.png) Pam Martens writes about the Segarra Tapes released last week. These tapes show how the regulation of Wall Street is a complete failure, a farce, with only punishment waiting for those who speak out as Carmen Segarra did.

Pam Martens writes about the Segarra Tapes released last week. These tapes show how the regulation of Wall Street is a complete failure, a farce, with only punishment waiting for those who speak out as Carmen Segarra did.

William D. Cohan noted that the Segarra Tapes didn't reveal much we didn't already know. Sadly, this is true. Carmen Segarra provided solid evidence to what we probably suspected anyway (Why the Fed Will Always Wimp Out on Goldman). However, solid evidence may mean something still.

In spite of our jaded attitude that corruption at the "regulating authority" New York Fed is well-known, and won't be fixed, EVER (because that's how powerful the bankers and regulators are!), perhaps there is hope. The tapes contain clear-cut, understandable proof of conflicts, regulatory capture and self-dealing.

With some luck, the tapes could prompt a little public fury, further investigations (by entities other than the NY Fed…), greater oversight and some real reforms to our Wall Street managed banking system. As a start, Senators Elizabeth Warren and Sherrod Brown are calling for Senate Banking hearings on the conflicted dealings of the New York Fed.

Carmen Segarra: Wall Street's Spy Vs Spy

Courtesy of Pam Martens

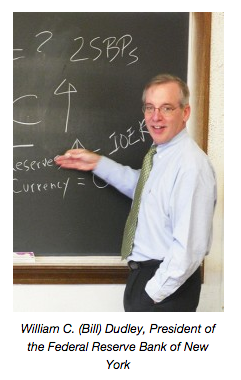

If you missed our coverage in 2012 of the Lower Manhattan Security Coordination Center where Wall Street sleuths from those serially charged firms like Goldman Sachs and JPMorgan dunk donuts alongside New York’s finest in a $150 million spy center, keeping tabs on the comings and goings of their own Wall Street employees as well as innocent pedestrians, then you may not fully appreciate why Carmen Segarra has been celebrated all weekend for her temerity in taping her boss and colleagues at the New York Fed, as well as employees inside the cloistered bowels of Goldman Sachs.

While Wall Street was spying on everyone else in lower Manhattan in a high tech center funded by the taxpayer, Segarra strolled over to a Spy Store, plunked down a modest sum and walked out with a tiny tape recorder. She then proceeded to capture the essence of the quintessential captured regulators who didn’t see the 2008 crash coming and won’t see the next one coming either – because their job is not to see too much. (We called the Spy Store on Saturday to ask if they had experienced an upsurge in sales of the tiny recorder. We were informed that sales were brisk but not unusual.)

[There are three Spy Stores, two in NY and one in NJ. One is on corner of Christopher St & 7th Ave., with the entrance conveniently next to Bank of America. It's the place for you if you have someone who needs spying on–your babysitter, lover, husband, boss, employee. Get the edge on your situation When You Need to Know. When is that? Face it, you ALWAYS need to know.]

Back to Pam:

Segarra is a lawyer and former bank examiner at the Federal Reserve Bank of New York, one of Wall Street’s key regulators, who charged in a lawsuit filed in October 2013 that she was told to change her negative examination of Goldman Sachs by colleagues, who also obstructed and interfered with her investigation. According to her lawsuit, when she refused to alter her findings, she was terminated in retaliation and escorted from the Fed premises.

After having her case tossed by a Judge whose husband was representing Goldman Sachs, Segarra turned over her 46 hours of tape recordings to ProPublica’s Jake Bernstein and public radio’s This American Life. ProPublica and This American Life released their stories on the tapes this past Friday, creating a media frenzy.

The hubbub has reached the ears of the U.S. Senate, with Senators Elizabeth Warren and Sherrod Brown calling for Senate Banking hearings on the deeply conflicted New York Fed.

Over the years, Wall Street On Parade has written about a raft of conflicts of interests at the New York Fed that would not be tolerated at any other financial regulator. During 2007 and 2008, as Citigroup entered an intractable death spiral from off balance sheet debt bombs and obscene executive pay, New York Fed Chief Tim Geithner was busy hobnobbing – enjoying 29 breakfasts, lunches, dinners and other meetings with Citi execs.

Read Pam's past coverage of the Carmen Segarra story and the deeply conflicted New York Fed at these links:

Carmen Segarra: Secretly Tape Recorded Goldman and New York Fed

Blowing the Whistle on the New York Fed and Goldman Sachs

The Carmen Segarra Case: Welcome to New York, Wall Street and McJustice

A Mangled Case of Justice on Wall Street

Is the New York Fed Too Deeply Conflicted to Regulate Wall Street?

New Documents Show How Power Moved to Wall Street, Via the New York Fed

Intelligence Gathering Plays Key Role at New York Fed’s Trading Desk

Relationship Managers at the New York Fed and Citibank: The Job Function Ripe for Corruption

New York Fed’s Strange New Role: Big Bank Equity Analyst

New York Fed’s Answer to Cartels Rigging Markets – Form Another Cartel