From around the Web:

Business Insider presents the 10 things in tech you need to know today. Company mentioned include Apple, Google, Amazon, Yahoo, Facebook and Uber.

Alasdair Macleod at GoldMoney argues "though the Fed would deny it, it is clear from the minutes of the last Federal Open Market Committee (FOMC) meeting that a rise in interest rates has been put off indefinitely" in Central Banks Are Paralyzed At The Zero Bound. Macleod continues,

"The Fed Funds Rate, which is the interest rate the Fed targets to set all other rates, has now been less than 0.25% for six and a quarter years, gradually declining from roughly 0.15% to about 0.10% today. It was set at a target range of between zero and 0.25% in December 2008… If normalisation is the result of economic recovery we will be familiar with the playbook. Demand for money in the economy picks up, and instead of pyramiding bank credit on reserves held at the Fed, the Fed feeds back the excess reserves to the banks by selling government securities into the markets. The bear market in government bonds should be manageable because of underlying pension and insurance company demand coupled with a diminishing budget deficit. This is the long-understood theory behind withdrawing from deficit financing." (Continue)

Forbes explains: Why Oil Could Be Facing A 20-Year Bear Market.

In the past, the usual “oil crisis” was caused by self-serving news items of an oil shortage, causing soaring prices. Just 2-3 years ago, the fear mongers said that the world had “seen peak oil,” meaning that oil production would be on a long term decline and there would be big shortages. Instead, oil production is now at a high

The current crisis is one of plunging oil prices and a glut as far as the eye can see. (Read more)

Share Ferro at Business Insider writes that there is no shortage in oil storage capacity, and it's unlikely that there will be, in Sorry, but there was never an oil storage crisis:

Crude oil storage inventories in the US are at their highest levels in decades. Is that going to cause the price of West Texas Intermediate crude to crash?

Probably not, according to Robert Rapier of Energy Trends Insider.

In fact, we're not even close.

Rapier writes that "oil producers could continue to add a million barrels a week (which is about the average over the past year) for nearly four years before crude oil storage is actually full." …

"We are currently in the season when refinery utilization is lowest. Refiners take equipment offline in fall and spring to do maintenance, so they use less crude oil at this time of year. This maintenance usually peaks in March, and then crude oil demand picks back up as refiners gear up for the summer driving season. The difference in refinery demand between this time of year and summer is generally around a million barrels per day, so even if nothing else changes that storage build should start to flatten. (Continue)

From Harvard Businss Review: The Real Leadership Lessons of Steve Jobs

His saga is the entrepreneurial creation myth writ large: Steve Jobs cofounded Apple in his parents’ garage in 1976, was ousted in 1985, returned to rescue it from near bankruptcy in 1997, and by the time he died, in October 2011, had built it into the world’s most valuable company. Along the way he helped to transform seven industries: personal computing, animated movies, music, phones, tablet computing, retail stores, and digital publishing. He thus belongs in the pantheon of America’s great innovators, along with Thomas Edison, Henry Ford, and Walt Disney. None of these men was a saint, but long after their personalities are forgotten, history will remember how they applied imagination to technology and business.

“The people who are crazy enough to think they can change the world are the ones who do.”—Apple’s “Think Different” commercial, 1997

Doug Gollan at Forbes explains How The Internet Created The Superstar Travel Agent.

The Internet, experts said, was going to kill travel agents. In the nineties, airline and hotel executives gleefully dreamed of cutting out the middleman, saving on commissions, and creating direct relationships with their customers. Instead they got OTAs (online travel agents), whose dominance has led to even higher mass travel distribution costs. Hotel companies are fighting that by offering guests incentives to book directly on their websites. (Continue)

In Strong Dollar, Weakened World, Mark Whitehouse writes at Bloomberg View,

Back when the U.S. Federal Reserve was doing whatever it could to keep credit flowing, companies and governments in emerging markets went on a borrowing spree in dollars. Now, with the Fed changing course and the U.S. currency rising, all that dollar-denominated debt is becoming one of the weakest links in the global financial system. (Full Article)

Time to ask for that pay raise you still haven't gotten? The Economist writes, American firms are having to get back into the habit of granting pay rises. Excerpt:

Carmaking is not the only industry where there is upward pressure on pay. In February Walmart, known for its stingy wages and lack of unions, said it would pay junior staff at least $9 per hour, which is above the federal minimum wage of $7.25. That will affect 500,000 staff and cost $1 billion, equivalent to 6% of net profits. This week Target, another retailer, was reported to have raised its minimum pay to $9 an hour. It so far refuses to confirm this.

The Federal Reserve and many economists may be perplexed as to why hourly wage rises across the economy remain subdued, at just 2% year-on-year in February, even as the unemployment rate has reached a low of 5.5%. But to many bosses it is clear which way the wind is blowing.

From the Huffington Post: New Jersey's Six Flags Great Adventure To Cut 18,000 Trees To Go Solar — A theme park plans to cut down more than 18,000 trees for the construction of what it says will be the largest solar farm in New Jersey.

Bill Bonner at the Acting-Man blog writes in The American Dream Part 2 – We Now Live In A "Pimpocracy":

Today, we continue mouth wide open (Part 1 here) … staggered by the shabby immensity of it … a tear forming in the corner of our eye.

Yes, we are looking at how the US economy, money and government have changed since President Nixon ended the gold-backed monetary system in 1971. It is not pretty.

We already know about the money. Since 1971, it’s been a credit-based, not a gold-based, system. The pre-1971 economy had three key characteristics:

1) It was healthy – Industry made things and sold them at a profit

2) It was fair – Financial progress was fairly evenly distributed.

3) It was solvent – The US was a creditor, not a debtor, nation.

Cartoon by David Horsey

(Continue here.)

Oil Companies Reap Large Gains After Cashing In Hedging Bets (WSJ): "Rocked by months of plunging crude prices, oil producers are harvesting financial bets to raise, for some, much-needed cash…"

Woe Betide the Value Investor: "Research Affiliates is a value shop in the tradition of Ben Graham’s investment philosophy. As investors, we sell the popular securities that have become overpriced and we bargain-hunt for assets that have fallen out of favor. Today, however, we must acknowledge an inconvenient truth. The excess return earned by the average value mutual fund investor has been meaningfully negative."

Neil DeGrasse Tyson Has Some Choice Words For Anyone Who Votes For A Climate Denier Via ThinkProgress:

“I don’t blame the politicians for a damn thing because we vote for the politicians,” he said. “I blame the electorate.” (More.)

9 basic concepts Americans fail to grasp by Alex Henderson via Salon:

To hear the far-right ideologues of Fox News and AM talk radio tell it, life in Europe is hell on Earth. Taxes are high, sexual promiscuity prevails, universal healthcare doesn’t work, and millions of people don’t even speak English as their primary language! Those who run around screaming about “American exceptionalism” often condemn countries like France, Norway and Switzerland to justify their jingoism. Sadly, the U.S.’ economic deterioration means that many Americans simply cannot afford a trip abroad to see how those countries function for themselves. And often, lack of foreign travel means accepting clichés about the rest of the world over the reality. And that lack of worldliness clouds many Americans’ views on everything from economics to sex to religion.

Here are nine things Americans can learn from the rest of the world….

Profit warnings are piling up, as Market Watch reports:

The strong dollar appears to be wreaking more havoc on companies’ outlooks than the bad weather did last year.

The pace of first-quarter profit warnings from S&P 500 companies is running slightly ahead of the pace of set at the same time a year ago, and well ahead of the five-year average, according to data provided by FactSet senior earnings analyst John Butters. (More..)

The coldest place on Earth just got warmer, Antarctica Recorded Its Hottest Temperature Ever This Week.

According to the weather blog Weather Underground, on Tuesday, March 24, the temperature in Antarctica rose to 63.5°F (17.5C) — a record for the polar continent. Part of a longer heat wave, the record high came just a day after the previous record was set at 63.3°F. (Full article, Picture credit: SHUTTERSTOCK)

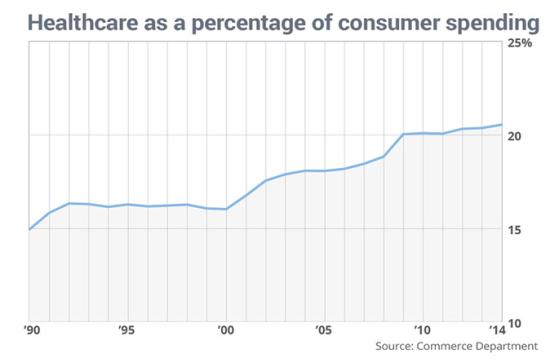

Share of consumer spending on health hits another record (Market Watch)

The percentage of money U.S. consumers spend on health care rose in 2014 for the third straight year to another record high, according to one government measure.

Some 20.6% of total consumer spending in 2014 was devoted to health care, including prescription and over-the-counter drugs, annual figures from the Commerce Department report on personal expenditures show. That’s up from 20.4% in 2013.

Health-care expenses has been rising for decades regardless of government efforts to control costs. The percentage of consumer spending on health care rose from 15% in 1990, topping 20% for the first time in 2009. (Full Article)

The Rise of the Tech Model May Soon Make You Obsolete (Institutional Investor) — Machine learning, artificial intellegence and other technological advances are transforming how pensions, endowments, sovereign funds and institution manage their assets.

Five Conspiracy Theories That Ted Cruz Actually Believes (Think Progress) — The following list is updated from a 2013 ThinkProgress post responding to reports that Sen. Ted Cruz (R-TX) was considering a presidential run…