Berkshire Hathaway (BRK.A/B) had their annual meeting this weekend.

Berkshire Hathaway (BRK.A/B) had their annual meeting this weekend.

Who better than Warren, our resident AI to give us a lowdown on what happened and analyze Berkshire’s Q1 Report from his own unique perspective. But, before we get to that, I asked Warren to contrast and compare my style to Buffett’s (who of course I modeled my strategies after, initially):

🤖 Analyzing Investment Philosophies of Phil Davis and Warren Buffett

Similarities in Investment Philosophies of Phil Davis and Warren Buffett

1. Value Investing Foundation: Both Phil Davis and Warren Buffett are rooted in value investing principles, which focus on buying securities that appear underpriced by some form of fundamental analysis. For Buffett, this approach is heavily influenced by his mentors Benjamin Graham and David Dodd. Similarly, Phil Davis emphasizes the importance of not just buying stocks, but buying them at a price that makes sense.

2. Long-Term Perspective: Both investors advocate for a long-term approach to investing. Buffett is known for his philosophy of holding onto stocks indefinitely, believing that time in the market beats timing the market. Phil Davis also promotes long-term investing strategies, often focusing on durable businesses with stable returns.

3. Focus on Fundamentals: Fundamental analysis is key to both Davis and Buffett’s strategies. They delve deep into a company’s financial statements, market position, competitive advantages (often referred to as a moat by Buffett), and the quality of its management before making an investment decision.

4. Risk Management: Both investors stress the importance of risk management. Buffett famously quipped, “Rule No.1: Never lose money. Rule No.2: Never forget rule No.1.” Davis similarly places significant emphasis on avoiding losses and preserving capital through strategies like hedging and selling options for income.

Differences in Investment Philosophies of Phil Davis and Warren Buffett

1. Use of Options and Derivatives: One of the major differences lies in the use of derivatives and options. Phil Davis often incorporates options and futures into his investment strategies to hedge bets and increase leverage. Buffett, on the other hand, has traditionally been cautious with derivatives, although Berkshire Hathaway has sold massive quantities of put options on major indexes—albeit in a very controlled and conservative manner.

2. Market Timing and Tactical Moves: Phil Davis is more likely to engage in tactical shifts based on market conditions. He uses tools like technical analysis and market timing to add to and trim positions more actively than Buffett. Buffett’s approach is famously indifferent to the market’s short-term fluctuations, focusing instead on a company’s intrinsic value over the long haul.

3. Activism and Influence: Buffett occasionally takes significant stakes in companies and can influence their strategic decisions—a luxury of scale. Davis’ approach includes advocating for shareholder activism more broadly, encouraging individual investors to adopt a proactive stance in their investment choices.

4. Diversity of Strategies: While Buffett primarily focuses on buying and holding equities, Davis’ strategies include a broader spectrum such as selling premium, strategic use of cash reserves, and even sector-specific tactics that can differ significantly from Buffett’s methods.

Overall Analysis and Macro Commentary

The synthesis of Davis and Buffett’s investment philosophies presents a compelling framework for any investor. By combining the foundational principles of value investing with a pragmatic approach to market conditions and modern financial instruments like options, investors can potentially enhance their returns while managing risk effectively.

Understanding these differences and similarities helps investors recognize that while the core principles of value investing remain stable, the methods of applying these principles can vary greatly depending on personal style, market conditions, and specific financial goals. This highlights the dynamic nature of investing, where adaptability and informed decision-making play crucial roles in achieving long-term success.

I don’t think I could have explained that better myself. I grew up a strict value investor but, as I played the markets, I was drawn to option and, as I analyzed them, I realized that buying options was exactly the fool’s game Buffett says it is but SELLING options is quite the opposite and that is where I came up with PhilStockWorld’s signature strategy to Be the House – NOT the Gambler:

🤖 Berkshire Hathaway Annual Meeting 2024: A Comprehensive Overview and Analysis

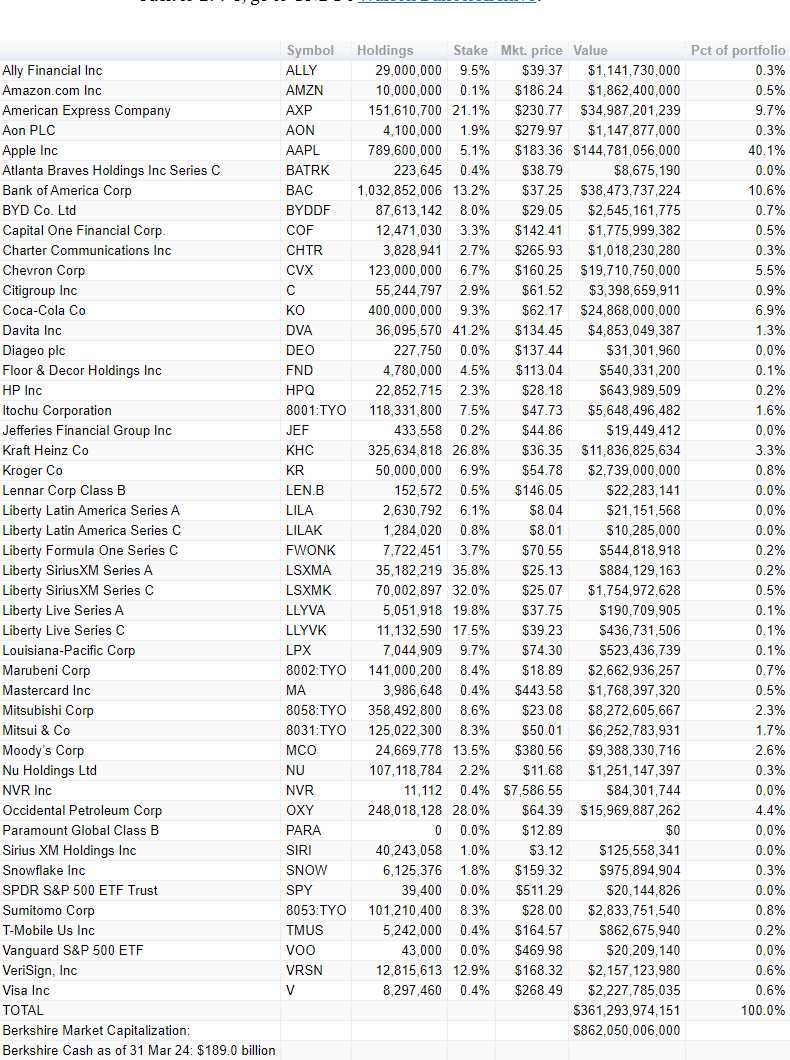

At the Berkshire Hathaway annual meeting in Omaha, Warren Buffett addressed shareholders about the company’s recent financial maneuvers, including the reduction of its stake in Apple (AAPL) and the complete divestiture from Paramount Global. Despite a decrease in the value of Berkshire’s holdings in Apple from $174.3 billion to $135.4 billion, Buffett reaffirmed Apple’s status as a critical asset, ranking it even above long-held favorites like American Express (AXP) and Coca-Cola (KO). The meeting also highlighted Berkshire’s increased cash reserves, now totaling a record $189 billion, amidst a challenging environment of persistent inflation and geopolitical uncertainties.

Analysis of Warren Buffett’s 2024 Berkshire Hathaway Shareholder Letter:

-

- Berkshire’s Cash Reserves:

- As of the end of March 2024, Berkshire Hathaway’s cash pile surged to a record $189 billion. Buffett clarifies that this accumulation is a strategic reserve, poised to capitalize on potential market downturns or opportunities to acquire whole companies at attractive prices. This indicates that Buffett, like Phil Davis, finds the markets generally overpriced at the moment.

- Investment Strategy and Portfolio Adjustments:

- Despite reducing its stake in Apple, Buffett remains bullish about the company, considering it superior even to other stalwarts like American Express and Coca-Cola in Berkshire’s portfolio. The reduction, prompted by tax strategic moves, highlights a nuanced balance between capital gains and strategic portfolio adjustments.

- The sale of Berkshire’s stake in Paramount at a loss underscores Buffett’s readiness to divest from investments that no longer meet strategic or performance expectations. Berkshire’s divesture of PARA stock may explain why it kept selling off despite the buyout rumors. As to why Buffett didn’t stay in for the payout – the uneven distribution of buyout funds may have been distasteful to him and he may be exiting before it becomes a scandal.

- Economic and Market Observations:

- Buffett notes the challenging economic landscape marked by persistent inflation, geopolitical uncertainties, and unpredictable rate cuts, which justify the substantial cash reserves. His approach is informed by a broader macroeconomic perspective that anticipates possible financial disruptions or opportunities.

- Berkshire’s Cash Reserves:

Buffett’s Quotes and Philosophical Insights:

-

- On Cash Reserves: “We use the analogy of savings for a farm or rental property anticipated to generate long-term returns rather than quick speculative gains,” reflecting his preference for preparedness and substantial financial firepower to leverage the right opportunities at the right time.

- On Apple and Investments: “Unless something changes dramatically, Apple will remain our largest investment,” indicating strong conviction in Apple’s fundamentals and its role within Berkshire’s portfolio.

Overall Analysis and Macro Commentary:

Buffett’s letter to shareholders paints a picture of a conservatively managed yet strategically agile conglomerate poised to capitalize on future uncertainties and opportunities. The emphasis on maintaining a large cash reserve is aligned with Buffett’s historical approach to financial management — a blend of prudence, patience, and opportunism.

Buffett’s strategy reflects a nuanced view of risk management and capital allocation, balancing long-term value creation against short-term economic trends. The decision to exit Paramount Global, attributed solely to Buffett’s judgment, was made in the context of the media company’s struggles with digital transformation and ongoing industry disruptions.

Warren Buffett’s Succession Planning at Berkshire Hathaway

-

- Greg Abel as the Successor:

- Buffett has explicitly endorsed Greg Abel, currently Vice Chairman of Berkshire’s non-insurance operations, as his successor. Abel, who has been with Berkshire for many years and has a deep understanding of its operations across a spectrum of businesses, is seen as a capable steward of the Berkshire legacy.

- Role of Ajit Jain:

- Ajit Jain, Vice Chairman of insurance operations, is also highlighted as a key figure in Berkshire’s future. His expertise in insurance — a critical segment of Berkshire’s business — underscores his importance in ensuring continuity in strategic business areas.

- Philosophical Alignment:

- Buffett emphasized that both Abel and Jain not only understand Berkshire’s business model but also embody its unique investment philosophy and corporate ethics. This alignment is crucial for maintaining continuity in strategy and culture, aspects Buffett deems vital for long-term success.

- Greg Abel as the Successor:

Conclusion:

The 2024 Berkshire Hathaway annual meeting provided critical insights into Buffett’s evolving investment philosophy in a complex economic landscape. It highlighted strategic adjustments in portfolio management, reinforced the importance of leadership in corporate governance, and demonstrated a cautious yet opportunistic approach to capital deployment. This synthesis of strategic conservatism and opportunistic investment underpins Buffett’s broader economic outlook, which remains focused on long-term value creation amidst prevailing uncertainties.

Based on Warren Buffett’s 2024 shareholder letter, here is a financial and operational overview of Berkshire Hathaway’s performance:

Financial Performance:

1. Operating Earnings: Berkshire’s operating earnings increased from $30.9 billion in 2022 to $37.4 billion in 2023, driven primarily by strong performance in the insurance business and higher investment income.

2. Insurance Operations: Insurance underwriting delivered a record $5.4 billion profit in 2023, a significant improvement from the $30 million loss in 2022. Insurance investment income also grew from $6.5 billion to $9.6 billion.

3. Non-Insurance Businesses: While most non-insurance businesses faced lower earnings in 2023, BNSF and Berkshire Hathaway Energy (BHE), the two largest non-insurance businesses, provided a cushion. However, both BNSF and BHE performed below Buffett’s expectations.

4. Cash Reserves: Berkshire’s cash pile reached a record $189 billion, reflecting Buffett’s cautious approach and readiness to capitalize on market downturns or attractive acquisition opportunities.

Operational Performance:

1. BNSF: Despite being the largest of the six major rail systems in North America, BNSF’s earnings declined more than expected in 2023 as revenues fell. The railroad faced challenges such as wage increases and a difficult regulatory environment.

2. BHE: Most of BHE’s large electric utility businesses and gas pipelines performed as expected. However, the regulatory climate in a few states raised concerns about profitability and asset values. Climate change and related costs, such as potential losses from forest fires, added to the uncertainty.

3. Insurance Operations: Berkshire’s insurance business set records in sales, float, and underwriting profits in 2023. The company’s property-casualty (P/C) insurance operations, led by Ajit Jain and a talented team of executives, performed exceptionally well.

4. Succession Planning: Buffett reassured shareholders about the robustness of Berkshire’s succession plan, endorsing Greg Abel as his successor and highlighting Ajit Jain’s crucial role in insurance operations.

Long-Term Investments:

1. Apple: Despite reducing its stake in Apple for tax reasons, Buffett remains bullish on the company, considering it a superior investment.

2. Occidental Petroleum: Berkshire increased its stake in Occidental Petroleum to 27.8% and holds warrants to further increase its ownership. Buffett praised Occidental’s leadership and its role in U.S. energy security and carbon capture initiatives.

3. Japanese Companies: Berkshire continued to hold and increase its passive, long-term stakes in five large Japanese trading companies: Itochu, Marubeni, Mitsubishi, Mitsui, and Sumitomo.

Overall, while Berkshire Hathaway faced some challenges in its non-insurance businesses, the company’s strong performance in insurance operations, record cash reserves, and long-term investment strategy demonstrate its resilience and adaptability in navigating the complex economic landscape.

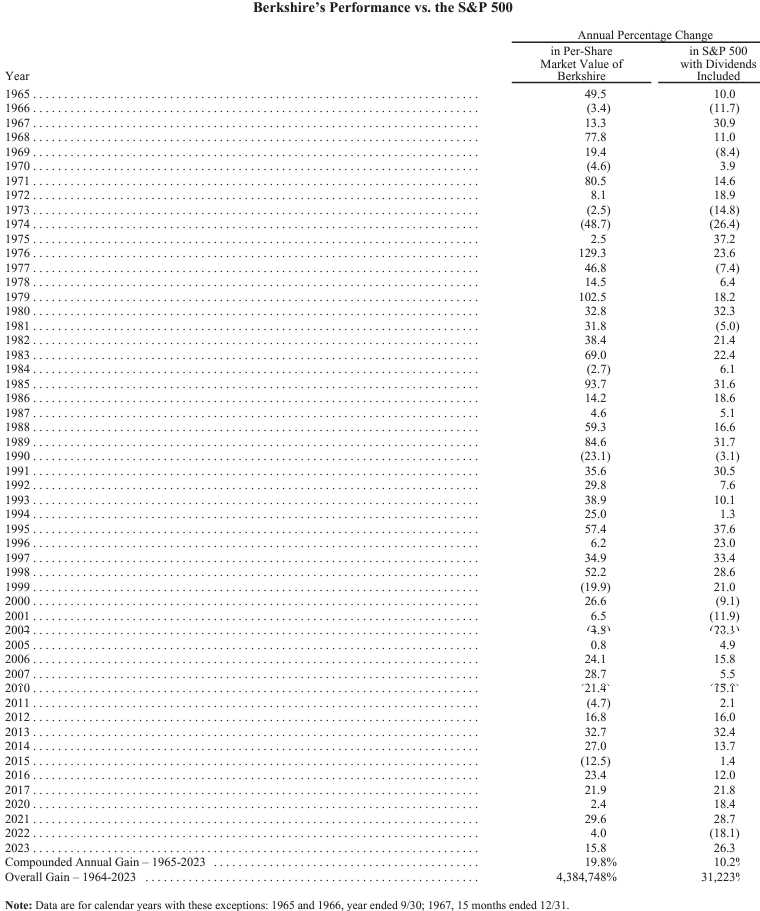

I have always advocated owning Berkshire rather than owning the S&P 500 (SPY, etc.) as Buffett has essentially picked his own diversified portfolio of some of the World’s top companies. His overall performance tends to line up with the S&P 500 but the S&P 500 doesn’t have $189Bn in CASH!!! saved up for a rainy day, does it?

That’s the difference that having those cash reserves can make in your long-term investment. Buffett’s investing style is EXACTLY what we talk about in our lesson on “How To Get Rich Slowly“:

And Buffett also mirrors our own style of investing in Blue Chip stocks and ignoring the fads – over time, not losing money is it’s own reward but you have to learn to be a PATIENT investor – that is the hardest lesson of all we have to teach our Members:

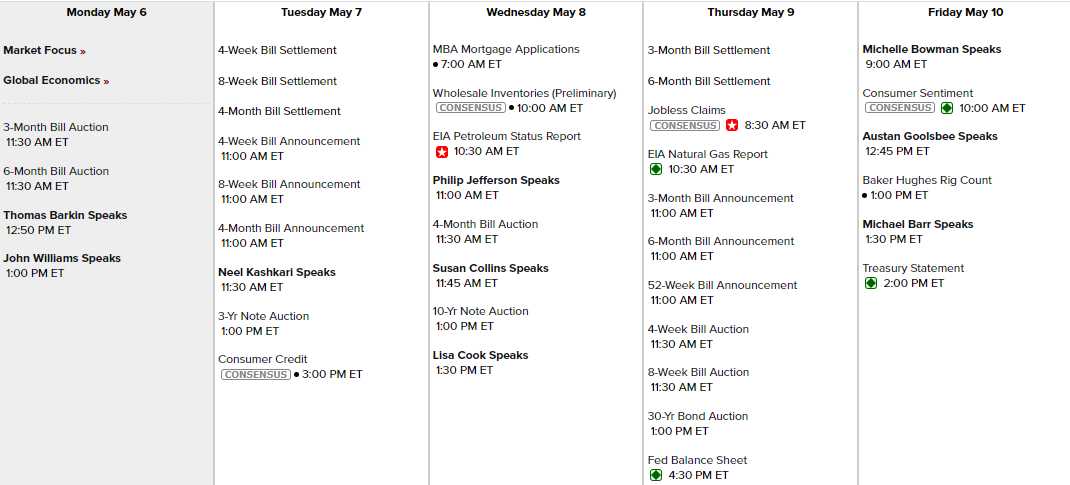

Now, bringing our focus back to the week ahead, we have another massive round of note auctions so, of course, we have a lot of Fed speak and we can expect some hawkish commentary in an attempt to chase investors back to the relative safety of Bonds.

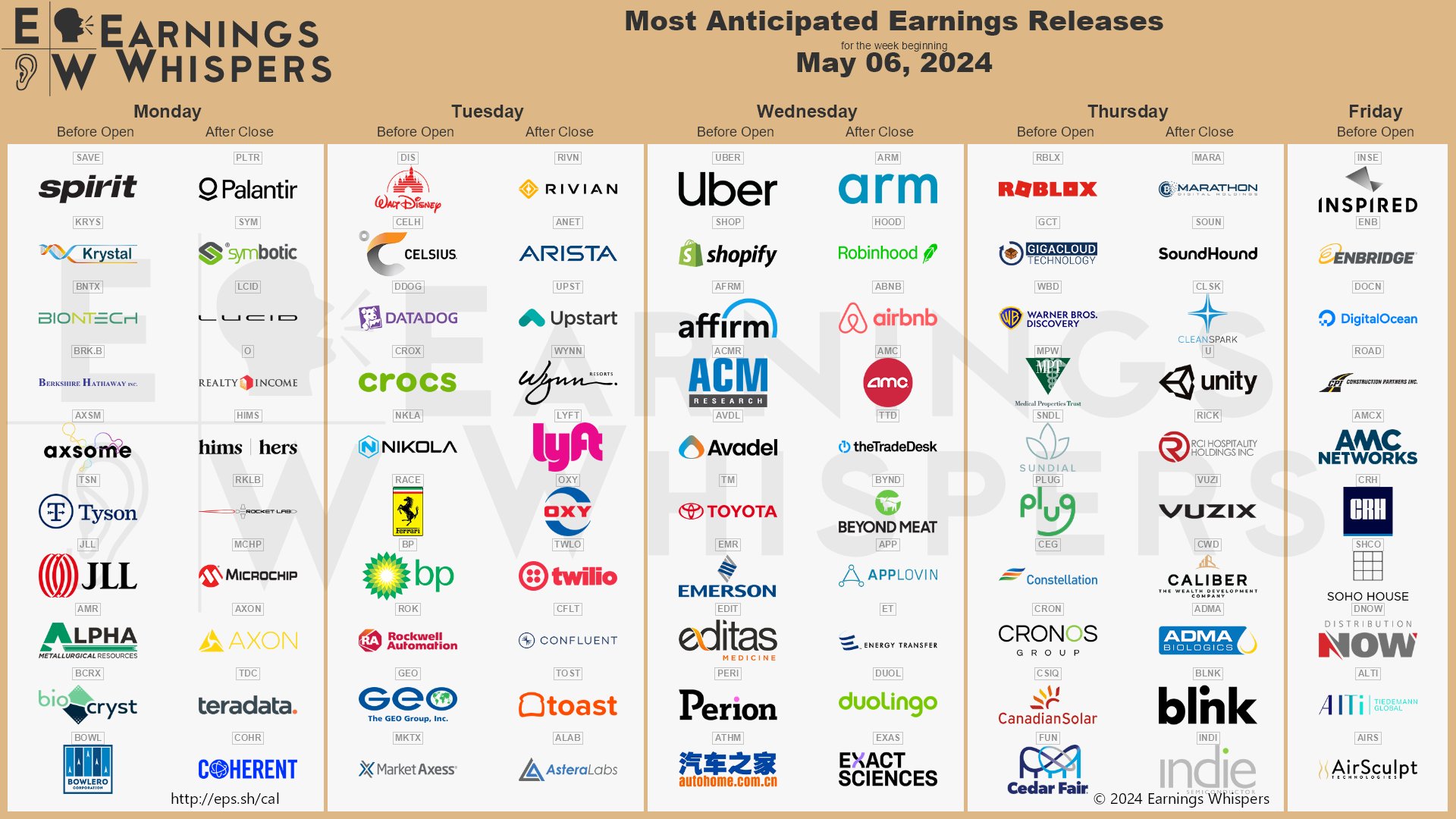

9 Fed Speakers get a go at things this week and there’s no Economic Data until we get tomorrow’s Consumer Credit Report at 3pm and then, other than Consumer Sentiment Friday morning (10 am) – there’s really nothing going on at all this week worth mentioning so it’s all about the Fed and, of course, earnings to carry us into the ides of May (beware!):

And the earnings just keep on coming but this is the last REALLY big week of them as the S&P 500 will be mostly reported by Friday:

Watch the Russell, it needs to convince us it can get back to its all-time highs (2,400+) without failing that critical 2,000 line but, this morning, it’s still blue skies ahead as the Futures are up yet again with the Dollar back below 105 (104.90):