Courtesy of Mish.

Dr. Eric Dor, director of IESEG School of Management in Lille, has an update on bank exposure to Greek debt liabilities.

The numbers are roughly in line with figures I have posted earlier, but the breakdowns and other details are interesting.

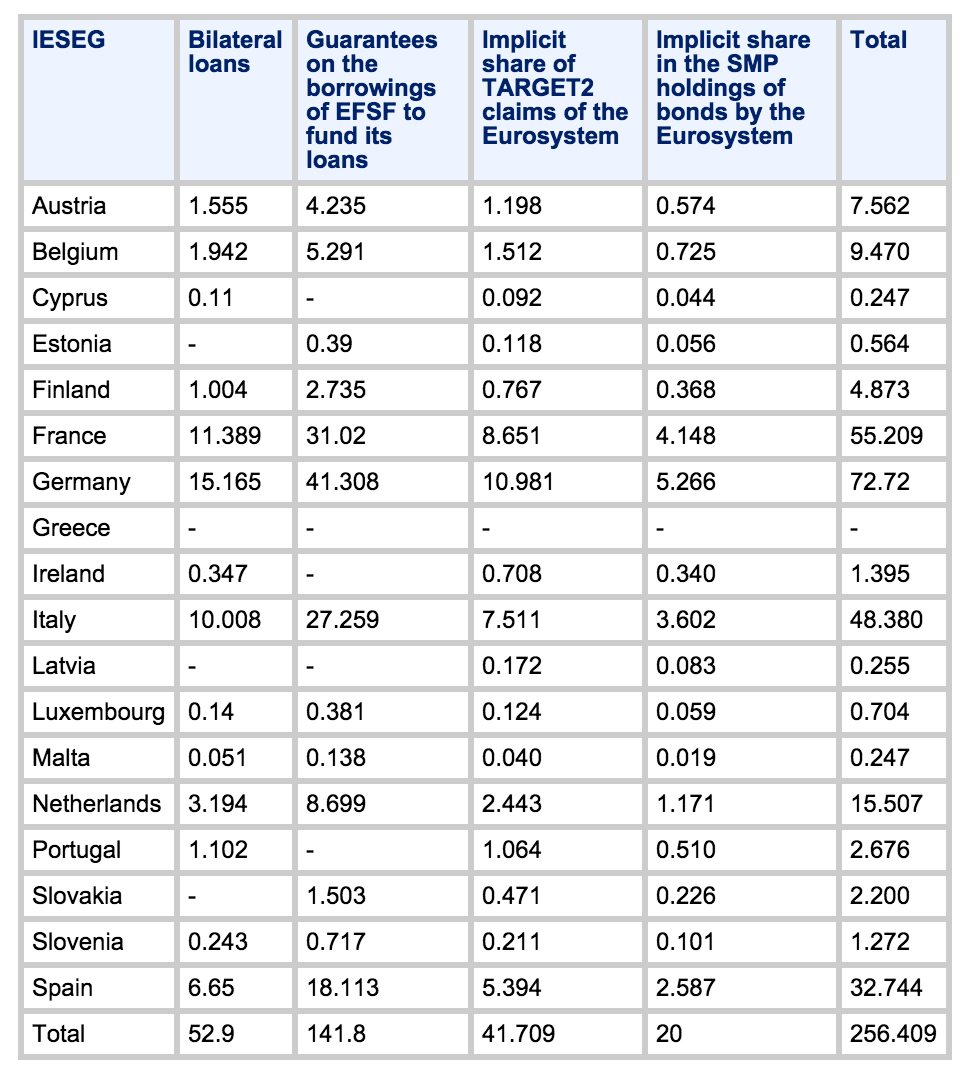

The above table from Exposure of European Countries to Greece by Dr. Eric Dor, IESEG School of management.

Exposure of European Banks

The exposure of European banks to Greek public and private debt is most interesting.

Nearly all the liabilities have been shifted from banks to the public. For example the exposure of German banks to the Greek public sector is now limited to $181 million.

German Bank Claims on Greek Public Sector

The exposure of French banks to the public sector of Greece is now limited to $102 million.

French Bank Claims on Greek Public Sector

…