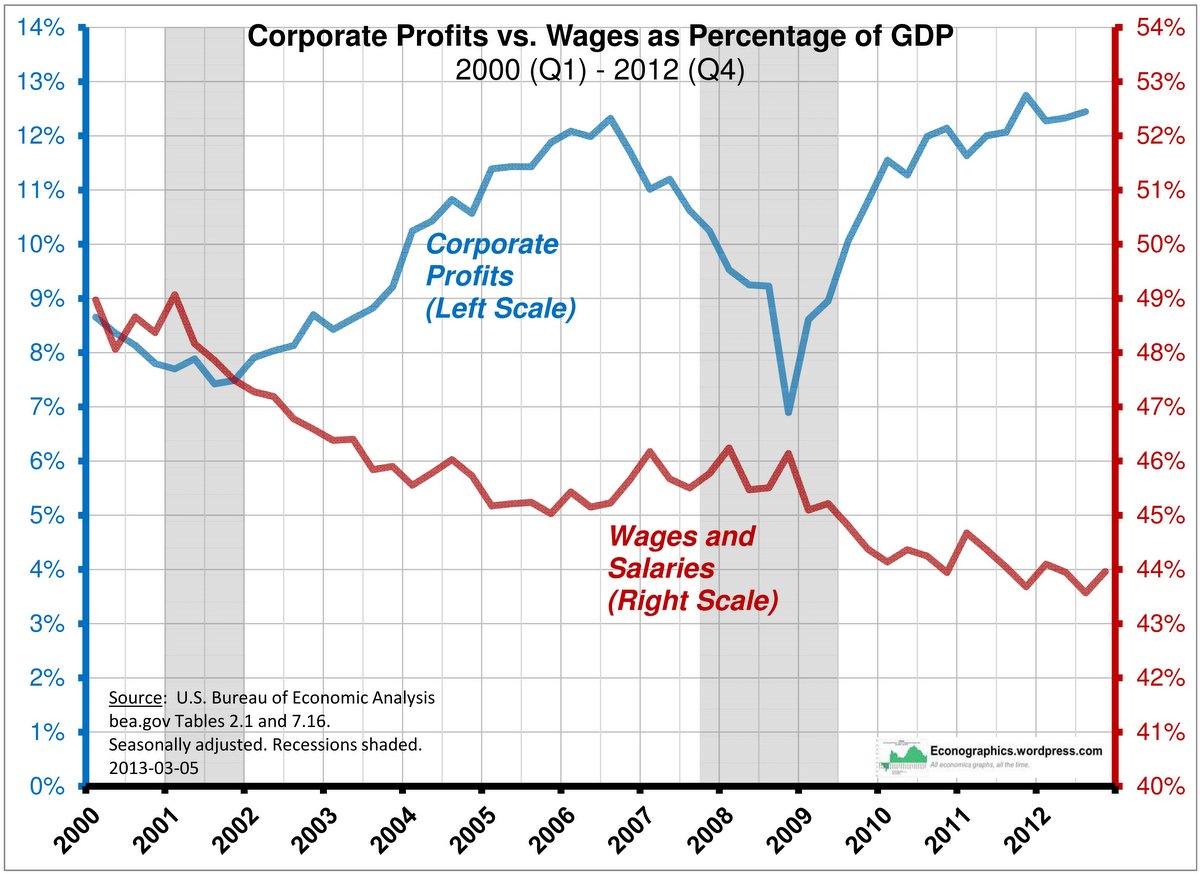

Look at this chart:

Look at this chart:

LOOK AT IT!!!! This is America, damn it! We peaked out in earnings in 2000 and it's been downhill ever since. Even worse, this is America AFTER the Federal Reserve spent $4 TRILLION to boost the economy. This is America AFTER our Government plunged another $6 TRILLION into debt – supposedly to save jobs and support the economy.

This is a DISASTER! If this were the chart of a company you owned – you'd be selling. If there were a board of directors, we'd be looking to make changes, right? Actually, there is a sort of board of directors and, as is often the case with Corporate Management – they're the only ones making any money!

Only in Washington DC and Dick Cheney's Wyoming are people in this country still making as much money as they were in the good old days (Clinton years). The rest of the country is in various states of decline – some of it fairly drastic – and in big states like Ohio, Michigan and Illinois, where people are earning about 20% less now than they did 14 years ago.

Our standard of living is in decline, especially when you consider that inflation is chewing into those lower wages from the other end as well. How much more evidence can we possibly need that the Bush Tax cuts were a complete and utter policy failure? Yet you will hear none of that in the MSM. What TV station owner or newspaper & magazine publisher is going to tell you that they should be paying 20% more taxes than they are paying now?

Our standard of living is in decline, especially when you consider that inflation is chewing into those lower wages from the other end as well. How much more evidence can we possibly need that the Bush Tax cuts were a complete and utter policy failure? Yet you will hear none of that in the MSM. What TV station owner or newspaper & magazine publisher is going to tell you that they should be paying 20% more taxes than they are paying now?

There's a reason that, despite the BS Employment Numbers put up by the Administration, that the #1 concern of US voters is JOBS! People may HAVE jobs (actually 20% of the families in our country have NO ONE employed at the moment) but, clearly, from an economic perspective – the jobs suck! Even people lucky enough to keep their jobs through the crisis haven't had raises in a decade but, of course, they are too afraid to leave because we all know people who lost their jobs and didn't find another one for a year – who can afford that?

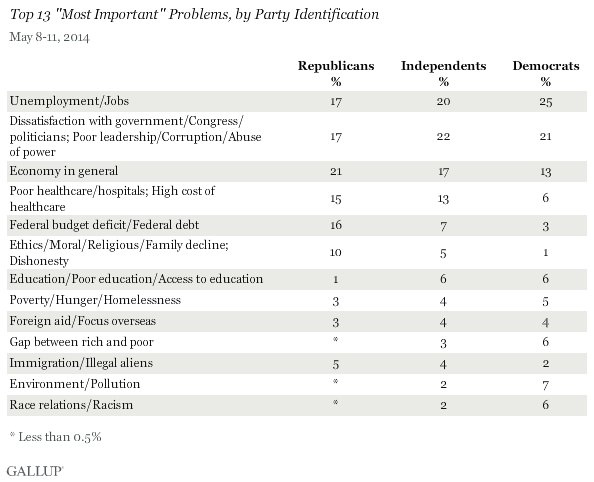

I do love these polls, it's so interesting to see the difference in what people from each party care about:

6 times more Democrats and Independents care about Education than Republicans. This is why I use big words when I make fun of the GOP – they don't understand them anyway… ![]() Democrats are no longer worried about Health Care – we fixed that. Republicans are still freaking out about it. Republicans think Racism is no longer an issue – nor is pollution or the wealth gap, which makes sense – how could anyone who understands the wealth gap be a Republican?

Democrats are no longer worried about Health Care – we fixed that. Republicans are still freaking out about it. Republicans think Racism is no longer an issue – nor is pollution or the wealth gap, which makes sense – how could anyone who understands the wealth gap be a Republican?

.png) The moral majority is still a big factor in the GOP, with 10 time more Republicans making morals and religion their top issue than the Godless Democrats. The Deficit is also a huge disparity, with 5 times more Republicans worrying about it than Democrats and the Independents are right between the two on that one.

The moral majority is still a big factor in the GOP, with 10 time more Republicans making morals and religion their top issue than the Godless Democrats. The Deficit is also a huge disparity, with 5 times more Republicans worrying about it than Democrats and the Independents are right between the two on that one.

The GOP should be concerned with the huge number of Democrats, Republicans AND Independents who are dissatisfied with the current leadership as all 234 of their Representatives are up for re-election (or not) in November.

Unfortunately for the Democrats, 21 of the 36 Senate seats up for grabs already belong to them and the GOP is projected to even up the Senate if the Dems can't improve their narrative between now and November. The GOP needs to flip 6 seats to take control – it's going to be a very interesting 6 months ahead!

It's tricky, as investors, to digest this information. It's great for our Corporate Masters when wages are depressed and, unlike us, they don't have to live in this declining country. They certainly don't have to sell here. The transfer of wealth from the poor and middle class to the top 1% isn't just an American phenomenon – it's Global!

It's tricky, as investors, to digest this information. It's great for our Corporate Masters when wages are depressed and, unlike us, they don't have to live in this declining country. They certainly don't have to sell here. The transfer of wealth from the poor and middle class to the top 1% isn't just an American phenomenon – it's Global!

That means that 1% of this planet's 7Bn people or 70M people, are very, very rich. And it's not 70M people – it's 70M families so figure about 170M people are able to spend 20-1,000 times more than the median income (see chart in yesterday's post) in their country. Even in countries where the median income is $5,000 – that still puts them into what would be the top 10% in the US.

When we were growing up and even when most of us went to college, we didn't consider the GLOBAL MARKET because it was, traditionally, too hard to reach. That's not true anymore. I can buy or sell something on Ebay with people in Africa and UPS will get it there in 3 days. There are virtually no barriers to global trade and the Internet makes it just as cheap to advertise your product in Botswana as it is in Brooklyn.

When we were growing up and even when most of us went to college, we didn't consider the GLOBAL MARKET because it was, traditionally, too hard to reach. That's not true anymore. I can buy or sell something on Ebay with people in Africa and UPS will get it there in 3 days. There are virtually no barriers to global trade and the Internet makes it just as cheap to advertise your product in Botswana as it is in Brooklyn.

So what we are seeing, in terms of rising profits, is the success of Globalization that has been made possible by the Internet (circa 1995ish). All that BS they used to promise us about changing the World is actually happening – only not quite as quickly as we expected and, unfortunately for US Citizens, Globalization is also globalizing our wages to bring them DOWN to the levels that other countries have suffered with for decades.

I'm not proposing a "fix" to this problem – the obvious one is to tax excess wealth but the problem with that is, if we do it and Russia doesn't – then our Corporate Citizens and the top 1% will simply move there. There's no patriotism at work here – they threaten to do it all the time. If you think things are rough in this country now – think about what would happen if the only people with any money left too! So we're trapped and the only thing we can really do about it is to be rich – so you too will have the freedom to move to wherever they tax you the least, or where the business climate is best.

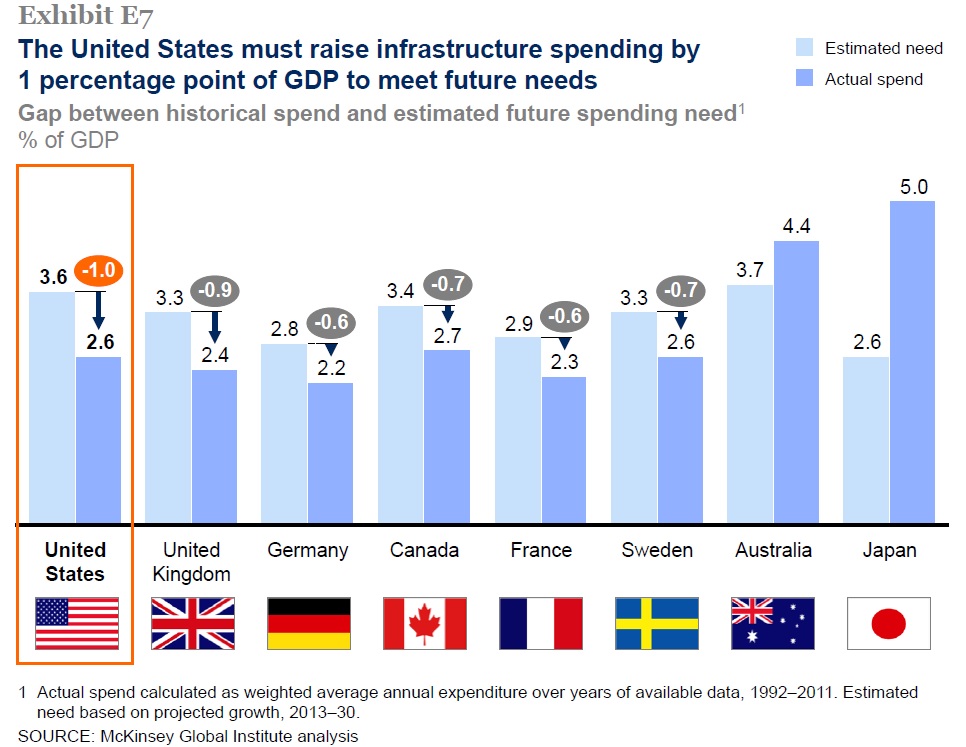

There's still a lot of nationalism in people's thinking but it will be gone in another generation or so. If you had a business in the US and most of your customers were in Florida – you'd consider moving to Florida. As we continue to globalize, companies will make very different decisions than they have in the past, because it no longer matters where your Corporate Headquarters are. In fact, the US is actually falling far behind in infrastructure – which is what made us a Global powerhouse in the first place.

Long-term, I'm still bullish as Corporations will adapt and survive in the changing global landscape but, between now and then, there are likely to be some serious dislocations that are currently being papered over by our Fed and other Central Banksters cranking up the printing presses and handing out Trillions to support the struggling top 0.01% (struggling to wipe you out).

Long-term, I'm still bullish as Corporations will adapt and survive in the changing global landscape but, between now and then, there are likely to be some serious dislocations that are currently being papered over by our Fed and other Central Banksters cranking up the printing presses and handing out Trillions to support the struggling top 0.01% (struggling to wipe you out).

Take CAT, for example (we're short), their April Global Sales Report shows a 13% decline from last year and this is the 17th consecutive decline posted by the company. NONETHELESS, the company is still making about $1Bn per quarter – because they laid people off and, more importantly, got FREE MONEY to finance their debt. Artificially low interest rates are causing artificial corporate profits and, for a company like Caterpillar, with $64Bn in liabilities, shaving a couple of points off their interest rates more than makes up for a little 13% decline in sales.

Money is so cheap for CAT that they bought back $2Bn of their own stock last year (4%), rather than pay down 3% of their debt. Having less stock to divide into lower earnings is another trick corporations have been using to "beat" expectations this year. Again, as a worker for the company or a citizen of the country that is going into debt to finance this fiasco – you might be disgusted but, as a shareholder – THANK YOU UNCLE SAM!

Money is so cheap for CAT that they bought back $2Bn of their own stock last year (4%), rather than pay down 3% of their debt. Having less stock to divide into lower earnings is another trick corporations have been using to "beat" expectations this year. Again, as a worker for the company or a citizen of the country that is going into debt to finance this fiasco – you might be disgusted but, as a shareholder – THANK YOU UNCLE SAM!

As I said yesterday – you can't fight the Fed. As long as they keep printing money and handing it out to their rich friends, this charade can go on and on. God help us all when the music stops…

.jpg)