Why Intel Wants Altera

By Brian Nelson, Tumblr

In its biggest potential acquisition in history, newsletter portfolio holding Intel is reportedly in talks to acquire Altera, though deal terms have yet to be disclosed. We think Intel could pay up to ~$40 per share for the company on the basis of the high end of our fair value estimate range for Altera and still generate value for shareholders, though we wouldn’t expect Altera’s $2 billion revenue stream to be much of a needle-mover against Intel’s $50+ billion revenue base, at least initially. However, there are a few reasons why this would be a strategic win for Intel.

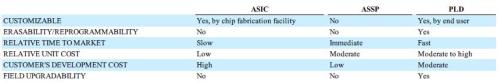

Altera is one of the top standard cell ASIC (application-specific integrated circuit) suppliers in terms of revenue. Due to the rising cost of transistors, however, the ASIC and ASPP (application-specific standard product) models have come under pressure as of late. Altera’s response has been to position itself as one of the two largest manufacturers of field-programmable gate arrays, FPGAs, a sub-segment of programmable logic devices (PLDs) that have much better economics than either ASICs or ASPPs and are poised to displace legacy technologies, almost across the board (ASSP, ASIC, DSP, MCU, CPU, and GPU).

Image Source: Altera

Full article: Brian Nelson's Tumblr — Why Intel Wants Altera.