The Monetary Politbureau and the Markets – A Game of Chicken

Courtesy of Pater Tenebrarum of Acting Man

December FOMC Decree

Prior to the announcement of the FOMC decision on Wednesday, it was widely expected that the verbiage in the statement would be changed so as to convey an increasingly hawkish stance. Specifically, it was expected that the following phrase, which has been a mainstay of FOMC statements for many moons, would finally be given the boot and no longer appear:

“…it likely will be appropriate to maintain the 0 to 1/4 percent target range for the federal funds rate for a considerable time”

It is inter alia this bizarre focus on little turns of phrase in the FOMC statement that has caused us to compare the analysis of the actions of the monetary bureaucracy with the art of “Kremlinology” of yore. The Committee is indeed reminiscent of the Soviet Politbureau in many respects. It is unelected, it is engaged in central planning, and its pronouncements are cloaked in an aura of mysticism, akin to decrees handed down from Olympus.

While it is fairly easy (and in our opinion, absolutely necessary) to make fun of this, it is unfortunately affecting the lives of nearly everyone on the planet. The only exceptions that come to mind are Indian tribes in remote areas of the rain forest, since they don’t use money and possess no capitalistic production structure.

Fed chair Janet Yellen: “A couple. You know, a pair. What the Russians call “dva”, although I hear the Russians are no longer as familiar with such low numbers as they once used to be. My dictionary says it means “two”. One less than the number one is supposed to count to before throwing the holy hand grenade of Antioch after its pin has been removed. Not one, definitely not five, absolutely not four and not three either. Two.”

Photo credit: Agence France-Presse / Getty Images

So what has happened to the above mentioned phrase? It has indeed been altered. Instead we got this:

“Based on its current assessment, the Committee judges that it can be patient in beginning to normalize the stance of monetary policy.”

Crikey! What to make of this? The committee is evidently aware though of the plight of professional Kremlinologists who have to decipher these cryptic semantic changes and therefore has added the following by way of explanation:

“The Committee sees this guidance as consistent with its previous statement that it likely will be appropriate to maintain the 0 to 1/4 percent target range for the federal funds rate for a considerable time following the end of its asset purchase program in October, especially if projected inflation continues to run below the Committee’s 2 percent longer-run goal, and provided that longer-term inflation expectations remain well anchored. However, if incoming information indicates faster progress toward the Committee’s employment and inflation objectives than the Committee now expects, then increases in the target range for the federal funds rate are likely to occur sooner than currently anticipated. Conversely, if progress proves slower than expected, then increases in the target range are likely to occur later than currently anticipated.”

Okey dokey, so “patient” actually means exactly the same as “considerable time”. The algos that interpret news releases to guide fully automated trading decisions in the stock market probably only needed to see the term “considerable” again, because the DJIA was up more than 300 points within an eye-blink after the release.

As can be seen above, the explanation went into additional detail, so as to make sure that even the intellectually challenged among market participants get it. It is essentially saying: “We have actually not the foggiest idea what is going to happen (duh). We will continue to keep our focus firmly on the rear-view mirror of economic statistics that have no bearing whatsoever on the future, and depending on what these statistics seem to be saying, we will react.”

Or as the official phraseology has it: the decision will be “data dependent” – which incidentally has been repeated ad nauseam by the Fed for what seems to be an eternity by now.

It remains to be added that the two lone “hawks” that were voting members on the FOMC this year – Richard Fisher and Charles Plosser (note that next year only doves will have a vote) for the very last time indicated that they are unhappy with ZIRP by dissenting from the decision. Interestingly, Narayana “Havenstein” Kocherlakota dissented as well, because he thought the statement was too hawkish (seriously). He’s worried about declining “inflation”, i.e., he thinks the prices of consumer goods aren’t rising fast enough.

Lastly, in her press conference, Janet Yellen became a bit more specific about the meaning of the term “patient” (under ceteris paribus conditions). According to the WSJ’s summary of the press conference:

“Ms. Yellen said the Fed’s new statement on patience means that “it is unlikely to begin the normalization process for at least the next couple of meetings”

[…]

What does “a couple” mean? A good question: Does a “couple” of meetings mean two? (It’s the Fed, so you never know.)

Yellen: “I believe the dictionary probably says a couple means two, so a couple means two.”

We also want to refer readers to the WSJ’s trusty “FOMC statement tracker” that compares the December statement to the October statement. There have actually been quite a few changes, but none of them strike us as particularly consequential.

A Game of Chicken

As Marketwatch informs us, Wall Street strategists are largely unperturbed by the prospect of rising interest rates potentially derailing the echo bubble:

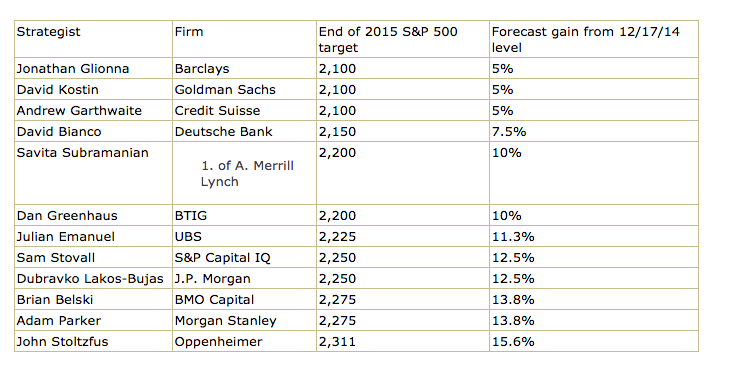

“Faced with the first Federal Reserve rate increase in more than eight years, market strategists, on average, expect the S&P 500 index to keep climbing the wall of worry and end 2015 about 10% higher than current levels. The degree of bullishness among strategists varies depending on how much they balance impending Fed rate hikes and volatility against the role of the stronger dollar, lower energy prices, and economic improvement. Given the recent downturn in stocks, the average predicted gain is slightly higher than the S&P 500’s current year-to-date gain of about 8%, and higher than the average forecast rise of 6% seen this time last year before Treasury yields and oil prices surprised to the downside and the dollar rallied.

Here is an overview:

The three strategists expecting a 5% gain in 2015 are what Wall Street refers to as “bears” (regarding this redefinition of the term “bear” over the past year, see this).

So basically, the “official” stance on Wall Street seems to be: there is actually no circumstance that could possibly be bearish for stocks. If rates are not hiked, it will obviously be bullish, because ZIRP has been bullish so far. If they are hiked on the other hand, it will also be bullish, because it will mean that the economy is improving.

We think it would be far more accurate to view the interaction between the Fed’s policy actions and financial markets as a “game of chicken” (Bill Fleckenstein deserves credit for having been the first to describe the situation in these terms). This game has been playing out with every new Fed chairperson in recent decades. When Alan Greenspan took over from Paul Volcker in 1986, he inherited an ongoing stock market bubble and a sharply declining dollar. In order to establish his credentials as a worthy inflation fighter, he immediately embarked on a rate hike campaign, until the market crashed. The crash of 1987 was a fateful event, because it established a new modus operandi for the Fed that has been adhered to ever since: when the market declines sharply, open the floodgates and crank up the printing presses to rescue it. This became known as the “Greenspan put”.

When Greenspan exited, the same happened again: Bernanke inherited a combined real estate and stock market bubble and likewise tried to establish his credentials as an “inflation fighter” by raising rates – until the house of cards came crashing down again, to even more devastating effect.

Bernanke exited after having restored bubble conditions with a deft policy of monetary pumping, the scope of which dwarfed anything seen before. Now it is Ms. Yellen’s turn – she inherited the Bernanke echo bubble and ever since she in charge, another baby-steps tightening campaign has been underway. It will continue until something breaks – and the first thing actually has already broken, namely the price of oil. Naturally this is not seen as a concern, whereby we would qualify this by saying “not yet”.

With speculators reassured that the Fed would always come to their aid in times of trouble, ever more risks were taken and ever greater bubbles were blown. The bubble currently underway is in several respects already the biggest in all of history. While the US stock market is “only” in the 94th percentile in terms of the CAPE or Shiller P/E ratio (the 1929 and 2000 peaks were at higher levels in terms of this ratio), it is the most overvalued market in history in terms of the valuation of the median stock and in terms of price to sales. As we have pointed out previously, with respect to sentiment and positioning, never before seen records have been established as well.

An even bigger bubble – and likely the major Achilles heel of the current era of financial excess – is that in low grade debt (both corporate and government debt in emerging and frontier markets, as well as the government debt of a number of developed markets). Never before has such a huge mountain of debt been issued by borrowers of highly dubious creditworthiness in such a short period of time.

While it is unknowable at this juncture when exactly the piper will have to be paid, it would be quite foolish to expect the outcome to be any different from that we have seen after previous bubbles were deprived of sufficient monetary oxygen. Below is a chart of the year-on-year rate of change of US money TMS-2 (the broad true money supply). As you can see, US money supply growth continues to slow down.

US money TMS-2, 12 month growth rate – click to enlarge.

Whether the sanguine 2015 forecasts of Wall Street strategists will come true or not depends only on one thing: whether monetary inflation re-accelerates or continues to slow down. Market participants are continually trying to guess what the monetary bureaucracy will do next, and when it will do it. We believe many are milling around close to the exit door, with the intention of leaving the party “just in time”. After all, missing out on a rally is a grave career risk. Most fund managers actually face less career risk by getting caught in a major downturn than by missing a rally. Still, no-one likes to lose money. Outperforming one’s peers in a downturn can also enhance a fund manager’s reputation considerably.

However, it is in the nature of the game that not everybody can sell at the peak – in fact, only a tiny minority will get out with its gains intact when the denouement comes. We continue to believe that the key to this will be the credit markets – they are likely to come unglued well before the stock market does. The first major warning signs in this respect are already discernible.

Three major asset bubbles egged on by loose monetary policy – click to enlarge.

Conclusion

The interplay between monetary policy and the asset bubbles that have been set into motion worldwide due to unprecedented monetary pumping is becoming ever more interesting. We are in a time when central banks are trying to communicate the thought processes of their decision makers with hitherto unknown clarity, so as to prepare markets for coming changes. And yet, there is no difference in market behavior in evidence as a result.

Market participants are so far in no mood to discount a tightening monetary environment. In our opinion this practically enures that the eventual adjustment will be extremely abrupt and harrowing – not unlike the recent crash in crude oil prices and the Russian ruble. In short, there can be little doubt as to how the “game of chicken” will end – the only thing that is unknowable is the precise timing.

Charts by: St. Louis Fed, StockCharts