Wheeeeeee – What a ride!

Wheeeeeee – What a ride!

As with skiing, a nice drop can be lots of fun – if you are ready for it. If not, things can get broken… Supports were broken yesterday as we lost the 200-Day Moving Average on the NYSE (10,600) and the 50 dma on the Dow (16,930), Nasdaq (4,500) and the S&P (1,975).

We lost the Russell ages ago, when we made our Death Cross so "told you so" on that one. As I said at the time (9/16):

Of course, we've been telling you for weeks now that the markets were toppy but at least now it's getting obvious. The Fed may still pull a rabbit out of its ass and goose the markets once again but I very much doubt anything is going to stop the eventual correction now. Delay, maybe – stop, no.

Our trade idea that day in our morning post that day was:

If, however, you buy just $2,500 worth of the of the TZA Oct $13/16 bull call spread at $1 (25 contracts), they will pay you back $7,500 if TZA goes up about 15% (just a 5% move up in the RUT) AND they don't lose all their money until TZA is down 10% (a 3% move up in the RUT).

That trade is already 110% in the money and on it's way for a $5,000 per unit gain (200%) – a very nice way to hedge what is, so far, less than a 10% pullback in our indexes. What we do, once these hedges go in the money (if we're still bearish) is add another layer of hedges at higher strikes and we put a stop on our original hedges to lock in those gains. That's where we are now as we begain playing for a bounce yesterday in our Live Member Chat Room (you can join us HERE).

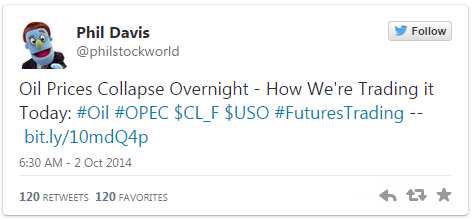

This morning, we're waiting on Draghi to wave his magic stimulus wand and stop the market slide but I'm not sure he can pull it off (see our early morning discussion). Overnight, oil collapsed down to $88.18 and, since $88.50 was the -2.5% line for the day, we applied our 5% Rule™ and called a bullish play from there to $89, which I tweeted out along with an Alert to our Members at 6:30 am and already we've gotten our $500 per contract gains for the morning and the Egg McMuffins are paid for.

This morning, we're waiting on Draghi to wave his magic stimulus wand and stop the market slide but I'm not sure he can pull it off (see our early morning discussion). Overnight, oil collapsed down to $88.18 and, since $88.50 was the -2.5% line for the day, we applied our 5% Rule™ and called a bullish play from there to $89, which I tweeted out along with an Alert to our Members at 6:30 am and already we've gotten our $500 per contract gains for the morning and the Egg McMuffins are paid for.

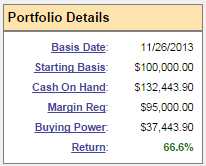

In preparation for this morning's hopefully bullish action, we cashed in our DXD Oct $24 calls at $1.20 (up 166% from our 0.45 entry) in the Short-Term Portfolio, which finished the day up an ominious 66.6% for the year. We swung more bullish but maintianed DXD and SQQQ spreads – just in case Draghi fails us but we locked in the gains on our directional shorts, satisfied with where we are off that little dip.

In preparation for this morning's hopefully bullish action, we cashed in our DXD Oct $24 calls at $1.20 (up 166% from our 0.45 entry) in the Short-Term Portfolio, which finished the day up an ominious 66.6% for the year. We swung more bullish but maintianed DXD and SQQQ spreads – just in case Draghi fails us but we locked in the gains on our directional shorts, satisfied with where we are off that little dip.

Greed kills in the market and we try to hammer that point home to our Members. This morning we'll take off the EWJ Oct $12 puts we highlighted for you on Tuesday as those should be up 150% (yes, in 48 hours) at 0.50+ with the Nikkei falling 2.6% overnight. Also from yesterday's post (and Tuesday's post), our long Yen position did exactly as we'd hoped and USD/JPY fell to 108.31 overnight – up $1.69 from our 110 entry at $900 per penny, per contract for a total gain of $152,100 per contract. Nice work if you can get it!

We don't do a lot of currency trading as it's just too annoying but 110 on the Yen was the fat pitch we'd been waiting for to short USD/JPY and you can read the logic that led up to that call in Tuesday's morning post (which would be delivered to your mailbox if you subscribed!) which, of course, was a mere summary of all the discussions we'd been having in Member Chat. What I said that morning was:

Ahead of the open, the Euro went into free-fall this morning with a plunge to $1.257 and that sent the Dollar flying to 86.30 and the Yen to 109.85. If you like currency trading, you can play for a retrace at 110, which means the Dollar will pause below 86.50 and that run was from 83 so 3.5 in September means we expect a retrace of 0.75 (weak) to 85.75 and, possibly, a strong retrace back to the 85 line.

The Yen, meanwhile, should drop back to 109 (weak) and 108 (strong) and that means it's game on for the /NKD shorts (16,250) and EWJ can be played short at $12 with Oct $12 puts at 0.20.

As you can see, we also caught a 645-point drop on the Nikkei Futures, which pay $5 per point, per contract for a $3,245 per unit gain on those. That's 3 trade ideas, played 3 different ways, using the same 5% Rule™ based on our same Fundamental observations of the Asian markets and our own currency – something we discussed extensively in our Live Member Chat Room last week and over the weekend.

Fundamental trading is not for everyone – it requires patience and a good deal of study before we come up with our trade ideas but, as you can see, it's very rewarding when it hits! This is probably a good time to invite you to join us for our LIVE 2-Day Seminar in Las Vegas, November 9th and 10th, where we'll be teaching our techniques – including a live trading session on Monday, the 10th.

Meanwhile, Draghi has gone hog wild in Europe. Though the ECB did not lower their rates, they are stepping up their Asset Purchase Program by about $1.3Tn ($1,300,000,000,000.00) AND will widen the scope of asset purchases to include bonds from countries with ratings below BBB- (ie. JUNK!). This will make the ECB the biggest, baddest bank in the World with $4Tn of crap on their books. Promises include:

- Covered bond purchases will begin this month, and asset backed securities purhases will begin this quarter.

- The weakening growth momentum and inflation outlook in the Eurozone warrant two years' worth of purchases.

- The governing council is unanimuous in its commitment to use further unconventional mechanisms if the outlook worsens (this means QE is still on the table)

- Draghi says it's "hard to give a figure" on the purchases because the ABS and covered bond programmes overlap with the disappointing TLTRO bank credit policy. Another announcement on this is coming at 10:30 a.m. ET.

- Draghi has "decided to include countries that have a rating below BBB-" in the purchases programmes. That means Greece and Cyprus will be included, as the Financial Times suggested.

- "We did a lot of things since June. We did a lot of unprecedented things." Draghi is cheering the ECB's actions over the summer, but says "let's see" over sovereign bond purchases (QE).

Well, as promised, Draghi has indeed pulled out all the stops in an attempt to keep the EU out of a full-blown Recession. The only question that remains is – is he doing enough? As we can see from the US example, Central Bank policies alone are not enough to restore prosperity – all it does is make a lot of Banksters and the top 1% investors that own them happy.

So far, there is little change in the European indexes or in our own futures and God help us all if we begin failing the sad levels we're at now. We'll have to play it by ear in our chat room but, at the moment, I'm inclined to get a bit more aggressively bearish until I see some bounce lines taken back.

Let's be careful out there!