For Liquidity, Look No Longer to Fed, Look To ECB

Courtesy of Lee Adler, Wall Street Examiner

[This is an excerpt of the Professional Edition of the Wall Street Examiner. For more, click here.]

The Fed has been between the usual monthly rounds of MBS purchase settlements which take place at mid month every month. This month, they begin on Thursday 9/11, and should total around $35 billion, which should be enough to give the market a little burst, especially if the mini flight from Treasuries that began last week picks up a little steam.

The Fed is not the only player in this game. While it is winding down QE, the BoJ continues to pump liquidity into many of the same dealer banks served by the Fed, and the ECB has now confirmed that it will join the pumpfest with direct ABS securities purchases of its own. They have not yet specified the amounts, and we don’t know what the sellers will do with the cash. As I discussed in the latest Radio Free Wall Street video, they may use it to continue deleveraging by paying down ECB loans.

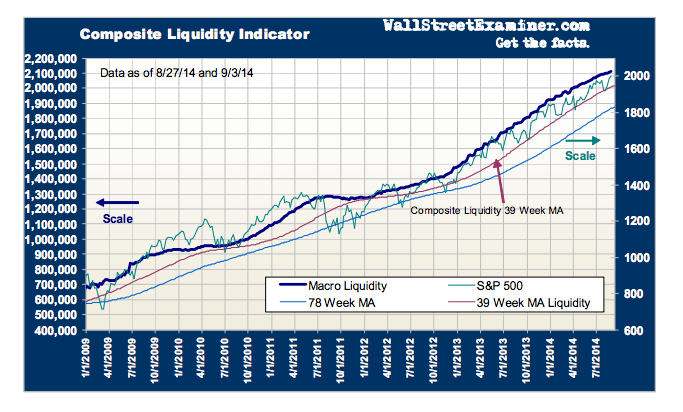

Meanwhile, the Composite Liquidity Indicator (CLI) continues to rise at a slowing pace and, magically, the S&P 500 continues to bounce from the CLI’s lagging 39 week moving average. As the CLI flattens, signaling the slowing growth of liquidity, I would expect the trajectory of stock prices to

flatten similarly, but much will depend on just how much buying the ECB does and what the counterparties do with the cash. Those details will supposedly begin to be made known in October. The churning in stock prices, with a possibly mildly upward bias, should continue in the meantime. If the ECB purchase program is small, and/or if the cash is used for further reductions in leverage, the US stock market will see more volatility next year.

Get regular updates on the machinations of the Fed, Treasury, Primary Dealers and foreign central banks in the US market, in the Fed Report in the Professional Edition, Money Liquidity, and Real Estate Package. Click this link to try WSE's Professional Edition risk free for 30 days!

Copyright © 2012 The Wall Street Examiner. All Rights Reserved.