rising at a record pace with the extra yield investors demand to hold three-year AAA corporate bonds instead of government notes surged 35 basis points last week to 182 basis points, the biggest increase since data became available in September 2007. Again, how many warning signs are we going to ignore?

“Existing interest-rate levels and tighter credit conditions will pose downward pressure on growth,” said Kewei Yang, head of Asia-Pacific interest-rate strategy at Morgan Stanley in Hong Kong. “Any potential defaults or bankruptcies in 2014 will trigger the market to reprice credit risk.”

Issuers have postponed or scrapped at least 73.5 billion yuan of notes this month, more than double the 29.8 billion yuan pulled in October, according to filings on the websites of Chinamoney, Chinabond and Shanghai Clearing House. China Development Bank and Agricultural Development Bank of China are among borrowers that delayed or downsized bond offerings this month.

Issuers have postponed or scrapped at least 73.5 billion yuan of notes this month, more than double the 29.8 billion yuan pulled in October, according to filings on the websites of Chinamoney, Chinabond and Shanghai Clearing House. China Development Bank and Agricultural Development Bank of China are among borrowers that delayed or downsized bond offerings this month.

“With such high funding costs, there’s no impetus for companies to expand,” said Qiu Xinhong, a bond fund manager at Golden Eagle Asset Management Co. in Guangzhou, which oversees about 10 billion yuan in assets. “Losses at some companies may cause the economy to slow.”

The China "growth" story is the result of an unprecedented increase in the supply of money handed out to an unprecedented amount of people (1.4Bn) along with expansionist Government policies that pay people to build empty cities that are serviced by empty airports, unused highways and bullet train tracks with no trains. Power plants capable of producing hundreds of Megawatts are called on to power the single home that's occupied in developments of thousands. It's madness, but it's madness that's been going on for a decade and it's not stopping.

So, is this the "new normal" we're supposed to accept or is this on great big MoFo of a bubble that is going to pop in very, very messy ways. My attitude is simple, if it's the new normal, then the markets will grow 20-30% next year too and we won't miss too much if we skip 5% of it by being cautious into the holidays. Maybe we'll miss making some money, but maybe we'll miss making some losses and certainly we won't miss spending some extra time with our families – and what's that worth?

Have a happy Thanksgiving,

– Phil