1.21 TRILLION Dollars!

1.21 TRILLION Dollars!

That's the size of Japan's Pension Investment Fund and, this morning, they raised their allocation for buying domestic stocks from 8% to 25% and that sent the Nikkei (we're short) flying up 200 points, to close at 18,785. That's theoretically $200Bn additional Dollars that will be buying Japanese equities, so of course the market popped on the news. But should it have?

Aside from my minor concern that putting 25% of your pension money into a market that has already popped 30% since October in a country where the rapidly aging population and diminsihing workforce CAN'T AFFORD TO LOSE IT – how about the fact that it was the SAME EXACT ANNOUNCEMENT that popped the Nikkei from 14,529 to 17,520 in October/Novemeber in the first place?

Fortunately for Japanese Central Banksters, you CAN fool some of the people all of the time and re-announcing $200Bn of mindless equity spending did the trick of popping the Nikkei over the top of their trading range. Now we'll see if they can break 19,000 (but we're still betting they won't). Meanwhile let's cheer them on:

Fortunately for Japanese Central Banksters, you CAN fool some of the people all of the time and re-announcing $200Bn of mindless equity spending did the trick of popping the Nikkei over the top of their trading range. Now we'll see if they can break 19,000 (but we're still betting they won't). Meanwhile let's cheer them on:

Oh Nikkei, you're so fine you're so fine you blow my mind, hey Nikkei, hey Nikkei

Oh Nikkei, you're so fine you're so fine you blow my mind, hey Nikkei, hey Nikkei

That should be good for another 200 points… Meanwhile, we're running out of ways to talk up the S&P at 2,110, maybe we need to break into that Social Security lock box and put that into the market. What? Already taken? Oh well…

That should be good for another 200 points… Meanwhile, we're running out of ways to talk up the S&P at 2,110, maybe we need to break into that Social Security lock box and put that into the market. What? Already taken? Oh well…

We had a lot of fun shorting the index Futures yesterday as I made a call in our Live Member Chat Room to short the spike on the Nasdaq (/NQ) at 4,460 (we got burned at 4,450 earlier) and the Russell at 1,236 and we caught a ride down on /NQ to 4,430 for a $600 per contract gain and the Russell fell to 1,228 for a $800 per contract gain. This morning we got an opportunity to re-short at 1,235 and 4,450 so we'll see how things go.

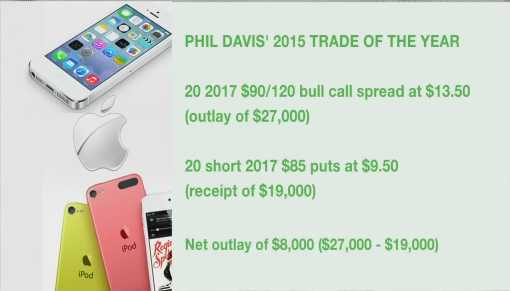

Overall, it's not a market we can get too short on. That's why we've been adding long positions for the past two weeks, even as we ratchet up our short-term protection. We're in very good shape, as would you be if you followed our Stock of the Year pick on AAPL,which is already up $20,200 (+252%), on the way to the expected 525% return (so you can still squeeze a double out, even coming in this late!). In the reveiw (link above) where we last discussed that trade, I also said:

Meanwhile, for those who did miss getting long on AAPL with us earlier in the year, in our Live Member Chat Room yesterday we played Apple's earnings by going long on /NQ (Nasdaq Futures) as they bottomed out at 4,150 at 11:15.

As noted earlier, we're now shorting /NQ at 4,450, up $6,000 per contract from where we called the long on 1/28. Another long idea from that post came with the caveat that, we can lead a horse to water, but we can't make them drink as I noted:

There are so many ways to make money using options and futures and we're happy to teach them to you but, be warned, these are not "tricks", it takes hard work and lots of PRACTICE to be ready to take advantage of these opportunities. Even now, I will tell the cheapskate free readers that the following trade can turn $2,300 cash into $12,000 (up 421%) in 12 months and they won't follow it because they don't understand it and won't believe it:

- 40 CLF Jan 2016 $5/8 bull call spread at $1.20 ($4,800)

- Selling 20 Jan 2016 $5 puts for $1.25 ($2,500)

That spread is already netting $3,400, up 47% from our entry in less than 30 days. Just because we make a long-term entry doesn't mean we can't make some very nice money in the short-term but, as I said, this trade is designed to make 421% by January, so 47% in a month is only a tiny bit ahead of our projected profit schedule.

By no means are we complaining about this insanely pumped-up, overpriced, manipulated market – we're happy to play along for as long as it lasts and we have trade ideas like the ones above for our Members every single day in our Live Chat Room BUT we also don't let ourselves get baffled by the BS – we KNOW it's a fake market and we KNOW this house of cards can collapse at a moment's notice. Hopefully, that knowledge (and our hedging) will keep us from giving back all our gains when and if things do fall apart.

By no means are we complaining about this insanely pumped-up, overpriced, manipulated market – we're happy to play along for as long as it lasts and we have trade ideas like the ones above for our Members every single day in our Live Chat Room BUT we also don't let ourselves get baffled by the BS – we KNOW it's a fake market and we KNOW this house of cards can collapse at a moment's notice. Hopefully, that knowledge (and our hedging) will keep us from giving back all our gains when and if things do fall apart.

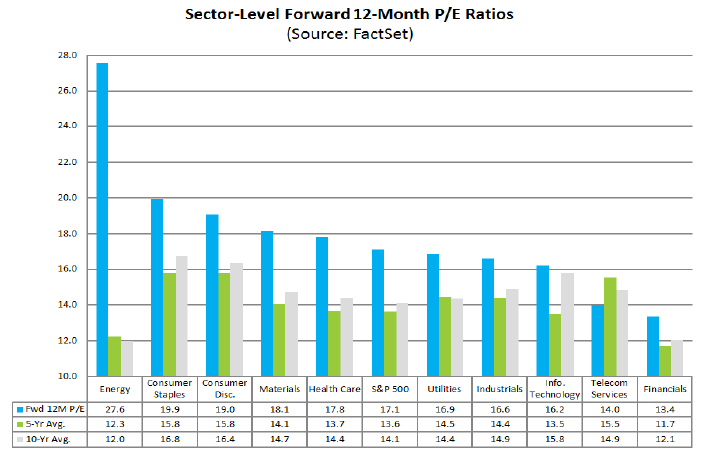

If not, it's certainly not like we're running out of things to buy. We just added CAT on a pullback. Imagine that, Global markets at all-time highs, stimulus everywhere and CAT hit $80 on disappointing earnings. That's silly, isn't it? Either the Global Markets are wrong and the economy sucks or CAT sellers are wrong so we're happy to play CAT bullish while we hedge the globe – just in case p/e ratios ever matter again.