Get ready for rising interest rates — and stocks

By JEFF REEVES, JEFF REEVES'S STRENGTH IN NUMBERS

Going back to 1962, equities have been helped by Fed tightening

There is increasing evidence the Federal Reserve will tighten monetary policy in the next year, ending its bond-buying efforts and positioning itself to raise interest rates.

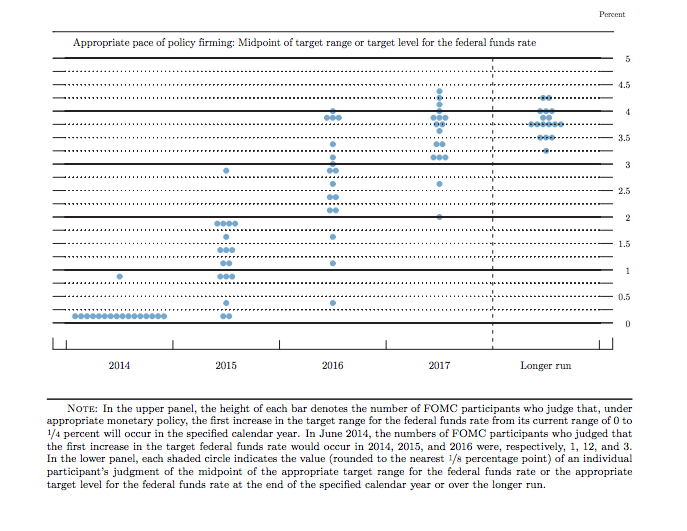

Quantitative easing is effectively over, with the stimulus program scheduled to end in October, and the “dot plot” of projections from Fed officials shows rates will likely get their first bump in 2015 with a projected fed funds rate of 3.75% by the end of 2017.

Say what you want about previous central-bank policies, but it’s indisputable that the massive stimulus efforts of the Federal Reserve were unheard of, and the winding down of its recession-era policies will be an equally unprecedented task.

As a result, many investors are worried about what the end of easy money policies will mean for the stock market. If history is any guide, however, rising rates should also mean rising stocks.

There are a boatload of caveats here. For starters, the early days of a rate hike often are characterized by weakness in the stock market…

Keep reading: Get ready for rising interest rates — and stocks – MarketWatch.

****

Here's the "dot plot" from the Federal Reserve:

According to Rex Nutting at Market Watch, the recent dot plot released by the Fed indicates that it is likely to raise interest rates at nearly every Federal Market Committee meeting for two years:

The federal funds rate is now between 0% and 0.25% and is likely to remain there for a “considerable time,” the Fed said Wednesday. But by the end of 2017, the majority of the committee expects the fed funds rate to rise to around 3.75%.

The Fed usually raises rates in quarter-point moves. That means the end game of 3.75% is 13 rate hikes away… (Dot plot shows Fed will be quick about raising rates, once it starts)