Apple will return $200 billion to shareholders (Business Insider)

Apple will return $200 billion to shareholders (Business Insider)

In a statement, Apple CEO Tim Cook said that "most of our program will focus on buying back shares."

The company said it plans to tap debt markets to fund this program.

The iPhone maker reported earnings and revenue that topped expectations, and in after hours trade on Monday, shares of the company were up about 2%.

A Giant Preview of This Week's Economic Data (Bloomberg)

The two main events in the coming week are the April FOMC meeting and the initial look at first-quarter GDP growth, although there is a smattering of other noteworthy economic releases also scheduled. Consumer confidence (Tuesday) and unit motor vehicle sales (Friday) should provide greater clarity on the extent to which consumer spending will build upon decent gains in March. The Employment Cost Index (Thursday) will provide a more comprehensive update on wage inflation at the start of the year. Finally, the Chicago PMI and the manufacturing ISM will be scrutinized for evidence as to whether the factory sector is being further depressed by strong-dollar headwinds.

Japan Retail Sales Slump Flashes Warning Signal for Kuroda (Bloomberg)

Japan’s retail sales fell in March the most since 1998, cutting against central bank chief Haruhiko Kuroda’s view that cheaper energy will give a boost to the world’s third-biggest economy.

Pope Francis Steps Up Campaign on Climate Change, to Conservatives’ Alarm (NYTimes)

Pope Francis Steps Up Campaign on Climate Change, to Conservatives’ Alarm (NYTimes)

Since his first homily in 2013,Pope Francis has preached about the need to protect the earth and all of creation as part of a broad message on the environment. It has caused little controversy so far.

But now, as Francis prepares to deliver what is likely to be a highly influential encyclical this summer on environmental degradation and the effects of human-caused climate change on the poor, he is alarming some conservatives in the United States who are loath to see the Catholic Church reposition itself as a mighty voice in a cause they do not believe in.

Tesla Rises as Analysts Cite Energy Storage Opportunity (Bloomberg)

Tesla Motors Inc. climbed the most in three weeks after two analysts said the electric-car maker’s plan to offer storage batteries for homes and businesses is a growth opportunity.

Are the Good Times Over? (Project-Syndicate)

STANFORD – In the 25 years before the Great Recession of 2008-2009, the United States experienced two brief, mild recessions and two strong, long expansions. Globally, incomes grew briskly; inflation abated; and stock markets boomed. Moreover, the recovery from the last major slump, in the early 1980s, brought about a quarter-century of unprecedentedly strong and stable macroeconomic performance. This time, however, the return to growth has been much more difficult.

One Of The Only Ways To Get Really, Really Rich (BusinessInsider)

One Of The Only Ways To Get Really, Really Rich (BusinessInsider)

Want to be remarkably successful? Want to get really rich? (While there are many ways to feel "rich," in this case we're talking about monetary wealth.) Then check out this little gem of an investment opportunity.

It's a simple investment. You only have to invest almost all of your money. On the upside, after a year you might earn 3 percent more. The downside? Any day you could lose it all, for reasons usually outside your control and that you will almost never see coming.

Jeff Bezos Is Now Richer Than Three of the Four Wal-Mart Heirs

mazon.com Inc.'s first-quarter results sent a jolt into the fortune of Jeff Bezos Friday, making him richer than three of the four Wal-Mart heirs, according to the Bloomberg Billionaires Index. The online shopping giant increased sales 15 percent, beating analysts expectations, and broke out results for its Web Services cloud computing unit for the first time. Bezos's fortune jumped $4.9 billion to $40 billion making him the world's 10th-richest person. The jump puts him on par with Wal-Mart founder Sam Walton's daughter-in-law, Christy Walton, the richest woman in the U.S.

Apple Finds Bigger Is Better When It Comes to IPhone Sales (Bloomberg)

Bigger is turning out to be better for Apple Inc.’s iPhone.

A second blockbuster quarter of smartphone sales suggest the larger-screened iPhone 6 and 6 Plus, introduced in September, may help the Cupertino, California-based company keep demand for the device alive for longer than previous models.

Here's How Restaurants Manipulate Menus To Make You Spend More Money (HuffingtonPost)

Here's How Restaurants Manipulate Menus To Make You Spend More Money (HuffingtonPost)

Americans are spending more on eating out than ever before, and restaurants are doing everything they can to up the bill. Professionals known as "menu engineers" work to increase the amount of money consumers will spend by looking at the profitability, placement and popularity of certain items.

Last week, Mental Floss published some of the psychological tricks menu engineers use to persuade diners to order more expensive items. Restaurant consultant Aaron Allen told the outlet that removing the dollar sign from prices makes customers more likely to spend more money. "We get rid of dollar signs because that’s a pain point,” he said. “They remind people they’re spending money." To eliminate that "pain," restaurants sometimes even spell out prices.

Treasury ETFs Inflows Outpacing All Other Bond Funds This Month (Bloomberg)

Exchange-traded funds that hold U.S. Treasuries are seeing more cash inflows this month than any other fixed-income funds for the first time this year.

Is Your Job ‘Routine’? If So, It’s Probably Disappearing (WSJ)

The American labor market and middle class was once built on the routine job–workers showed up at factories and offices, took their places on the assembly line or the paper-pushing chain, did the same task over and over, and then went home.

New research from Henry Siu at the University of British Columbia and Nir Jaimovich from Duke University shows just how much the world of routine work has collapsed. The economists released a paper today, published by the centrist Democratic think tank Third Way, showing that over the course of the last two recessions and recoveries, a period beginning in 2001, the economy’s job growth has come entirely from nonroutine work.

Rangers Playoff Run Could Ice Clapton’s Birthday Concert at MSG (Bloomberg)

Rangers Playoff Run Could Ice Clapton’s Birthday Concert at MSG (Bloomberg)

The New York Rangers’ second-round playoff series might force Eric Clapton to delay one of his 70th birthday party celebration shows at Madison Square Garden.

Clapton has concerts scheduled for Friday and Saturday at the Garden, where the Rangers will host the first two games of their Stanley Cup playoff series this week against either the New York Islanders or Washington Capitals.

Why a Greek Default Is Becoming More Likely and Italy Needs to Worry (TheStreet)

Why a Greek Default Is Becoming More Likely and Italy Needs to Worry (TheStreet)

By May 12, Greece is going to have to pay nearly a billion euros to the International Monetary fund and one wonders how it will do so.

The Greek government, sharing these concerns, passed a controversial bill on April 24 mandating local governments to transfer idle cash reserves to the Greek Central Bank. From there, the funds can be borrowed by the state to (theoretically) squeak by its upcoming IMF bill, totaling €967 million ($1.05 billion): some €201 million of interest payments, due by May 6, with a €766 million principle payment coming up on May 12.

Dollar Slumps to Two-Month Low on Signs Stall in Growth Persists (Bloomberg)

The dollar fell to its lowest level in almost two months as U.S. economic reports added to speculation that last quarter’s sluggish growth may persist.

The greenback fell against most of its major peers before a report April 29 that is forecast to show the American economy grew at its slowest pace in a year. An index of services-sector activity in April slumped for the first time since December, indicating the uneven economic growth continued beyond the first quarter, eroding the scope for the Federal Reserve to raise interest rates for the first time since 2006.

End Nuclear Power Now, Says World Uranium Symposium (GlobalResearch)

End Nuclear Power Now, Says World Uranium Symposium (GlobalResearch)

While many pro-nuclear governments regard nuclear power as a clean, low-carbon form of energy, the politicians ignore the carbon footprint of the mines and the consequences for the health of workers. Photo credit: Climate News Network

Uranium mining across the world should cease, nuclear power stations be closed and nuclear weapons be banned, according to a group of scientists, environmentalists and representatives of indigenous peoples.

Sydney Home Prices Surging at 5 Times Wages Fuel Bubble Woes (Bloomberg)

Sydney Home Prices Surging at 5 Times Wages Fuel Bubble Woes (Bloomberg)

Don’t count on a wage increase putting that Sydney home within reach.

Home prices in Australia’s biggest city have surged more than five times faster than wages in each of the past two years, adding to fears of a housing bubble.

Oil-Industry Debt Mounts Up (WSJ)

SINGAPORE—Oil and gas companies are continuing to pile up debt, a trend some warn could extend the slump in energy prices and hit economies reliant on the sector for growth and tax revenue.

Tesla Rises as Analysts Cite Energy Storage Opportunity (Bloomberg)

Tesla Motors Inc. climbed the most in three weeks after two analysts said the electric-car maker’s plan to offer storage batteries for homes and businesses is a growth opportunity.

Meet IBR, The Student Loan Bubble's Dirty Secret (ZeroHedge)

A little over a week ago we asked: “Is The Student Debt Bubble About To Witness Its 2007 Moment?” We were prompted by Moody’s decision to place 14 student loan-backed ABS tranches on review for downgrade as the ratings agency cited the very real possibility that the tranches wouldn’t fully pay down by their maturity date.

‘No One’s Going Back’: Everest Industry Shut for a Second Year (Bloomberg)

‘No One’s Going Back’: Everest Industry Shut for a Second Year (Bloomberg)

Ada Tsang remembers the ground shaking and then trying to zip up a tent flap before the roaring ocean of snow overtook her. Ice and rocks flew into her face and Tsang, a high school teacher from Hong Kong, was slammed to the ground, unconscious.

“Everyone just yelled, ‘Run! Run!,’” she recalled as she recovered in a Kathmandu hospital, her face cut and swollen and her head bandaged all around. “Eventually it caught up and hit everyone.”

Two-Speed Recovery: Small Firms Lag Big Business (WSJ)

The economy has taken longer to recover since the latest recession than previous economic downturns. But that lag is even more pronounced for small businesses, according to new research from Goldman Sachs.

Call it a two-speed economy. While large corporations have generally performed well since the crisis, generating strong revenue growth and boosting wages for workers, business formation has dropped off for small firms and employment growth is tepid.

Colombian Currency Leads Global Gains on Recovery in Oil Prices (Bloomberg)

Colombia’s peso climbed to a two-month high as oil, the South American nation’s biggest export, traded near its highest price this year.

America, Land of the Pothole (BloombergView)

America, Land of the Pothole (BloombergView)

Get in your car and go for a drive just about anywhere in the U.S. You will be confronted with a transportation system desperately in need of a reboot. I'm not referring to a full upgrade to smart roads — the sensor-driven intelligent system that promises to move vehicles more cheaply and efficiently. Rather, I refer to essential repairs: Filling potholes, basic maintenance.

Tesla March Model S Registrations Rise in China, JL Warren Says (Bloomberg)

Registrations of Tesla Motors Inc.’s Model S sedans in China rose 25 percent in March from the previous month, according to JL Warren Capital, in a sign that the automaker’s sales may be improving in the world’s largest auto market.

Austrian Economists Understand Why There Is A Commodity Glut (ZeroHedge)

The worldwide commodity glut is not a surprise to Austrian school economists.

It is a wonderful example of the adverse consequences of monetary repression to drive the interest rate below the natural rate.

Longer term projects, such as expansion of mineral extraction, appear to become profitable. But such is not the case for the simple reason that printing money does not represent an increase in real, saved resources.

Eventually it will be clear that capital has been wasted, what Austrian school economists call “malinvested”.

When Your Kid Moves Out West, She Takes the U.S. Economy With Her (Bloomberg)

When Your Kid Moves Out West, She Takes the U.S. Economy With Her (Bloomberg)

Cranes punctuate Austin’s skyline. Startups skip Boston for Denver’s downtown, where silver boom-era warehouses are transformed into offices. In San Francisco, technology engineers revive long-blighted Market Street.

Cities in the West and Southwest are experiencing economic growth exceeding records set before the financial crisis, with young, educated workers creating housing shortages and traffic jams as they drive up wages.

Effort by Japan to Stifle News Media Is Working (NYTimes)

Effort by Japan to Stifle News Media Is Working (NYTimes)

It was an unexpected act of protest that shook Japan’s carefully managed media world: Shigeaki Koga, a regular television commentator and fierce critic of the political establishment, abruptly departed from the scripted conversation during a live TV news program to announce that this would be his last day on the show because, as he put it, network executives had succumbed to political pressure for his removal.

“I have suffered intense bashing by the prime minister’s office,” Mr. Koga told his visibly flabbergasted host late last month, saying he had been removed as commentator because of critical statements he had made about Prime Minister Shinzo Abe. Later in the program, Mr. Koga held up a sign that read “I am not Abe,” a play on the slogan of solidarity for journalists slain in January at a French satirical newspaper.

Yoga Wars: What a Lululemon Challenger From Goldman Sachs Means for Retail (Bloomberg)

Yoga Wars: What a Lululemon Challenger From Goldman Sachs Means for Retail (Bloomberg)

Rishi Bali makes an unlikely yoga baron. No one would mistake him for a health nut. And until recently, Bali had no experience in marketing, retail, or apparel manufacturing. The warrior poses he was most familiar with were on the trading desks of Goldman Sachs, where he spent much of his career orchestrating interest-rate swaps and other complex financial instruments for big corporate clients.

But Bali, now 41, grew up in the birthplace of yoga, a slice of Northern India in the foothills of the Himalayas. And he loves the practice in a pure, ashram-in-the-1960s sense. When Bali talks about yoga, his eyes squint, his head tilts to the side, and he cracks a blissed-out grin that belies his career in the canyons of Wall Street. Bali also happens to be very good at business.

The Spectacular Collapse of For-Profit Corinthian Colleges (Bloomberg)

The Spectacular Collapse of For-Profit Corinthian Colleges (Bloomberg)

For-profit education company Corinthian Colleges announced that, effective today, it is shutting down all of its 28 remaining campuses. That will mean no more classes for approximately 16,000 students attending Corinthian's various trade schools, including the 150-year-old Heald College. It also means the end of a long collapse for a once-hot company.

9 States That Are Running Out Of Water (HuffingtonPost)

9 States That Are Running Out Of Water (HuffingtonPost)

For many states, the rainy season is over, and most of the Western United States is now locked into a fourth consecutive year of drought. The imminent dry summer is particularly foreboding for California, where more than 44% of land area is engulfed in an exceptional level of drought. This was the highest such share nationwide and the kind of water shortage seen only once a century.

F-35 Engines From United Technologies Called Unreliable (Bloomberg)

F-35 Engines From United Technologies Called Unreliable (Bloomberg)

F-35 engines from United Technologies Corp. are proving so unreliable that U.S. plans to increase production of the fighter jet may be slowed, according to congressional auditors.

Data from flight tests evaluated by the Government Accountability Office show the reliability of engines from the company’s Pratt & Whitney unit is “very poor (less than half of what it should be) and has limited” progress for the F-35, the costliest U.S. weapons system, the watchdog agency said in a report sent to lawmakers this month.

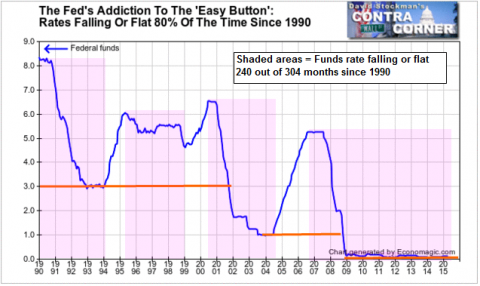

Why Markets Are Manic—-The Fed Is Addicted To The ‘Easy Button’ (WallStreetExaminer)

Later this week another Fed meeting will pass with the policy rate still pinned to the zero bound. The month of May will make the 77th consecutive month of ZIRP—–an outcome that would have been utterly unimaginable even a decade ago, and most especially not with the unemployment rate at 5.5% and after 23 quarters had elapsed since the end of the official end of the recession.

75% of Heat Waves Are Attributable to Climate Change (Bloomberg)

Blame global warming for about 75 percent of the world’s unusually hot days and 18 percent of its extreme snow or rain, according to a new paper in the journal Nature Climate Change.

Heat waves and heavy storms are occurring at least four times more often than they did before carbon pollution started driving up thermometers. Global average temperatures are now about 0.85 degrees Celsius (1.4 Fahrenheit) higher than before industrialization.

Journalists Facing Biggest Threats in Recent Times, Advocacy Group Says (NYTimes)

The ascendance of militant extremists and criminal gangs who abduct and kill reporters, combined with rising government repression in the cause of counterterrorism, has created the biggest threat to journalism in recent times, a press advocacy group said in an annual report on Monday.

Rousseff Skipping Traditional May 1 Speech After Brazil Protests (Bloomberg)

Brazilian President Dilma Rousseff won’t deliver her traditional televised speech to the nation on May 1 after protesters tried to drown out her recent addresses.

Hunting the rich (Economist)

Hunting the rich (Economist)

The horns have sounded and the hounds are baying. Across the developed world the hunt for more taxes from the wealthy is on. Recent austerity budgets in France and Italy slapped 3% surcharges on those with incomes above €500,000 ($680,000) and €300,000 respectively. Britain's Tories are under attack for even considering getting rid of Labour's “temporary” 50% top rate of income tax on earnings of over £150,000 ($235,000). Now Barack Obama has produced a new deficit-reduction plan that aims its tax increases squarely at the rich, including a “Buffett rule” to ensure that no household making more than $1m a year pays a lower average tax rate than “middle-class” families do (Warren Buffett has pointed out that, despite being a billionaire, he pays a lower average tax rate than his secretary). Tapping the rich to close the deficit is “not class warfare”, argues Mr Obama. “It's math.”

Maryland Declares Emergency as Riots Follow Man’s Death (Bloomberg)

Maryland Declares Emergency as Riots Follow Man’s Death (Bloomberg)

Maryland Governor Larry Hogan declared a state of emergency Monday amid riots and looting in Baltimore over police treatment of a black man who died after suffering injuries while in custody.

Hogan activated the National Guard and condemned those responsible for attacks against civilians, businesses and law enforcement officers.

U.S. Stocks Fall as Biotech Slumps; Apple Climbs in Late Trading (Bloomberg)

U.S. stocks fell, retreating from records, as declines in biotechnology companies overshadowed a rally in commodities stocks before Apple Inc.’s results.

Guessing Game: China's "Real" GDP Growth Could Be As Low As 3.8% (ZeroHedge)

In “Ignore This Measure Of Global Liquidity At Your Own Risk” we pointed out that according to the very data points which Premier Li Keqiang himself prefers to examine for an indication of where the economy stands (electricity consumption, rail freight volume, and credit growth), China’s GDP growth is likely running far below the reported 7% figure. Here’s the visual:

Boehner: Congress Doesn't Have Votes to Stop Iran Deal (BloombergView)

Boehner: Congress Doesn't Have Votes to Stop Iran Deal (BloombergView)

The top ranking Republican in Congress privately acknowledged this weekend that his party doesn't have enough votes to overcome a veto of any resolution disapproving the nuclear-weapons deal President Barack Obama hopes to reach with Iran.

Speaking at an off-the-record event Saturday at the Republican Jewish Coalition's meeting in Las Vegas, House Speaker John Boehner told the audience that he didn't expect that more than two-thirds of Congress would vote to overturn a veto from Obama if Congress voted against a nuclear deal, according to four people who were inside the room for the private talk.

The Rumble in Riga: How the EU Lost Patience With Varoufakis (Bloomberg)

The Rumble in Riga: How the EU Lost Patience With Varoufakis (Bloomberg)

When Yanis Varoufakis warned his fellow euro-area finance chiefs of the dangers of pushing his government in Athens too far, Peter Kazimir snapped.

Kazimir, Slovakia’s finance minister, launched a volley of criticism at his Greek counterpart, releasing months of pent-up frustrations among the group at the political novice. They’d had enough of what they called the economics professor’s lecturing style and his failure to make good on his pledges.

Obama Finally Gets Angry At Climate Science Deniers And It’s Hilarious (ThinkProgress)

Obama Finally Gets Angry At Climate Science Deniers And It’s Hilarious (ThinkProgress)

President Barack Obama just gave pitch-perfect delivery to one of the most brilliant pieces of writing on climate change you are ever going to see. At the annual White House Correspondents’ Association dinner Saturday night in DC, Obama used devastating humor to express rare passion and anger over climate science denial.

Obama is famously low key. That’s why on the hit Comedy Central show “Key & Peele,” Keegan-Michael Key plays “Luther, President Obama’s anger translator.” The Correspondents’ dinner, however, is a rare place where the President can cut loose — as long as he uses humor.

Caution Reins in Dollar Gain Before Fed Meeting Amid Weak Data (Bloomberg)

Caution Reins in Dollar Gain Before Fed Meeting Amid Weak Data (Bloomberg)

A gauge of the dollar remained lower after completing a four-day slide on Monday as investors weighed whether a spate of disappointing U.S. economic data will delay the Federal Reserve’s first interest-rate increase since 2006.

The index that tracks the greenback against its major peers closed at an eight-week low in New York before a report on Wednesday forecast to show the American economy grew at the slowest pace in a year. A barometer of services-sector activity slumped in April for the first time since December, indicating the uneven economic growth continued beyond the first quarter.

Key Earnings Reports This Week (Bespoke)

More than 800 companies will report earnings over the remainder of this week, and below is a list of the largest companies set to report. We’ve pulled this data from our Interactive Earnings Season Calendar, which goes out to Bespoke Premium and Bespoke Institutional subscribers on a regular basis throughout earnings season. For each stock, we highlight its expected report date and time, its current consensus analyst EPS estimate, and its historical earnings and revenue beat rates (% of time beating estimates). We also include its average one-day change on its historical earnings reaction days and its average earnings-reaction day volatility.