Boy is this getting silly.

Boy is this getting silly.

Apparently, we never learn. Well, we at PSW learn. We've been hedging the crap out of this rally for reasons that should be entirely evident on this chart – earnings are NOT GOOD!

If earnings aren't good, then why are companies racing up to all-time high valuations? Simply because (as I noted yesterday) monetary manipulation is at work.

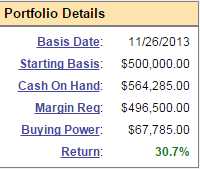

It's not like we haven't gone along for the ride – we're still up 30.7% in our bullish, Long-Term Portfolio, which is the where the vast majority of our allocations are put to work (see "Smart Portfolio Management" in the PSW Wiki). Sure it's been 15 months now, so less impressive than 30% in a year – but not a bad pace (2% per month), nonetheless.

It's not like we haven't gone along for the ride – we're still up 30.7% in our bullish, Long-Term Portfolio, which is the where the vast majority of our allocations are put to work (see "Smart Portfolio Management" in the PSW Wiki). Sure it's been 15 months now, so less impressive than 30% in a year – but not a bad pace (2% per month), nonetheless.

Our Short-Term Portfolio, where we do our hedging, has taken a beating in February as we have spent a good deal of money adding protective short positions to protect the $150,000+ we gained in the Long-Term Portfolio – just in case the market isn't as safe as people seem to think it is. Our STP has dropped from $204,000 in February (up 104% in the same 15 months) to just $193,720 as of yesterday's close, down $10,000 but still a nice, combined $844,000 – up 40.6% as a pair.

We spent that $10,000 on purpose, re-investing part of our 2014 profits into hedges that will (in theory) protect us from a market correction. Long-term, we are still bullish and we intend to ride out a pullback but short-term, it's hard to imagine the market crushing through these nose-bleed levels without some sort of pullback. That's why we're hedging in a nutshell.

We spent that $10,000 on purpose, re-investing part of our 2014 profits into hedges that will (in theory) protect us from a market correction. Long-term, we are still bullish and we intend to ride out a pullback but short-term, it's hard to imagine the market crushing through these nose-bleed levels without some sort of pullback. That's why we're hedging in a nutshell.

As you can see from Doug Short's S&P chart, we're "only" up 151% from our 2009 low on the S&P on an inflation-adjusted basis. In raw numbers, we're up 217% at 2,117 from 2009's Hellish low of 666 but that still doesn't bring us to the levels of those 5 other historic bull runs. It does, however, mark the biggest move made without a significant correction since before the crash of 1929 – so can you really blame us for being just a little bit cautious?

Being cautious is NOT the same thing as being bearish. We buy health insurance even though we are healthy and expect to remain so, we buy fire insurance and have no intention of burning down our home nor do we think it's likely to burst into flames spontaneously. It's just that if it did, the jolt to our assets would be catastrophic – so it would be FOOLISH not to buy insurance to protect ourselves, wouldn't it?

Being cautious is NOT the same thing as being bearish. We buy health insurance even though we are healthy and expect to remain so, we buy fire insurance and have no intention of burning down our home nor do we think it's likely to burst into flames spontaneously. It's just that if it did, the jolt to our assets would be catastrophic – so it would be FOOLISH not to buy insurance to protect ourselves, wouldn't it?

Why then, do people not realize that it is just as important to protect your investment portfolio? Not just your active investments, but also your retirement savings, college plans, etc. If you have money that is tied up in the markets and you never hedge, then your fortunes are at the mercy of timing – as people who needed that money in 2008 or 2009 discovered.

We had a fantastic year last year but what's the point if we don't protect our gains this year? We are NOT OK with giving back 10% in a market correction so we're INVESTING in Portfolio Insurance this year and, if the market keeps going up, we'll miss a bit of the gains but, if the market does correct – avoiding the losses will be MUCH more valuable to our overall wealth-building goals.

We will review our portfolio hedges and hedging strategies in today's Live Trading Webinar (1pm, EST) and hopefully today's action will give us some idea of whether or not Nasdaq 5,000 is a real and sustainable thing. If it is – we are happy to get a bit more bullish and BUYBUYBUY. After all, we're not even using half of our margin in the LTP and, despite the rally, there are plenty of bargins to be had (we added LL yesterday as a Top Trade Alert).

We will review our portfolio hedges and hedging strategies in today's Live Trading Webinar (1pm, EST) and hopefully today's action will give us some idea of whether or not Nasdaq 5,000 is a real and sustainable thing. If it is – we are happy to get a bit more bullish and BUYBUYBUY. After all, we're not even using half of our margin in the LTP and, despite the rally, there are plenty of bargins to be had (we added LL yesterday as a Top Trade Alert).

On the whole, I'd rather be ready for anything than praying for one thing!