What an interesting month this has been!

What an interesting month this has been!

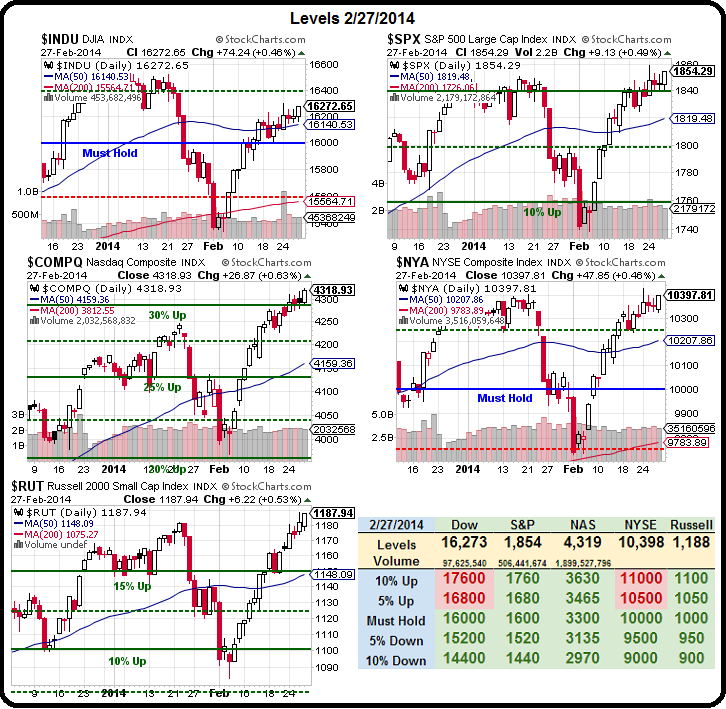

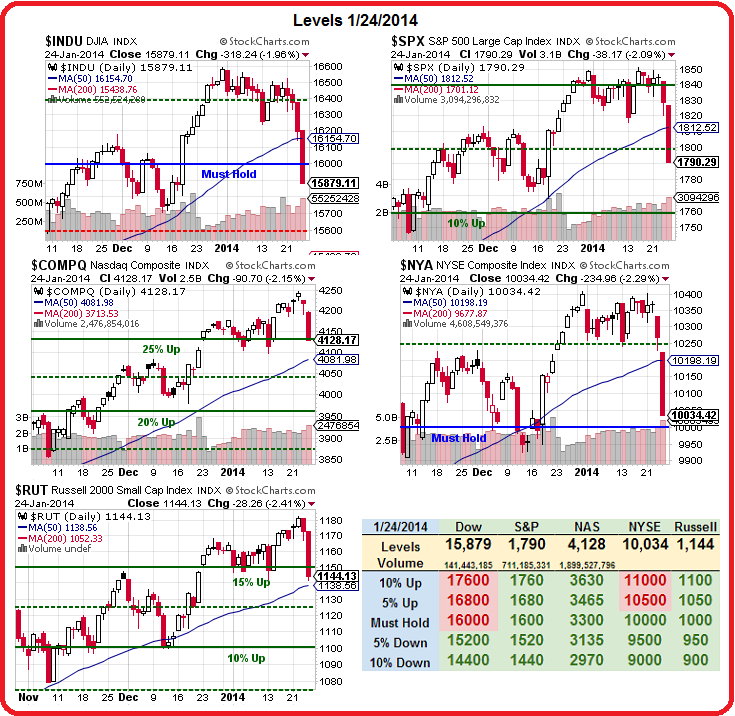

It will be even more interesting as we begin our trade reviews with the last week of the previous month and, when we left off in our January Trade Review, on the 24th, we had been shorting like crazy on the way down. Despite the massive flip-flop in the market, we caught it pretty well and came up with 118 winning trade ideas in January against 27 misses for an 81% success rate.

Always keep in mind that it's fairly arbitrary when we do the review vs. when we initiated the trade - especially in a market that fluctuates as wildly as this one. As long as you follow strategy rules for stopping out, stay balanced and portion your trades appropriately, all you need to do is pick a few more winners than losers and the money should take care of itself.

January 25th was the day we began our January Trade Review (Part 1 here) and we were thrilled with the drop at the time. It's always a good exercise to go over the month with the benefit of hindsight - aside from seeing which premises played out and which did not - you also may find some trades that are real hidden gems - ones that we still like but are cheaper than our original entries. Here we go:

Jan 27: Monday Market Momentum - Reversing or Just Bouncing?

Jan 27: Monday Market Momentum - Reversing or Just Bouncing?

What a lovely correction!

As noted in our Weekend Trade Reviews, we saw this dip coming from a mile away and, from the outset, we were never expecting more than 10% at most. We're not even close to 10% so far but is it already time to fish the bottom or should we maintain a "Cashy and Cautious" stance?