Courtesy of Mish.

An interesting article came my way today courtesy of a friend “BC”. The article is Deconstructing ShadowStats. Why is it so Loved by its Followers but Scorned by Economists? by Ed Dolan.

Mish readers likely know that I believe inflation to be understated, and that I also believe Williams’ ShadowStats is wildly on the high side. For example, please consider GDP, Real GDP, and Shadowstats “Theater of the Absurd” GDP.

I have also mentioned food inflation on many occasions. While food prices (especially beef) did jump in the last year or so, I recently bought chicken breasts for $.99 a pound and very lean center cut pork chops for $2.49. Sale prices on center cut pork chops have generally ranged from $1.79 to $2.49 for 15 years! Not on sale, I have seen them as high as $5.49.

So I buy pork chops on sale, and freeze them. Same with chicken and beef. While non-sale prices have gone up more, ShadowStats calculations seem absurd.

Want to combat food inflation? Buy a big freezer, buy food on sale, and freeze it.

I never dove in into Williams’ numbers to see where he may have gone wrong. Ed Dolan just did that, with convincing tables, graphs, and commentary.

Here is a snip.

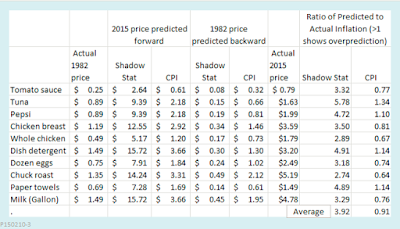

A can of tomato sauce that cost $.25 at Piggly Wiggly in 1982 cost $.79 at my local market in early 2015. Starting from the 1982 price, the CPI predicts that it should cost $.61 in 2015 while ShadowStats predicts that it should cost $2.64. Starting from the 2015 price and working backwards, the CPI predicts that it should have cost $.32 in 1982 while ShadowStats predicts that is should have cost $.08. Based on these calculations, we see that the CPI underestimates inflation, as measured by the Tomato Sauce Index: The ratio of the 2015 predicted price of $.61 to the 2015 actual price, $.79, is .77, an underestimate of 23 percent. The ratio of the ShadowStats prediction to the actual price is 3.32, an overstatement of 223 percent. For tuna, both indexes overestimate inflation, the CPI by 34 percent and ShadowStats by 478 percent, and so on.

Has Williams Simply Made a Mistake?

The fact that the ShadowStats inflation rate fails every crosscheck makes one wonder whether Williams has simply made some kind of mistake in his calculations. I believe that he has done just that. The mistake, I think, can be found in a table given in a post that represents Williams’ most complete explanation of his methodology.

… Williams’ use of a running total of inflation differentials to compute a “cumulative inflation shortfall” of 5.1 percentage points exaggerates the true impact of the methodological changes made by the BLS. A better way to estimate the cumulative inflation shortfall would be to look at the differences between CPI-U-RS and CPI-U before 1983, the year when the BLS implemented the first of the changes that it incorporates in the CPI-U-RS series. That approach is not quite as precise when we use real-world numbers, as Williams does in his original table. As explained earlier, the actual data include statistical noise caused by changes in weighting and in relative price changes among sectors. However, we can approximate the true inflation shortfall by averaging the numbers for 1981 and 1982 from Williams’ table, giving an estimate of -0.45 percentage points….