From around the web:

Oil Companies Reap Large Gains After Cashing In Hedging Bets (The Wall Street Journal)

Rocked by months of plunging crude prices, oil producers are harvesting financial bets to raise, for some, much-needed cash. (Read More)

Woe Betide the Value Investor (Research Affiliates)

Research Affiliates is a value shop in the tradition of Ben Graham’s investment philosophy. As investors, we sell the popular securities that have become overpriced and we bargain-hunt for assets that have fallen out of favor. Today, however, we must acknowledge an inconvenient truth. The excess return earned by the average value mutual fund investor has been meaningfully negative.

Why We Feel So Poor (In Two Charts) (John Rubino at Dollar Collapse Blog)

Among the many things that mystify economists these days, the biggest might be the lingering perception, despite six years of ostensible recovery, that the average person is getting poorer rather than richer. Lots of culprits come in for blame, including the growing gap between the 1% and everyone else, negative interest rates (which starve savers and retirees of income) and the crappy nature of the new jobs being created in this recovery.

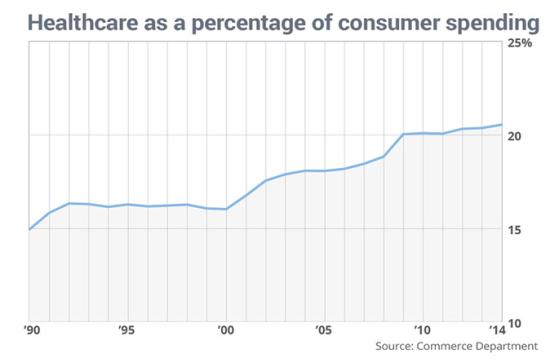

But one that doesn’t get much mention is the changing nature of the bills we’re paying. It seems that Americans are spending a lot more on health care, which leaves less for everything else. Here’s an excerpt from a MarketWatch report of a couple of weeks back, with two charts that tell the tale:

Share of consumer spending on health hits another record

The percentage of money U.S. consumers spend on health care rose in 2014 for the third straight year to another record high, according to one government measure.

Some 20.6% of total consumer spending in 2014 was devoted to health care, including prescription and over-the-counter drugs, annual figures from the Commerce Department report on personal expenditures show. That’s up from 20.4% in 2013.

Health-care expenses has been rising for decades regardless of government efforts to control costs. The percentage of consumer spending on health care rose from 15% in 1990, topping 20% for the first time in 2009. (Full article)

A 4-inch iPhone 6 would be welcomed by many users (but will Apple deliver?) (Venture Beat)

Some people say the smaller phones are more manageable in the hand, while the larger iPh

one 6 is easier to drop. And the iPhone 6, without a case, is easy to drop (as the small dents in mine prove), because of the smooth metal surface of the device. Had Apple put stripes of rougher metal down the sides of the phone this wouldn’t have been a problem. (Continue here)

The Rise of the Tech Model May Soon Make You Obsolete (Institutional Investor)

Machine learning, artificial intellegence and other technological advances are transforming how pensions, endowments, sovereign funds and institution manage their assets.

[Image Credit: Jimmy Turrell]

North Dakota’s Jobless Rate Is the Lowest No Longer (The Wall Street Journal)

For the first time since the depths of the U.S. financial crisis, North Dakota no longer boasts the nation’s lowest jobless rate, a potential hint of trouble for energy-rich states bolstered by an oil boom that has since gone bust.

The shale-rich state was replaced by Nebraska, whose unemployment rate fell to 2.7%. North Dakota’s rate rose to 2.9% from 2.8% in what the Bureau of Labor Statistics called “the only significant over-the-month rate increase” for any state. The last time the state did not have the lowest rate in the nation was October 2008, the Labor Department said. (Read more)

These Are The Cities Where Workers Are Getting Priced Out Of The Housing Market (Business Insider)

Home prices have grown 13 times faster than wages in the housing recovery. That's according to a RealtyTrac study that compared government data on average weekly wages to median home prices between 2012 and 2014.

"Those markets with the biggest disconnect between price growth and wage growth during the last two years are most likely to see plateauing home prices in 2015 until wages catch up," Daren Blomquist, vice president at RealtyTrac, said in the report. (More)

The General Motors Buyback: Beyond The Hysteria! (Value Walk)

Here is a script for a movie about the evils of stock buybacks, with the following players. The victim is an well-managed company in a business with significant growth opportunities and profit potential. The company has delivered products that its customers love, while paying its workers top-notch wages & benefits and invested heavily and prudently in its future. The villain is an activist investor, and for added color, let’s make him greedy, short term and a speculator. In the story, he forces the company to redirect money it would have spent on more great investments to buy back stock. (Full article)

"Electric Cars Are Doing More Harm Than Good" Professor Warns (Zero Hedge)

"Electric Cars Are Doing More Harm Than Good" Professor Warns "An electric car does not make you green… You’re better off filling up at the pump," if you live in Canada. According to a new study by professor Chris Kennedy, even if every driver in Canada made the switch – from gas to electric – the total emissions might not actually go down… since in Alberta, Saskatchewan and Nova Scotia, electric cars generate more carbon pollution over their lifetimes than gas-powered cars. Paging Al Gore… (Read more)

Video Killed The Television Star: Why Total Fragmentation Is The New Norm (Darmano Typepad)

Moment in time—the world seems obsessed with the renaissance of app led live video streaming and the rivalry between MeerKat and Twitter backed Periscope.

Debating who will win is a moot point.

The real winner is digital video in all its forms—especially if it involves a popular app like Snapchat or a mobile optimized popular platform such as Netflix. The demise of traditional television happened somewhere around the time that YouTube began gaining popularity alongside with DVRs that empowered us to skip ads. Since then, things have only gotten worse for traditional, tied to the box television viewing. A recent poll found that millennials find YouTube entertainment and the stars who create it, more relatable and entertaining than TV. (More)

How Successful People Spend Their Weekend (Forbes)

As co-founder of Hotwire.com and CEO of Zillow for the last seven years, 39-year-old Spencer Rascoff fits most people’s definition of success. As a father of three young children, Spencer is a busy guy at home and at work.

What’s the one thing that Spencer refuses to do on the weekend? Work—at least, in the traditional sense.

Jacquelyn Smith shared some interesting insights from Spencer in her article on how successful people spend their weekends:

“I never go into the office on weekends,” Spencer says, “but I do check e-mail at night. My weekends are an important time to unplug from the day-to-day and get a chance to think more deeply about my company and my industry. Weekends are a great chance to reflect and be more introspective about bigger issues.” (Continue)

Economic Growth, Corporate Profits Slowed as 2014 Ended (The Wall Street Journal)

WASHINGTON—Profits at U.S. corporations in late 2014 posted their largest drop in four years, a reflection of an economy weighed down by a strong dollar and weak global demand.

The Commerce Department’s third estimate of fourth-quarter gross domestic product also showed that the economy slowed in the final months of 2014, putting the growth trajectory on a lower path ahead of an apparent slowdown early this year. (More..)

The Bubble Machine Is Complete: Soaring Stocks Push Investors Into Bonds Whose Issuers Buy More Stocks (Tyler Durden, Zero Hedge)

It’s no secret that central bank asset purchases and investors’ desperate hunt for yield have driven yields to record lows on everything from government bonds, to SSAs, to IG, to HY. This has regrettably had the effect of ensuring that spreads signal virtually nothing to investors about the riskiness of any particular issue as the market has become so distorted that it can no longer facilitate price discovery. This is great if you’re a company looking to leverage your balance sheet because it means you can borrow for next to nothing, and the beauty of the whole thing is that what looks like next to nothing to you looks great to investors who have seen yields on their risk free assets fall to zero or below, so finding buyers for new issues is easy (unless you’re a Australian iron ore producer that is). Corporates can then funnel the proceeds from new bond offerings back into their own stocks via buy backs, driving prices higher and artificially boosting the bottom line. Here’s what this looks like:

Intel's Rumored Acquisition Of Altera Could Protect Its Massive Monopoly In Servers (Forbes)

The Wall Street Journal reported on Friday that chipmaking giant Intel is in talks to buy Altera. If this deal goes through, it’ll be one of the largest deals Intel has ever made – Altera’s market cap stood at $13.36 billion when markets closed on Friday.