We got off to a hell of a start.

We got off to a hell of a start.

Part one of our trade review was a very busy week where we went bottom-fishing with 46 trade ideas (mostly bullish) in just one week and only 7 of them were misses for a very nice 84% success rate to start off the month.

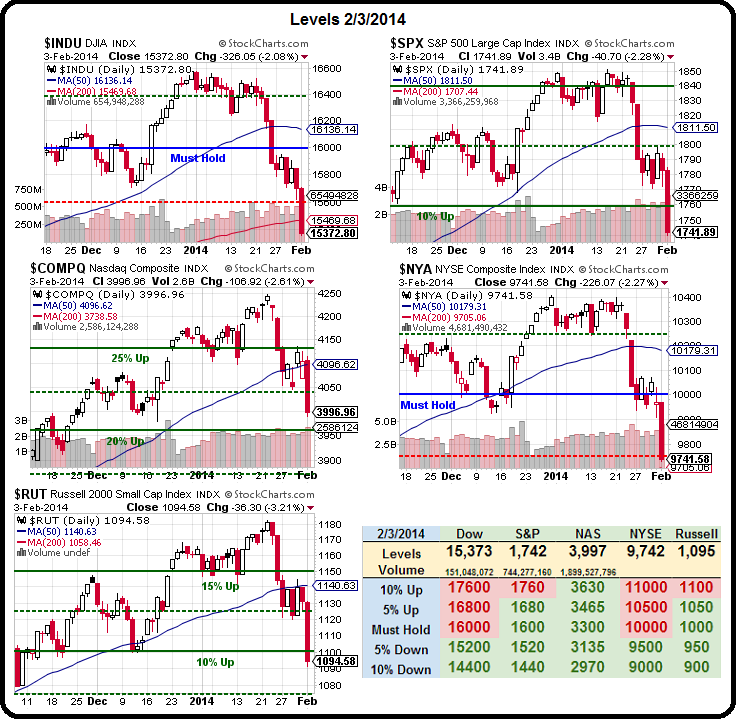

Of course bullish trade ideas are like shooting fish in a barrel when the market goes up and up like this - the smart part is that we had 46 of them and that we went heavily bullish in the last week of January, right when we were bottoming - giving us the best possible prices.

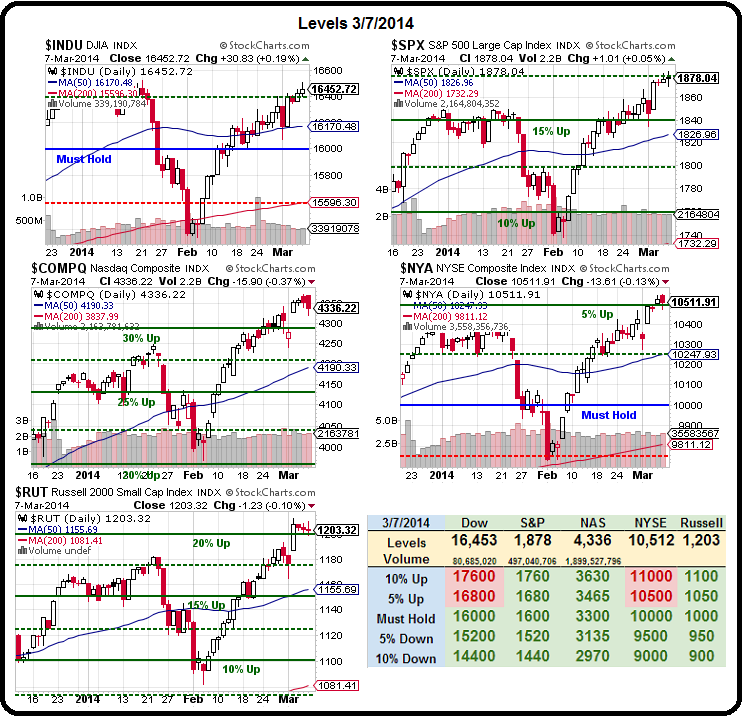

That's why these channels are so important to watch, we trade inside of them, playing the odds that the tops and bottoms will hold and we try to catch the turns. That's why, at the moment, we are BEARISH - until and unless we break over the tops of our channels - at which point we can go back to betting on new highs.

That's why these channels are so important to watch, we trade inside of them, playing the odds that the tops and bottoms will hold and we try to catch the turns. That's why, at the moment, we are BEARISH - until and unless we break over the tops of our channels - at which point we can go back to betting on new highs.

Most of the trade ideas we review here are from inside the daily PSW Member Chat Room (and you can join here) but some are right in our morning posts, which you can have delivered to your mailbox via our Report Membership, while it's in progress, at 8:30 ALMOST every morning (some mornings I miss the mail-bot deadline). In fact, today I'll put a couple of **'s next to trade ideas that were in the morning post - just to see how well those work out.

Feb 3: Meaningless Monday - Waiting on China

Feb 3: Meaningless Monday - Waiting on China

At the moment (7:50 am) our Futures are doing what they usually do in the morning – rising on very low volume. We went long in Member Chat already (6:44) because you don't have to show us the same move 10 times in a row before we finally get it.