It is suddenly not all that popular to be bullish, but here's a bullish perspective by the trading "whiz" Manny Backus.

My Expectations for the Stock Market End of the Year Performance

Courtesy of Manny Backus at Trading Tips

Courtesy of Manny Backus at Trading Tips

Do you know what to expect at the end of the year? Are you complacent or scared?

From the beginning the stock exchange seems to have ended up extremely tumultuous. Sometimes stocks go up and sometimes stocks go down. To become a good investor, you must look beyond the irrationalities of the stock market day by day.

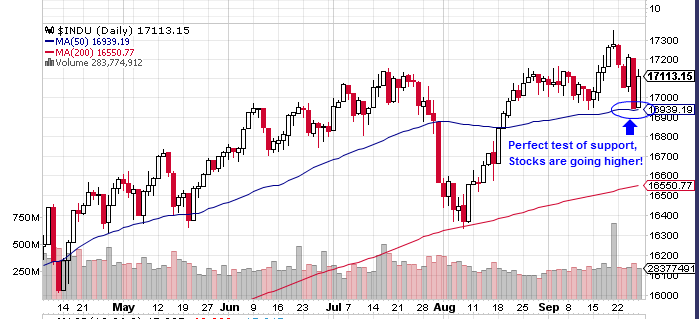

For illustration, I’ve decided to go over with the technical and fundamental analysis of (DJIA) Dow Jones Industrial daily stock charts. Let’s examine first the recent technical analysis of DJIA stock performance.

On an intraday basis, DJIA reached an all-time higher than 17300 in the previous 6 trading sessions. On the following 5 sessions, the record drop down to 16939 before settling and turn once again to an end high of 17113.

This is a textbook-perfect trend for technical analysis….

The high value drops and paused directly on the major support of the 50 day simple moving average before bouncing higher. The next level of support is at the 200 day SMA.

In fact, the uptrend stays in full effect and I expect extra upside in the major records from here.

In addition, the fundamental picture is very clear regarding the strong possibility of extra upside between now and year-end 2014.

The corporate income keeps on rising. These amounts of money have been exceptionally bold and are expected to go with their upward pattern for the following 3 or more quarters.

Subsequently, collapses and significant alteration generally happens when stocks are priced too high than the usual standards. Particularly, if there is severe overpricing and stock buying madness in the market.

At this time, stocks are priced somewhat higher than authentic standards. We are essentially not seeing the buildup and frenzy that for the most part signals the end of a bull market.

Furthermore, right now there is unparalleled market support by the Federal Reserve. The world's most influential central bank is obviously signaling their every action and stays supportive of equities.

Also, the way that wage inflation stays at exceedingly low levels is important since low wages means higher corporate profits which in return help the stock costs.

The economy is developing at a decent clip as per the most recent GDP numbers. When the economy keep on growing it will constrain the Feds hand to gradually begin to build investment rates.

That being said, the controlled and moderate ascent of rates ought not to harm the share trading system for long. The starting buildup encompassing the first build may cause a transient swoon in stock costs, yet the incredibly enhanced economic data will neutralize this selling in the more extended term. This implies that any selling ought to be considered as a buying opportunity.

All in all both the technical and fundamental analysis picture remains bullish until the end of year. To get the best returns on your stock purchases, find a solid stock and have a good idea of how the stock market is likely to perform in the near future. Examine a variety of factors carefully to find out the strength of the stock market tomorrow.

****

Manny Backus is the Founder and President of Wealthpire Inc., A Financial Publishing Company

In describing himself, he writes,

I'm known in investment circles as the "Stock Trading Whiz Kid," or "the untutored prodigy of stock investing." Since I was 15 years old, I've experienced great success in the stock market. I learned everything I could about price volatility and market timing. This has given me ample time to learn how the market works from the inside out. I have learned firsthand what to do and what not to do in order to not only survive, but to conquer the market.