At $50, This Fake Apple Watch Offers Features the Real One Lacks (Bloomberg)

At $50, This Fake Apple Watch Offers Features the Real One Lacks (Bloomberg)

In Shenzhen's famous Huaqiangbei electronics shopping district, you won't need to stand in any lines or make an appointment for these smartwatches.

At 299 yuan—that's less than $50—you can pick up a smartwatch that looks quite similar to Apple's own creation, complete with replica Digital Crown and touch screen. Like the Cupertino original that went on sale today for seven times the price, the generic offering spotted in this bustling Chinese city features an activity tracker, chat apps, Web browser, and Bluetooth connectivity. A brief demo unveiled shortcomings in the browser with only the text loading on screen.

Spurred by the advent of fracking and other high-tech ways of getting at North America’s fossil fuel reserves, the oil and gas industry has, for the past decade, been drilling at an astounding rate of 50,000 wells per year.

This may be a large continent, but their impact on the landscape is nonetheless enormous. The industry’s total operations, say researchers at the University of Montana, Missoula in a new study, occupy land area three times the size of Yellowstone National Park, “transforming millions of hectares of the Great Plains into industrialized landscapes” that are rarely converted back after the drillers have gone on.

Elaine Wynn Loses Dissident Drive to Retain Wynn Board Seat (Bloomberg)

Elaine Wynn lost her bid for re-election to the board of Wynn Resorts Ltd. after failing to win over enough shareholders to back her dissident campaign.

Wynn, 72, was asking investors to keep her on the board of the casino company co-founded by her ex-husband, Chairman and Chief Executive Officer Steve Wynn, after other directors declined to renominate her. They said a legal dispute between the two over her voting rights is influencing board decisions.

Nomura Forecast: Q1 GDP at 1.0% (CalculatedRisk)

Adverse weather conditions, West Coast port disruptions, the stronger dollar and the decline in crude oil prices all likely hurt economic activity in Q1 2015. Business investment slowed considerably as oil and gas exploration projects halted abruptly and precipitously on lower crude oil prices while manufacturing activity was additionally hurt by the stronger dollar. Also, we believe that lower gasoline prices failed to spur consumer activity as it appears that households decided to save or pay down debt using the extra money saved from lower gasoline prices. Furthermore, adverse weather conditions likely hurt consumer and construction activity. Taken together, we expect headline Q1 GDP to grow by 1.0% q-o-q on an annualized rate with final sales increasing by only 0.1%.

Significant Slip-Or Just A Blip-In Emerging Markets’ Foreign Exchange Reserves? (Bloomberg)

For those looking to invest in emerging markets, a steady growth in foreign exchange reserves—in many cases to higher levels than in most developed markets— has been a positive talking point for the past two decades. This reserve build-up has allowed emerging markets to be dominant buyers of US and European debt. However, a general decline in emerging market foreign reserves last year now has pundits pondering whether there is danger of more significant slippage with potentially ominous market implications.

Greek Finance Minister: It's not complicated – we just have to convince our creditors we're right, and they have to realize they're wrong (BusinessInsider)

Greek Finance Minister: It's not complicated – we just have to convince our creditors we're right, and they have to realize they're wrong (BusinessInsider)

Yanis Varoufakis, the finance minister of Greece, is back to blogging.

He posted on Project Syndicate Thursday, laying out his government's position and attempting to explain why there still hasn't been an agreement between Greece and its creditors.

There’s Nothing Like Disappointment to Keep Debt Markets Booming (Bloomberg)

There’s Nothing Like Disappointment to Keep Debt Markets Booming (Bloomberg)

If not for a steady stream of disappointing economic news, what would corporate-bond investors do?

The fact that company debt has rallied in recent months isn’t so much a reflection of optimism on growth and profits than it is a bet the spate of underwhelming data will keep the Federal Reserve from declaring happy hour over by raising interest rates for the first time since 2006.

Statue Of Liberty Evacuated Following Bomb Threat, Suspicious Package (ZeroHedge)

Statue Of Liberty Evacuated Following Bomb Threat, Suspicious Package (ZeroHedge)

The Statue of Liberty was evacuated Friday afternoon after someone called in a bomb threat and parks police reported a suspicious package, law enforcement sources tell NBC4 New York.

Merkel Calls for Calm as Greek Talks Descend Into Name-Calling (Bloomberg)

Merkel Calls for Calm as Greek Talks Descend Into Name-Calling (Bloomberg)

German Chancellor Angela Merkel called for calm after a euro-area finance ministers’ meeting on Greece descended into acrimony and name-calling.

Finance chiefs meeting in Riga, Latvia, on Friday, let loose at Yanis Varoufakis, their Greek counterpart, as they ruled out making a partial aid payment in exchange for a narrower program of reforms.

IT'S OFFICIAL: THE COMCAST-TIME WARNER DEAL IS TOAST (BusinessInsider)

IT'S OFFICIAL: THE COMCAST-TIME WARNER DEAL IS TOAST (BusinessInsider)

The news leaked yesterday, but now it's official — the merger deal between Comcast and Time Warner is officially dead.

Comcast was offering $45 billion for Time Warner Cable. Combined, the companies would have created the biggest cable company in the country.

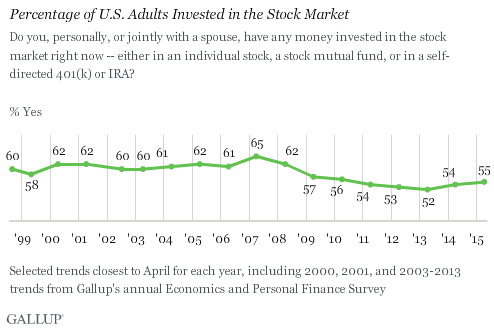

Little Change in Percentage of Americans Who Own Stocks (Gallup)

WASHINGTON, D.C. — Although the Dow Jones industrial average has made significant gains since it plummeted in 2009 after the financial meltdown, Americans are no more likely today than they were six years ago to report having money invested in the stock market. Fifty-five percent of Americans report having money invested in stocks, matching what Gallup found from 2009 through 2011, though up slightly from the low of 52% in 2013.

The happiest countries in the world, according to neuroscientists, statisticians, and economists (BusinessInsider)

An international team of economists, neuroscientists, and statisticians just released their third World Happiness Report, which measures well-being in countries around the world to help guide public policy.

Switzerland topped the list of the happiest nations, and all of the top eight countries were in the global north. Switzerland was followed by Iceland, Denmark, Norway, Canada, Finland, the Netherlands, and Sweden.

It Already Looks Like This Quarter Will Be an Economic Disappointment (Bloomberg)

It Already Looks Like This Quarter Will Be an Economic Disappointment (Bloomberg)

You can now hear the echo of weak first-quarter economic reports in forecasts for the second quarter.

Another round of weaker-than-expected data — this time in the form of the March durable goods orders report released this morning by the Commerce Department — is casting doubt on the assumption that the U.S. economy will rebound in the second quarter after a series of shocks slowed growth in the first three months of the year.

WTF Chart Of The Day – Chinese New Share Accounts Edition!!!! (ZeroHedge)

We've all seen Chinese stocks explode in the last year; we've all seen margin lending soar to fund this exuberance; we've all read the dominant buyer in this trading frenzy is high-school-educated housewives; and we've all seen the analogs to the 2000 dotcom bubble. But, we guarentee you have never – ever – seen anything like this…

The number of new A-Share accounts opened just last week was a mind-boggling 3.25 million!!! That is double the number opened in the peak euphoria stage of the 2007 bubble…

Meet The Richest Person in the World's Happiest Place (Bloomberg)

Meet The Richest Person in the World's Happiest Place (Bloomberg)

Ernesto Bertarelli has every reason to be happy. His $15.8 billion fortune makes him the richest person in Switzerland, the world's happiest place, according to a new survey. TheWorld Happiness Report 2015 names the alpine nation of 8 million people as the happiest country in the world, followed by Iceland, Denmark, and Norway.

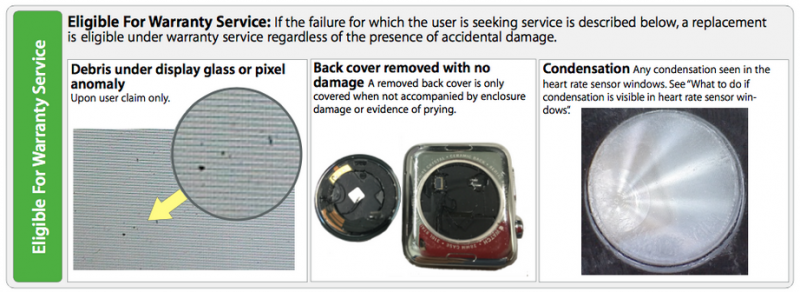

Apple Outlines Types of Apple Watch Damage Eligible for Warranty Service (MacRumors)

Apple Outlines Types of Apple Watch Damage Eligible for Warranty Service (MacRumors)

MacRumors has obtained official Visual Mechanical Inspection information for the Apple Watch that reveals what type of damage is eligible for warranty service, out-of-warranty service or no service at all. These guidelines are adhered to by Apple authorized service providers and are based upon Apple's standard 1-year limited hardware warranty for the Apple Watch.

Pimco’s Kiesel Sees Bubble in $3 Trillion of Negative-Yield Debt (Bloomberg)

Forget high-yield bonds. The real froth in markets can be found in the swelling pool of negative-yielding government debt from Europe to Japan.

That’s according to Mark Kiesel, chief investment officer for global credit at Pacific Investment Management Co., who’s increasingly wary of investors paying governments from Spain to Switzerland to lend to them.

The Old Models Of Work Are Broken (ZeroHedge)

The only sustainable way to avoid being commoditized is to learn to create value in ways that cannot be commoditized.

Though we are still in the early stages of web-enabled automation, it's already evident that the old models of work are broken–though few are willing to admit it.The primary model of work is being an employee in a hierarchy–Corporate America or the state (government) or a government-funded industry (defense, higher education, R&D, Medicare, etc.)

Mayweather-Pacquiao Resale Tickets Selling for $10,350 Record (Bloomberg)

Mayweather-Pacquiao Resale Tickets Selling for $10,350 Record (Bloomberg)

Resale tickets for the May 2 fight between Floyd Mayweather and Manny Pacquiao are selling at an average of $10,350 following Thursday’s public sale, still at record levels.

Lower-bowl seats on ticket aggregator SeatGeek are going for an average of $11,753, while upper-level seats are going for $7,218. The average is a 3.5 percent increase from listings before the public sale.

See the 50 Best Images Taken by Hubble (Time)

See the 50 Best Images Taken by Hubble (Time)

The best space machines reveal their purpose with a single glance. The gangly, leggy lunar module could only have been a crude contraption designed to land on another world. A rocket, any rocket, could only be a machine designed to fly—fast, high and violently.

And so it is with the Hubble Space Telescope—a bright silver, 43 ft. (13 m) long, 14 ft. (4.2 m) diameter cylinder, with a wide open eye at one end and a flap-like eyelid that, for practical purposes never, ever closes. Since shortly after its launch on April 24, 1990, that eye has stared and stared and stared into the deep, and in the 25 years it’s been on watch, it has revealed that deep to be richer, lovelier and more complex than science ever imagined.

Greek finance minister tells magazine: Grexit no bluff if more austerity imposed (Reuters)

The risk that Greece would have to leave the euro if it has to accept more austerity is no bluff, Greek Finance Minister Yanis Varoufakis told a French magazine, saying that no one could predict what the consequences of such an exit would be.

In a conversation with philosopher Jon Elster conducted at the end of March and published in France's Philosophie Magazine, Varoufakis, a specialist in game theory, said this was not the time to bluff over Greece's debt talks.

These U.S. Companies Are Hurting From Venezuela's Hyperinflation (Bloomberg)

Every time Venezuela introduces a new, weaker currency exchange rate, some of the world's largest companies face the decision of whether or not to adopt it. If they eventually do switch to the less favorable rate, it can result in multimillion-dollar charges that drag down balance sheets and earnings statements.

James Bond needs $5 million to hold a Sony phone, and he still doesn't like it (TheVerge)

James Bond doesn't work for free. He isn't just some gun for hire. He has standards, and values, and if you want him to use your smartphone in a movie you better come prepared with "a solid financial proposal." Because if Bond doesn't think your products are very good… Well, let's just say $5 million dollars will get him to hold your phone, but those are just table stakes.

How the World of Fine Art Gets Financing (Bloomberg)

How the World of Fine Art Gets Financing (Bloomberg)

Traffic on New York’s Park Avenue came to a standstill for two nights in March of last year while a construction crew unloaded seven massive metal sculptures by Alice Aycock.

“Park Avenue Paper Chase,” a four-month long installation displaying Aycock’s works, cost more than $1 million to produce, and it was up to Aycock’s gallery Thomas Schulte to foot most of the bill. Rather than come up with the funds itself, the gallery turned to Fine Art Partners, a Berlin firm that provides financial services to the art world, to pay for the show in return for a slice of the proceeds.

An Academic Job Slump is Making Graduate Students Depressed (Bloomberg)

An unforgiving job market and insufficient emotional support can make graduate school a tough slog—so much so that, at the University of California at Berkeley, 47 percent of Ph.D. students and 37 percent of master's students appear to be depressed, according to a new report.

Machinery Makers at Center of U.S. Capital Spending Slowdown (Bloomberg)

Machinery Makers at Center of U.S. Capital Spending Slowdown (Bloomberg)

Business investment is slowing and U.S. machinery makers are suffering the brunt of the damage from slumping energy exploration, a stronger dollar and tepid overseas markets.

Bookings for non-military capital goods excluding aircraft, a proxy for future corporate spending on new equipment, unexpectedly dropped 0.5 percent in March, a seventh consecutive decline, data from the Commerce Department showed Friday in Washington. Producers of machinery, including oil-drilling equipment and turbines, saw a 1.5 percent slump in demand.

"I’m Not Crazy, I’m Scared" – Why For One Trader, This Time It Is Different (ZeroHedge)

The SPX flirted with all-time highs. The Nasdaq Index made 15 year highs; Chinese equities, and so many other equity indices are flying. Bonds sold off this week, but the German 10-year yield is still ~17bps, the U.S. 10-year yield unable to get beyond 2%, and Greek bonds had a two-day rally that would be truly impressive if it wasn’t on volume that made it just an exercise moving wide bid/offer spreads, representing sentiment not trading.

The USD is selling off on the view that Greece is saved, the Fed is scared, and a “we can’t sit with positions because it never works” mentality. The only really new thing the market needs to digest is that commodities may be nearing a bottom

Happy days seemingly, but there have been some very discordant and troubling comments from the creme de la creme of smart – and big – investors.

Puerto Rico Agency Says Creditor Plan Adds $3.1 Billion Cost (Bloomberg)

Puerto Rico’s power utility disagrees with a proposal from bondholders to modernize the agency and fix its finances as a contract between the parties is set to expire at month-end.