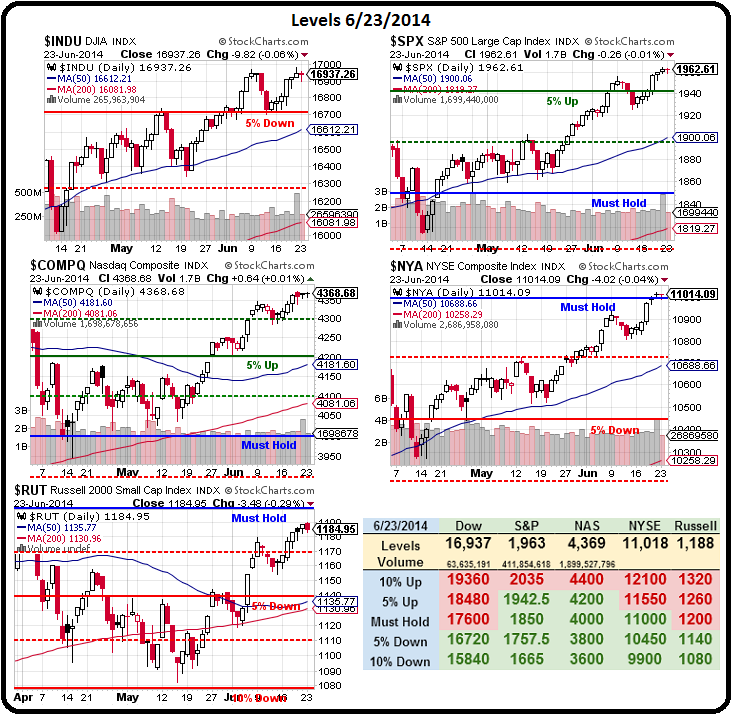

The new Big Chart is here:

Oooh, ahhh – look how high those levels have gotten. We discussed the whys for these adjustments in our weekend post and how is, of course, The Fed – along with the other Central Banksters who have been pumping up the economy by giving so much money to the top 0.001% that they have nowhere left to put it but equities and, so, we rally!

Top 0.001% (out of 7Bn people on Earth, that's 70,000 and, of course, that includes about 20,000 Corporate Citizens as well – even thought they are often owned by wealthy individuals – a double bonus for them!) corporations have so much money, they are running around buying each other and buying their own stock – anything they can think of to get rid of all the money the Central Banks are handing out. Well, anything but hiring people or investing in R&D, Infrastructure, Cap Ex or anything that would actually GROW the businesses.

Top 0.001% (out of 7Bn people on Earth, that's 70,000 and, of course, that includes about 20,000 Corporate Citizens as well – even thought they are often owned by wealthy individuals – a double bonus for them!) corporations have so much money, they are running around buying each other and buying their own stock – anything they can think of to get rid of all the money the Central Banks are handing out. Well, anything but hiring people or investing in R&D, Infrastructure, Cap Ex or anything that would actually GROW the businesses.

What the World's wealthiest businesses and individuals DO spend their money on is teams of accountants and lawyers who help them to shuffle their money around through various overseas shell corporations in order to avoid paying taxes. Here's how Google knocks their tax rate down to just 2.4% in 4 easy steps:

Now we have companies flat-out leaving the US to avoid taxes but it's not US taxes they are avoiding – it's ALL taxes. Medtronic (MDT), for example is acquiring Covidien (COV) for $43Bn and the combined group will be domiciled in low-tax Ireland, the official home of its merger partner, COV.

Medtronic’s executives will stay in Minneapolis and Covidien’s will remain in Mansfield, Mass. Covidien, then part of Tyco, left America for Bermuda in 1997 before moving to Ireland in 2009. The deal thus involves an inversion with a “foreign” firm that has itself already inverted: a sort of “inversion squared”.

Medtronic’s executives will stay in Minneapolis and Covidien’s will remain in Mansfield, Mass. Covidien, then part of Tyco, left America for Bermuda in 1997 before moving to Ireland in 2009. The deal thus involves an inversion with a “foreign” firm that has itself already inverted: a sort of “inversion squared”.

All this juggling will save MDT about $750M a year in taxes, which every single US taxpayer will then pay $5 each to make up for. Over the next 50 years, the merger will pay for itself in tax savings while extracting $250 from your wallet as well.

Of course it's not just $250, this is the 15th "invesion deal" of the last two years and just yesterday Shire (SHPG) turned down a $46Bn offer by AbbVie (ABBV) to do a similar deal and Pfizer (PFE) is trying to buy AstraZeneca (AZN) for a whopping $128Bn – what the hell it's only money (and your money at that!).

These top 0.001% companies are using the money YOU are subsidizing as the Central Bank artificially reduces borrowing costs that allow mega-corps to access stupendous amounts of cash, which then make deals like this worthwhile so, in addtion to 20 of these deals costing each and every taxpayer in the US $5,000 (money that we have to make up to pay the country's bills) – we also take on another $50,000 worth of debt on our National Debt Clock.

These top 0.001% companies are using the money YOU are subsidizing as the Central Bank artificially reduces borrowing costs that allow mega-corps to access stupendous amounts of cash, which then make deals like this worthwhile so, in addtion to 20 of these deals costing each and every taxpayer in the US $5,000 (money that we have to make up to pay the country's bills) – we also take on another $50,000 worth of debt on our National Debt Clock.

This does not, of course, affect PFE, GOOG or MDT – after all, they "live" in Ireland now! Good thing, too, because that National Debt Clock shows that your family is already on the hook for $757,351 (public and private) as of this morning. While another $100,000 won't make much difference to you, Corporations have teams of accounts who make sure money like that NEVER slips through the cracks.

Billions are being spent on lobbying efforts to lower Corporate Taxes even further and not just in the US. Just this morning, in fact, Japan knocked 15% off their Corporate Tax rates and our friends in the GOP are pusing for more tax reduction at the state and national levels. The joke is that, while we are being urged to bring our taxes down to Ireland's levels (12.5%), Ireland is looking to crack down on corporate tax cheats and RAISE their taxes.

Billions are being spent on lobbying efforts to lower Corporate Taxes even further and not just in the US. Just this morning, in fact, Japan knocked 15% off their Corporate Tax rates and our friends in the GOP are pusing for more tax reduction at the state and national levels. The joke is that, while we are being urged to bring our taxes down to Ireland's levels (12.5%), Ireland is looking to crack down on corporate tax cheats and RAISE their taxes.

As you can see from the chart on the left, Corporations are only paying 10% of the US tax burden now, which is funny because they earned $3Tn last year yet paid less than $250Bn in taxes (8.3% net), which is LOWER than Ireland's 12.5% rate. If we lower our rate to 12.5%, then Corporations will fire accountants who can't get it below 5% – this is not a war we're going to win, folks.

Is this, then, the new normal? I do have a concern here that we have reached "peak avoidance" and that there won't be much room left to cut after this. Companies are racing into Ireland mergers to take advantage of this scam before the loophole closes on them and, even if we assume earnings are improving – they are improving based on closing stores, cutting staff, shaving taxes, shrinking portions etc. and, from our last quarter's productivity report – we may have finally cut all the way to the bone.

Is this, then, the new normal? I do have a concern here that we have reached "peak avoidance" and that there won't be much room left to cut after this. Companies are racing into Ireland mergers to take advantage of this scam before the loophole closes on them and, even if we assume earnings are improving – they are improving based on closing stores, cutting staff, shaving taxes, shrinking portions etc. and, from our last quarter's productivity report – we may have finally cut all the way to the bone.

We're going to be watching earnings very closely for signs of real growth – as we'd love to be able to look to the high end of our new ranges with anticipation BUT, I am VERY concerned that we are reaching Peak Fed, Peak Tax Avoidance, Peak Subjugation of Workers and Peak Pretending There's No Inflation – all at about the same time and this, my friends, is a bubble you DO NOT want to pop!