Courtesy of ZeroHedge. View original post here.

Submitted by Tyler Durden.

Submitted by Tyler Durden.

Nearly a decade after Countrywide was sold to Bank of America in what has become the worst M&A deal of all time, bar none, having resulted in tens of billions of legal charges for Bank of America shareholders, the most recent of which was revealed also minutes ago when Bank of America reached a record $17 billion settlement with the government over the sale of mortgage-backed securities.

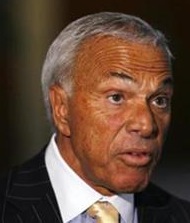

Moments ago Bloomberg announced that none other than Agent Orange himself, Angelo Mozilo, is about to be sued. Again, only this time the lawsuit may actually not be tossed or result in yet another DOJ trademark wristslap.

- U.S. SAID READYING LAWSUIT AGAINST MOZILO IN COMING MONTHS

- U.S. SAID PREPARING TO FILE MOZILO LAWSUIT IN LOS ANGELES

More from Bloomberg:

Government attorneys plan to sue Mozilo, Countrywide’s former chairman and chief executive officer, and other individuals using the Financial Institutions Reform, Recovery and Enforcement Act, said one person with knowledge of probe. The law, approved by Congress in 1989 in response to savings- and-loan scandals, gives prosecutors 10 years to bring cases and has less stringent liability requirements than criminal charges.

While U.S. prosecutors have notified lawyers that their clients are targets of civil cases, any suit against Mozilo and other individuals may be more than a month away, one of the people said.

The Justice Department has been focused on wrapping up a FIRREA settlement with Bank of America Corp. for about $17 billion over mortgage bonds inherited from its 2008 acquisition of Countrywide and 2009 purchase of Merrill Lynch & Co. The accord, which may be announced as soon as tomorrow, will penalize the Charlotte, North Carolina-based bank for how securities were marketed to investors, people familiar with the matter have said.

Mozilo said he has “no regrets” about how he ran Countrywide, according to a June 2011 deposition he gave in a lawsuit between the mortgage lender and bond insurer MBIA Inc.

But why wait so long? Well, before you go high-fiving Eric Holder who is about to arrive in Ferguson, it turns out that the government seemingly waited so long just so it would avoid filing a criminal case against the Moz. As it stands he will merely be slapped with a few civil charges, and promptly settle for a few basis points of what BofA paid him for Countrywide. Bloomberg explains:

More than 12 months after a deadline passed to file criminal charges, U.S. attorneys in Los Angeles are preparing a civil lawsuit against Mozilo and as many as 10 other former Countrywide employees, according to two people with knowledge of the matter.

The government is making a last ditch-effort to hold him accountable for the excesses of the past decade’s subprime-mortgage boom, using a 25-year-old law that has helped the Justice Department win billions of dollars from Wall Street banks, said the people, who weren’t authorized to discuss the case publicly.

…

U.S. prosecutors dropped a criminal probe of Mozilo in early 2011, a person with knowledge of the matter said at the time. Since then, President Barack Obama’s administration has faced a wave of criticism from public-interest groups, the media and lawmakers who say the government hasn’t held enough individuals accountable for causing the financial crisis.

The Citizens for Responsibility and Ethics in Washington, a watchdog group, sued the Justice Department in June to try to obtain its records detailing investigations of Mozilo and Countrywide. The group faulted the government for failing to prosecute either Mozilo or the company “despite substantial evidence of wrongdoing.”

The SEC’s lawsuit, filed 16 months earlier, accused Mozilo of reassuring Countrywide investors about the quality of the company’s loans, while knowing that its underwriting standards had deteriorated.

Until now, the harshest penalty imposed on Mozilo, 75, has been a $67.5 million accord with the U.S. Securities and Exchange Commission from 2010 to resolve allegations that he misled Countrywide investors. Mozilo agreed to settle the SEC case in October 2010 by paying a $22.5 million fine and disgorging $45 million of gains from stock sales at what the regulator said were inflated prices. Bank of America covered a portion of his penalties.

He earned $535 million from 1999 to 2008, according to compensation-research firm Equilar Inc. The size of the sanction in the SEC case, in which Mozilo didn’t admit or deny wrongdoing, compared with his pay has fueled public anger that financial executives walked away from the housing bust enriched and mostly unscathed.

Surely the best justice M&A proceeds can buy…