Courtesy of Doug Short.

Advisor Perspectives welcomes guest contributions. The views presented here do not necessarily represent those of Advisor Perspectives.

I could not resist the whimsical title. It is time for the annual Fed Symposium at Jackson Hole. This event, sponsored by the Federal Reserve Bank of Kansas City, has historically been the scene for various important hints about policy changes. It is also an occasion for informal, face-to-face meetings among central bankers and economists from around the world. This provides for a healthy exchange of ideas among academics, government officials, and private sector economists. I am skeptical of reports of discussions during white-water rafting, but I suppose it can happen while hiking the trails or fishing. You could probably learn a lot by hanging around the Blue Heron bar.

I expect that central bankers will be doing more personal unwinding than thinking about reducing their balance sheets! I expect financial media to be asking: What is the Fed plan for reducing policy stimulus?

Prior Theme Recap

In last week’s WTWA I expected that the dominant theme would be the various world crises. This was accurate to start and end the week, although the weak retail earnings and data drew a lot of buzz mid-week. As the humanitarian Russian convoy approached Ukraine, there were many nervous stories about a possible Trojan horse. The fear was exacerbated by conflicting reports about a second Russian convoy of military vehicles. Some sources claimed that it was partially destroyed by Ukraine forces. This raised speculation that Putin was seeking an excuse to invade. Markets reacted dramatically to each rumor.

Naturally we would all like to know the direction of the market in advance. Good luck with that! Second best is planning what to look for and how to react. That is the purpose of considering possible themes for the week ahead.

San Francisco Appearance

I have agreed to speak at the San Francisco Money Show on August 23rd. Here is more information. I am working on some special themes. We will have fun and also identify some good investment ideas. I look forward to meeting readers in person. I will probably not be able to write WTWA next weekend.

Congratulations to Charles Kirk

Charles is retiring from full-time trading and moving to Hawaii. His obvious love for teaching and mentoring means that he will continue his work at The Kirk Report, which I have often recommended as a great resource for both traders and investors. He intends to focus a bit more on investors, while still maintaining a daily update and his popular Weekend Chart Show. The modest membership fee goes partly to charity and is quickly earned back by those following his screens and setups. Charles has a concept of retirement that is the equivalent of a full-time job for many. I hope he finds time for some golf!

This Week’s Theme

Jackson Hole has been the scene for some big news in the past. Most recently this has included the suggestion of two different rounds of QE (2010 and 2012) and also the Michael Woodford speech about the significance of forward guidance. This year is notable for the change in the guest list — fewer Wall Street economists, including some of the biggest names.

What should we expect from this event? Here is the background from the WSJ’s Jon Hilsenrath:

Why is the job market improving so steadily when output growth is slow and erratic? How low can the unemployment rate go before officials need to worry about wage pressure and inflation? Can the long-term unemployed be drawn back into the workforce in a more vibrant economy? Is workforce productivity waning?

At the risk of oversimplifying the sharp contrast in thinking, I will emphasize two perspectives. I want a neutral name for each group, since I have smart friends within each. I am struggling to do better than the “Traders” and the “Academics.”

-

Traders. The market wants more clarity. Enough of this story about “data dependent” decisions and moving targets for unemployment rates. Many Wall Street types also reject the Fed indicators for inflation. They want a swift end to the era of aggressive Fed stimulus and a return to normal trading. There are many advocates for this concept, including some dissenting FOMC members and famous TV pundits. For once, it seems appropriate to cite an anonymous, aggregate source:

The Federal Reserve is already behind the curve, this is obvious as at no time in our history has the economy performed on this level with rates basically being held at ‘end of the world’ total meltdown levels! Sure Wall Street wants free money from Central Banks, this has been the easiest money making era of their lifetimes; now that rates will rise, they actually have to learn to differentiate between asset classes, companies, and investment strategies. This was what changed this week, these two important data points on GDP and Inflation put the nail in the ‘Free Money for Life’ coffin, and this sent shivers up the spine of financial markets!

And the forecast for the speech:

Look for a speech on Friday August 22nd by Janet Yellen where she officially signals the end of the ‘recession era’ ultra-dovish monetary malaise of the last 7 years with a more hawkish tone to signal to financial markets that they better start finding their respective chairs before the low interest rate music stops playing entirely.

- Academics. The students of markets and data have a sharply different perspective. “Academic” is an unfair handle, since many have experience in policy-making roles. Tim Duy has this valuable combination of experience. His Jackson Hole preview covers recent data on labor markets, including these charts from the JOLTS report:

Since the job market shows some tightening, what is Prof. Duy’s forecast for Yellen’s speech?

Bottom Line: Anything other than a dovish message coming from the Jackson Hole conference will be a surprise. Tight labor markets alone will not justify an aggressive pace of tightening. An aggressive pace requires that those tight labor markets manifest themselves into higher wage growth and higher inflation. Yellen seems content to normalize slowly until she sees the white in the eyes of inflation.

As usual, I have a few thoughts to help in sorting through these conflicting viewpoints. First, let us do our regular update of the last week’s news and data. Readers, especially those new to this series, will benefit from reading the background information.

Last Week’s Data

Each week I break down events into good and bad. Often there is “ugly” and on rare occasion something really good. My working definition of “good” has two components:

- The news is market-friendly. Our personal policy preferences are not relevant for this test. And especially – no politics.

- It is better than expectations.

The Good

There was some good news.

- Small business optimism hit the highest level since 2007—95.7. This has been a very conservative and lagging index. Small business owners have strong opinions about taxes and regulation. The improvement here is especially noteworthy. Barron’s has the story and this chart:

- Gasoline prices declined for the sixth consecutive week. I am scoring this as “good” but prices are still thirty cents higher than last November. See Doug Short’s analysis and his famous charts.

- It was a happy earnings season, with growth of 9.6% y/y. (Ed Yardeni).

- Tax revenues are higher. As Scott Grannis reports, Taxes Don’t Lie.

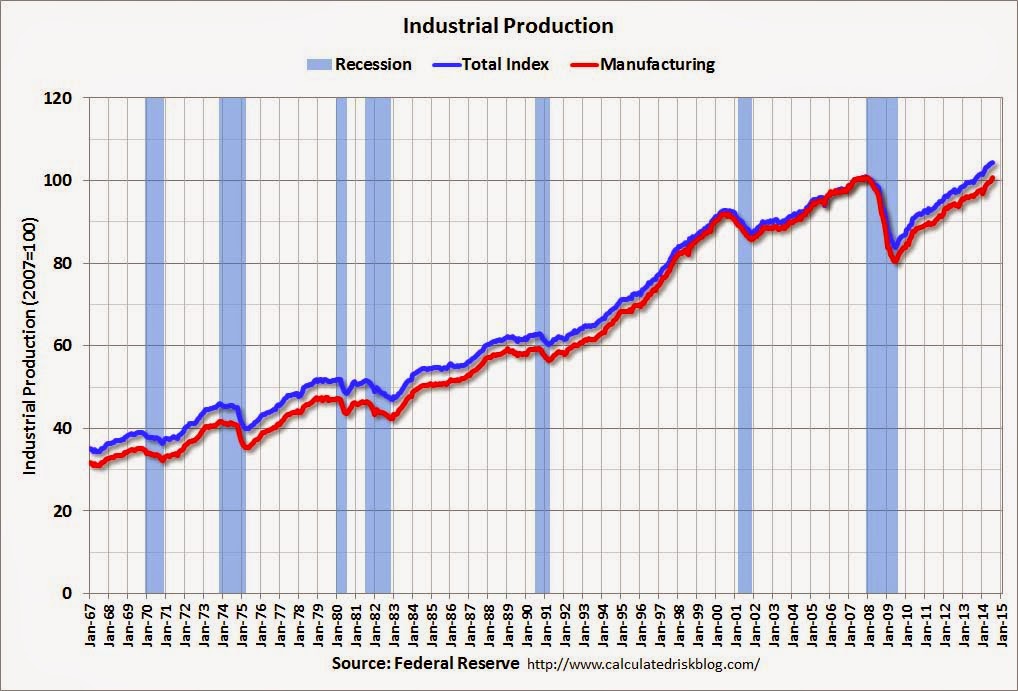

- Industrial production increased 0.4%. Calculated Risk shows the progress via this chart:

- The Ukraine situation may have stabilized. At least at my time of writing – Saturday night. Whatever the possible conflict concerning the Russian “military” convoy and the Ukraine attack, both sides seem to be backing off. The “humanitarian” convoy (although it has a lot of mysteriously empty trucks) seems to have been approved. Had this news hit during market hours on Friday, stocks would probably have finished higher and bonds a bit lower. For the moment, it seems to be a positive.

The Bad

There was also some negative news.

-

China’s economy. The data have been confusing. John Foley at BreakingViews explains the impact on confidence – a crucial element for growth.

It doesn’t really matter what economists think. But consumers and depositors are important. There the picture looks less fuzzy. Housing sales fell 17.9 percent year on year. The central bank’s quarterly confidence indices suggest people’s feelings about future income are the worst they have been in over a decade. Expectations are the most important part of the economy, and the hardest to manage. When China’s citizens are worried, there’s room for concern.

- Despite positive overall earnings, the average stock reaction was negative. Reports had to meet several tests beyond the basic report: quality of earnings, revenue, and outlook. Here is the result from Bespoke:

- University of Michigan consumer sentiment is at a nine-month low. This remains at the level at the start of the last recession. Whatever the progress on corporate profits, it is not necessarily reflected in confidence – a good indicator of employment and spending. Once again I point to Doug Short, who generates my favorite chart on this series, showing several variables in a single clear picture:

- Retail sales completely missed expectations. Some of the retail earnings reports were also very disappointing. Reuters cites opinion that employment data imply an improvement for retail. Scott Grannis calls it a lagging indicator. That will bear watching. See full analysis and many charts from Doug Short’s regular update.

The Ugly

Our “ugly” list for the last few weeks remains unfortunately accurate. We had headline news from all conflicts with plenty of violence and death competing for our attention. The Ebola crisis, cited a few weeks ago, continues to worsen. See the story and interactive graph at NYT.

The Silver Bullet

I occasionally give the Silver Bullet award to someone who takes up an unpopular or thankless cause, doing the real work to demonstrate the facts. Think of The Lone Ranger. No award this week. Nominations are welcome.

Quant Corner

Whether a trader or an investor, you need to understand risk. I monitor many quantitative reports and highlight the best methods in this weekly update. For more information on each source, check here.

Recent Expert Commentary on Recession Odds and Market Trends

Doug Short: An update of the regular ECRI analysis with a good history, commentary, detailed analysis and charts. If you are still listening to the ECRI (2 ½ years after their recession call), you should be reading this carefully. Doug includes the most recent ECRI discussion, which has been consistently bearish, including the blown call on the recession.

Bob Dieli does a monthly update (subscription required) after the employment report and also a monthly overview analysis. He follows many concurrent indicators to supplement our featured “C Score.”

RecessionAlert: A variety of strong quantitative indicators for both economic and market analysis. Dwaine’s “liquidity crunch” signal played out as projected. This week he highlights his HILO Breadth index which he has designed to pinpoint bottoms and to warn of protracted corrections. Current readings imply an opportunity that usually shows up only once a year. Check out the full post for a description and charts.

Georg Vrba: Updates his unemployment rate recession indicator, confirming that there is no recession signal. Georg’s BCI index also shows no recession in sight. For those interested in hedging their large-cap exposure, Georg has unveiled a new system. Georg now has another new program, with ideas for minimum volatility stocks for tax-efficient returns. He also has new advice for those seeking a safe withdrawal rate, now featuring the use of put options to protect against extreme events.

Antonio Fatas, has in interesting “thought experiment.” He asks about the implications if we were starting a recession right now. You need to read this very carefully. The conclusion is that it would represent a major change from all past indicators – essentially what I have been reporting here for several years, despite the ECRI forecast.

The Week Ahead

We have a big week for economic data and events.

The “A List” includes the following:

- FOMC minutes (W). Will mark the start of the week’s Fed focus.

- Housing starts and building permits (T). Rebound in housing remains key for a robust economic recovery.

- Initial jobless claims (Th). The best concurrent news on employment trends.

- Leading indicators (Th). Despite retail and housing, this indicator has remained strong.

The “B List” includes the following:

- CPI (T). Inflation is not a matter of key concern – yet.

- Existing home sales (Th). Good read on the housing market, but not as important for the economy as new sales.

I am not very interested in the Philly Fed, but it sometimes gets attention if the move is big.

The Jackson Hole previews, interviews and first speeches will dominate financial news at the end of the week.

How to Use the Weekly Data Updates

In the WTWA series I try to share what I am thinking as I prepare for the coming week. I write each post as if I were speaking directly to one of my clients. Each client is different, so I have five different programs ranging from very conservative bond ladders to very aggressive trading programs. It is not a “one size fits all” approach.

To get the maximum benefit from my updates you need to have a self-assessment of your objectives. Are you most interested in preserving wealth? Or like most of us, do you still need to create wealth? How much risk is right for your temperament and circumstances?

My weekly insights often suggest a different course of action depending upon your objectives and time frames. They also accurately describe what I am doing in the programs I manage.

Insight for Traders

Felix remains bearish, but it is a very close call with little conviction. Uncertainty remains high – typical for a trading range market. This week we were only partially invested and ended only with bonds. Inverse ETFs have positive ratings, but are still in the penalty box. Felix remains cautious, but has not yet gone short.

Brett Steenbarger highlights a long-term research study of day trading results. The good news is that there is persistence among those who do well in the first year of trading. The bad news is that the odds are terrible:

In other words, 87% of day traders in a given year lose money after fees are taken into account. About .28%–one in 360–is able to make money after fees year over year.

To be sure, that small group of very successful day traders earns a significant return. After expenses, they average +28 bps per day. Compare that to the 350,000 out of 360,000 daytraders who average a daily loss of 5.7 bps per day after expenses.

In another post Dr. Brett also highlights the relationship between skill at chess and trading. In the Chicago options trading world we had some chess and backgammon players, but bridge players had the best results.

You can sign up for Felix’s weekly ratings updates via email to etf at newarc dot com.

Insight for Investors

I review the themes here each week and refresh when needed. For investors, as we would expect, the key ideas may stay on the list longer than the updates for traders. The current “actionable investment advice” is summarized here. In addition, be sure to read this week’s final thought.

The market has finally provided some volatility. This is attractive for long-term investors who have a good shopping list.

Keep in mind this market move interpretation from Morgan Housel:

Stocks gained momentum on Monday, with the Dow Jones Industrial Average closing up 48 points, reversing losses from last week’s decline.

Experts hailed both moves as a “remarkable, textbook example of pure statistical chance,” chalking up Monday’s gains to a couple random marginal buyers being slightly more motivated than a few random marginal sellers.

“Imagine you pick 1 million random people from around the world every day,” said Toby McDade, chief investment officer of Momentum Fee Capital Management. “Some days, 51% would be in a good mood, 49% in a bad mood. The next day maybe it’s the opposite. Other days, random chance could mean 8% of people are really pissed off for no real reason. This is basically what the market is on a day-to-day basis,” he said.

Asked what his clients thought of this view, Mr. McDade laughed. “Oh my God, you think I could tell my clients that? How could I justify my salary?” Clients were told Monday’s gain was caused by a mix of reversing geopolitical instability, shifting uncertainty patterns, a risk-on atmosphere, and a perfect storm of beta meeting sigma. None knew what those words meant.

And this …

Marc Faber appeared on TV predicting a 20% stock market crash within the next six months, repeating a call he has made bi-weekly since the Carter administration. Another pundit explained that his last failed prediction would have been right if only he hadn’t been so wrong. Executives of financial TV networks met to discuss why ratings are at decade lows.

The yield on 10-year Treasury bonds fell from 2.42% to 2.38%. Nobody knows why.

I haven’t quoted the funniest parts, so check it out!

Here are some key themes and the best investment posts we saw last week.

Resources. David Merkel has a very helpful post describing his favorite research sources. He emphasizes those that are free, but also shares those for which he is willing to pay. Check it out and compare with your own favorites.

Fear Sells. The media jumped on a story about George Soros taking a “huge” bearish bet, as reported in his latest filings. I explained how the stories misinterpreted the data. If you missed it, you might find it interesting. I suspect that regular readers of “A Dash” have an instinctive suspicion about stories like this one.

Confirmation bias. In a brief and well-reasoned post, Robert Seawright explains the importance of disconfirmation in the inductive reasoning process. Despite this significance people neither seek nor recognize information that would disconfirm hypotheses. Try this little test and then read the full post:

My own worries. While on the subject of evidence and disconfirmation, I made a list of things that I was watching and what evidence would lead to less optimism about equities. I published it here as the Final Thought, and I keep it in mind.

Upside risk? At a time when the bullish pundits seem to have one foot out the door, Federated Investors’ Stephen Auth is unabashedly bullish. (This week’s Barron’s interview). S&P 2500? Possible in 18 months or so. That makes me look like a piker with my Dow 20K call from 2010. Auth’s reasoning rests on continuing economic growth and defeating assorted worries, pretty much as I have argued:

Market valuations depend on growth, bond rates, and perceptions of risk, and all three of those are going in the direction that actually expands the price/earnings multiple. At the same time, earnings are expanding, and that’s a recipe for another leg up in the market. In terms of economic expansion, we have been stuck in this 2% growth range since 2008-09. But we think something has happened and that animal spirits have returned. We’ve had these sky-is-falling moments, and every time we get through one of them, more and more people come out of their caves and say, “Maybe the sky is not really going to fall.”

And this…

Do stocks look attractive at these levels?

They are not dirt cheap, like they were at the first leg of the bull market. But they are inexpensive, relative to all the other alternatives, and that’s not a bad situation, considering that the fundamentals are quite good. Longer-term, say 18 months to two years out, we see the S&P 500 getting to 2500—about 30% higher than where it is now. We’ve been telling people to position themselves for a secular run in equities, because the economy has several years of expansion ahead of it.

One big call. Josh Brown discusses the results of those who “called the crash.” He also puts it in historical perspective. What we are seeing is just like those who made one big call.

Some have been uselessly frittering away the benefit of their having side-stepped the market’s decline in 2008 by repeatedly making long, short, in, out calls that have chopped up their acolytes for more than half a decade since. Others have called for more and more crashes that simply haven’t materialized, keeping their readers on the sidelines for one of the top five bull markets in history. And still others have opened hedge funds, advisories and timing services that have, to put it politely, sucked.

Almost all of the people who became household names as a result of having “seen it coming” in 2006 and 2007 have pretty much spent the post-crash period flailing.

Bad memories linger. On a similar theme, Barry Ritholtz describes the continuing effect of psychology from big crashes. Mark Hulbert joins in with an analysis of market timers:

It is hard to decide when the stock market has peaked and it is time to get out. It may be even harder to know when the damage is over and it is time to get back in.

But pulling off both in succession is exceedingly rare.

The average investor does worse with market timing than the results from holding cash – or almost any other asset! (Via Marketwatch).

If you are worried about possible market declines, you have plenty of company. This is one of the problems where we can help. It is possible to get reasonable returns while controlling risk. You can get our report package with a simple email request to main at newarc dot com. Also check out our recent recommendations in our new investor resource page — a starting point for the long-term investor. (Comments and suggestions welcome. I am trying to be helpful and I love and use feedback).

Final Thought

The chief distinction between the viewpoints I described as “traders” and “academics” (and I have been a member of both) seems to be a confusion between personal preferences and reality. That is why my terms are wrong.

The best traders I have known had no opinion. The worst academics were on a political mission. I try to find the best elements of each viewpoint. On this occasion, I am betting that Fed expert Tim Duy’s prediction is on target. I expect the Fed to reaffirm the very gradual path toward interest rate increases. The key issue will be labor force dynamics. Economic skeptics have made a major issue out of the level of labor force participation. It is now a topic on everyone’s agenda. Can participation rebound significantly? The answer is important to our evaluation about how much employment slack remains.

I also expect a story that has gotten little play so far. Even as the Fed prepares to unwind, Europe and Japan are increasing their own QE variants. Emerging market leaders are pondering the possible effects. The consequences of these policies will get plenty of attention.

Originally posted at Jeff’s blog: A Dash of Insight

© New Arc Investments