Courtesy of Mish.

Is it time to short the dollar? Saxo bank chief economist Steen Jakobsen thinks so. Via email from Steen …

What is wrong with changing your mind because the facts changed? But you have to be able to say why you changed your mind and how the facts changed. Lee Iacocca

My biggest call all year has been for global lower rates, and in particular lower core country (Germany, Denmark, and US) yields led by this magic trinity of factors:

1. China and Asia rebalancing growth away from nominal to quality growth

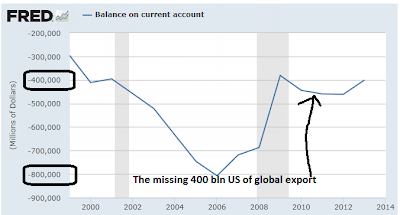

2. US current account deficit reduced by 50% (see chart below)

3. A Europe where Germany will pay the price for the first two factors with a lag of six to nine months.The headline call was and remains that Germany will be close to recession by Q4-2014 or Q1-2015 setting up a desperate ECB and a Europe once again close to zero growth instead of the “escape velocity” everyone and their dog promised you and me in December and January.

This past week we went through the important floor of 1% on ten year German Bund yield and I took profit on my long held position.

A position I established back in Q4-2013. Feeling “naked” I did some additional work and heavily supported by our Saxo JABA model we have changed the asset mix-up and also our yield call:

• Highest conviction call remains for lower global yields (Low in Q1-2015), but for rest of 2014 I see US yields falling more than European equivalent – this will lead to Bunds underperforming Ten year Treasury and set up the second call:

• US Dollar will significantly weaken from mid-Q3 into Q1-2015. Market remains overexposed to US dollar and US equities relative to norm – Furthermore with mid-term election on November 4th the coming budget talks will have a hard time producing convincing and long-term results needed. Bunds will not be able to follow the re-pricing of Fed (away from early 2015 hike) and growth in the US (It’s not the weather) as Q2 gets revised back down to 2.25-2.50% and geo-political risk and lag of global earnings for S&P-500 companies reduces margin and cash-flow. The US average GDP the last five years has been 2.0%……

I am presently almost square in fixed income – alpha model – from very long, but will use a any correction in US bonds to activate medium term long. (Again Bunds yields will continue to fall but less than US rates remains the new call…) hedging any US dollar exposure back into JPY and EUR. EUR/USD could trade 1.4000+ and USDJPY below 97.00.

…