Courtesy of Mish.

Of S&P 500 companies providing first-quarter outlooks, MarketWatch reports 84% have been negative as Profit Warnings Pile Up.

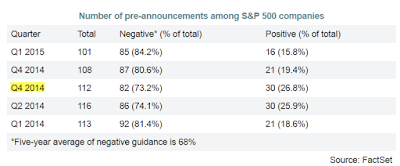

Ahead of the start of earnings reporting season, which unofficially kicks off when Alcoa Inc., reports results on April 8, about 84% of the companies that have provided first-quarter outlooks gave negative outlooks. That’s above the 81% that warned Q1 2014, and the five-year average of 68%.

I believe that yellow highlight I added should say Q3. More importantly, it would have been nice for MarketWatch to actually link to FactSet because it contains some interesting charts and analysis.

Earnings Insight

Let’s dive into the FactSet Earnings Insight Report for first quarter of 2015.

Key Metrics

- Earnings Growth: For Q115, year-over-year earnings for the S&P 500 are projected to decline by 4.6%. If the index reports a year-over-year decline for the quarter, it will be the first time since Q 3 2012 (-1.0%).

- Earnings Revisions: On December 31, the estimated earnings growth rate for Q1 2015 was 4.2%. All ten sectors have lower growth rates today (compared to December 31) due to downward revisions to earnings estimates, led by the Energy sector.

- Earnings Guidance: For Q1 2015, 85 companies have issued negative EPS guidance and 16 companies have issued positive EPS guidance.

- Valuation: The current 12-month forward P/E ratio is 16.7. This P/E ratio is above the 5-year (13.7) average and the 10-year (14.1) average for the index.

- Earnings Scorecard: Of the 16 companies that have reported earnings to date for Q1 2015, 14 have reported earnings above the mean estimate and 10 have reported sales above the mean estimate.

Earnings vs. Price

Q1 2015 Earnings Season: By the Numbers Overview

Analysts and corporations continue to lower expectations for earnings for the S&P 500 for the first quarter. On a per-share basis, estimated earnings for the first quarter have fallen by 8.2% since December 31. This is the largest decline in the bottom-up EPS estimate for a quarter since Q1 2009.

…