Courtesy of The Automatic Earth.

Esther Bubley Greyhound bus driver off duty, Columbus, Ohio Sep 1943

Given recent developments in Ukraine, and the accompanying PR, spin and accusations, the whole by now familiar shebang, I’m sure you would expect me to address the Kiyv vs Moscow vs the land of the brave issue today. Unfortunately, there are more important issues to talk about today.

Suffice it for me to say that the west is losing, and can therefore be expected to grab onto ever more desperate handles as we progress. Nothing new here: nothing proven, but plenty insinuated. We really should stop relying on our own news channels, for Ukraine, and for the economy, but those of you who’ve visited the Automatic Earth before, know that. And know why.

One prediction as per Ukraine: Angela Merkel will make sure Ukraine won’t be a member of NATO. Or she’s going to regret it something awful. My bet is she’s too smart to let things meander that far and too long.

What I do think should stand out from all of what we’ve seen recently is that there’s not a single news source in the Anglo Saxon world, or in what I read in the German, French and Dutch press, that’s even remotely trustworthy. And that’s still, no matter how long this has been going on, a pretty scary conclusion to draw.

The more important issues of the day for us are those that bubble under the surface. And maybe that’s not a coincidence. Maybe, just maybe, the whole warmongering thing serves to take your eyes of the failing economies in Europe and the US. And Japan.

I’m sure many people wonder why the Fed would cut QE and raise interest rates at the very moment Tokyo and Brussels are either preparing to or thinking about launch(ing) more stimulus, not less. You might think that US unemployment numbers, and GDP data, are behind the decisions, but then those are merely fabrications dutifully repeated by the news/politics system.

The US economy is in just as poor a shape as all other formerly rich economies are. And raising rates now risks blowing up very large segments of the global economy. Such as emerging economies, western mortgage holders, and all the millions in Europe and the US who’ve had to switch from well-paid jobs to a burger flipping standard of living. They may make stats look sort of OK (Mary’s got a job!), but both the people and the stats will topple over en masse when interest rates rise.

Why then should Janet Yellen raise those rates regardless? It’s very simple, and I don’t see why or how everybody has missed out on this, and how the vast majority still are.

Because anything and everything the Fed has done since Wall Street caused the crisis, and well before (ask Alan Greenspan), has been about protecting Wall Street. And protecting Wall Street, or rather enhancing Wall Street’s profits, is exactly why Janet Yellen is about to raise US interest rates.

Not that I think it’s necessarily a bad move, ultra low rates have been a scourge on our economies for far too long – and they have been around only because Wall Street could profit from them -, but because the act of raising them is once more being executed solely to benefit the TBTF banks. Certainly not to benefit the American people, millions more of whom will be forced out of their homes when the Fed funds rate moves to 3% or 4%, or bend over backwards just to stay put.

Don’t count or Yellen, or the rest of the Fed crew, to take that into account, though. That’s not what they do. That’s not their MO. They’re not thre for you. The whole storyline about the central bank looking out for the American people, for full employment and price stability, is just that: a storyline. No different from the one about how America is busy saving Kiev from Putin: a convenient storyboard that lures in enough people to stand on its own.

Reality resides in for instance this Philip Van Doorn article for MarketWatch:

Big US Banks Prepare To Make Even More Money

An expected rise in interest rates over the next year will help the largest U.S. banks earn billions of dollars in additional net interest income, setting up their cheap stocks for what could be a stellar run. [..]

The Federal Reserve has kept the short-term federal funds rate locked in a range of zero to 0.25% since late 2008, in an effort to increase loan demand and jump-start the economy. This policy and the “QE3” bond purchases that will end this year seem to have worked, with the U.S. economy expanding at a 4% annual rate during the second quarter and continuing to add over 200,000 jobs a month. But the debate at the Federal Reserve has now shifted to the timing of interest rate increases. Most economists expect the federal funds rate to begin climbing in the second half of 2015, but it could well happen sooner than that.

For most banks, the extended period of low interest rates has become quite a drag on earnings.

Net interest margins – the spread between the average yield on loans and investments and the average cost for deposits and borrowings – are still being squeezed, since banks realized the bulk of the benefit of very low interest rates years ago, while their assets continue to reprice downward.

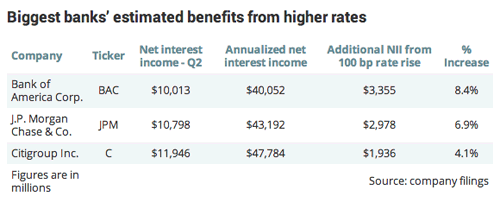

A 1% rise (from zero) in interest rates will grow BoA profits by 8.4%. That’s all you need to know, right there. What else do you need? How about a 3% rise? Low rates have brought down bank earnings for a couple years, and they’ve all bled that cashcow dry by now. The next big thing for Wall Street will by higher rates. Which they can pass on to you, Joe and Jill Main Street. Make sure you have your checkbooks ready.

When rates are low, banks can borrow on the cheap. But they can’t charge you high rates either. They’ve now borrowed all they want, and can, at zero percent (there’s a limit to profits even there). And the banks want to move to 3-4-5+%, so they can squeeze their customers for the difference.

The Fed is only too happy to comply. And it will use the argument of an improving US economy to do so. Because (some of) the – handpicked – stats say there’s improvement. Yellen is still dutifully hesitating, because they all know there really is no great US economy that would justify a rate hike, but all the pieces are in place.

And that’s why US interest rates will go up. And create chaos in global markets. And push millions of Americans and Europeans into servitude. It’s because the banks want it. Because they stand to profit greatly from the ensuing mayhem.