Courtesy of David Stockman via Contra Corner

Later this week another Fed meeting will pass with the policy rate still pinned to the zero bound. The month of May will make the 77th consecutive month of ZIRP—–an outcome that would have been utterly unimaginable even a decade ago; and most especially not with the unemployment rate at 5.5% and after 23 quarters had elapsed since the official end of the recession.

There never was an Armageddon-like crisis in 2008 that justified all this; it all happened because two emotionally unstable and misguided high officials—-Ben Bernanke and Hank Paulson—-panicked Washington into the utterly false fear that Great Depression 2.0 was at hand.

I debunked this urban legend by chapter and verse in The Great Deformation, but suffice it to say here that not withstanding all the crony capitalist larceny that this financial terrorism enabled, it is impossible with the stock market at 2100—-50% above its pre-crisis level—that there remains any justification for maintaining these “extraordinary policies” seven years later.

In fact, the Fed’s cowardly dithering for yet another meeting this week has precious little to do with the so-called Great Financial Crisis—-the ostensible reason why we ended up with perpetual free money subsidies for financial market speculators. Instead, it is a product of a policy ideology and insular culture that has been building at the Fed and most other major central banks for more than two decades.

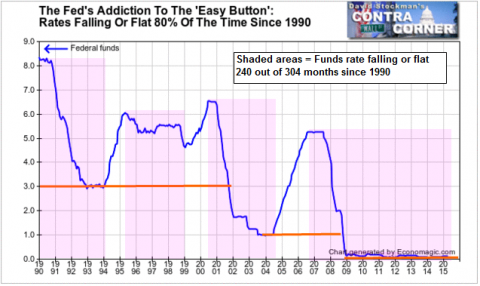

Central bankers now have their big fat thumbs perpetually on the Easy Button because they are addicted to it. In the case of the Fed, it has been in a rate cutting or rate holding mode during 80% of the time since 1990. Stated differently, during 240 of the last 304 months, the Fed has been riding the Easy Button.

The Fed’s Addiction To The ‘Easy Button': Rates Falling Or Flat 80% Of The Time Since 1990 – Click to enlarge

This is not just a case of an excess of zeal or too much of a good thing. In fact, the above chart constitutes just one more piece of evidence that world’s financial system is being destroyed by a few hundred central bankers and a couple of brigades of PhD’s and policy apparatchiks which populate their bounteous payrolls. Over the last two decades, this infinitesimal slice of mankind has engaged in a campaign of mission creep that dwarfs all prior aggrandizements of state power.

The result is that free market price discovery has been extinguished. The central nervous system of capitalism—-the markets for money, debt and other capital securities—-now goose-steps to the pegged prices and monumental liquidity infusions of the central bankers.

The truly diabolical aspect of this development is that central banks have seized an enormous aggregation of power that is utterly unaccountable. As a result, an increasingly threadbare ideology of self-justification goes unchallenged.

Moreover, this exemption from accountability insulates the actions and theories of central bankers in a manner that is different than all other institutions of the modern world. Namely, central banks are flat-out exempt from the discipline of both the market and the democratic process. Indeed, they are the most unaccountable concentrations of power since the era of absolute monarchy.

It is not hard to understand why this astonishing coup d’état has been so easily achieved. It suits the politicians just fine because the resulting massive monetization of the public debt has enabled nearly pain-free fiscal profligacy. The ancient threat of rising interest rates “crowding out” private investment has been eliminated long ago, thereby making “kick the can” the fiscal policy of choice.

Likewise, the central bank coup has generated its own praetorian guard in the financial system. That is, a giant class of speculators now exists in the form of hedge funds, traders, money managers and investment bankers which would not have a fraction of their current girth in an honest, at-risk financial system.

Needless to say, this giant speculative class is showered with immense windfalls in the casino system that inexorably supplants traditional financial markets under a regime of modern Keynesian monetary policy. The speculative class, in turn, returns the favor in the form of political support for the so-called “independence” of the Fed and via embracing the self-justifying ideology of the central bank usurpers.

At its most protean level, this central bank ideology holds that capitalism is chronically prone to accidents and under-performance. Indeed, it is claimed to exhibit a suicidal tendency for recession and depression absent the wise ministrations and counter-cyclical management skills of either the high priests or the monetary politburo——depending upon whether you prefer religious or secular metaphors—-who run the central banks.

This core central bankers’ proposition is absolute hogwash. Every one of the 10 business cycle downturns since 1950 have been caused by Washington, not the inherent tendencies of market capitalism.

Two were caused by abrupt but temporary economic cooling spells consequent to the end of an economic mobilization for war, as in the downturns after the Korean and Vietnam wars. The other eight cycles were caused by the Fed itself after it enabled a runaway increase in household and business credit that resulted in too much inventory accumulation and phony aggregate demand based on unsound credit extensions.

Later this week we will present chapter and verse with respect to these ten so-called business cycles, but the essence of the mater is this: When the war demobilizations were finished after the Korean and Vietnam downturns and after the Fed had brought to a halt the excessive credit growth rates it had first enabled during the other cycles, the nation’s capitalist economy recovered on its own.

In none of the cycles since 1950—including the so-called “deep” recessions of 1975, 1982 and 2008-2009—- was the US economy sliding into an economic black-hole that was self-feeding and irreversible save for the external intervention of the central bank.

In fact, all of these downturns were quite shallow—-once you set aside the inventory liquidation component, which is inherently self-limiting. To wit, when businesses over-invest in inventory owing to a central bank induced credit boom, they do not commit suicide in the process of adjusting their levels of raw, intermediate and finished goods. Instead, the heaviest portion of the inventory liquidation occurs quickly during the course of two or three quarters and then its done.

So the real measure of business cycle downturn is not the inventory fattened oscillations of the GDP number, but the change in real final sales. In not one case since 1950—-not even the so-called Great Recession—has real final sales declined by more than 3%, and, on average, it dropped barely 1% over the ten post-1950 cycles.

There is no reason to believe that the US economy would not have “recovered” on its own after these shallow downturns in real final sales—-downturns which were caused by central bank induced credit booms in the first place. So all along, then, the Fed has been fighting a bogeyman.

More importantly, it has been claiming powers of economic recuperation that do not exist. In fact, the Fed’s historical “counter-cycle” stimulus measures amounted to little more than a cheap parlor trick. That is, slashing interest rates to induce a temporary spurt of credit growth that does not actually generate sustainable gains in real wealth, but merely steals spending from the future by hocking balance sheets and imposing preemptive claims on future incomes.

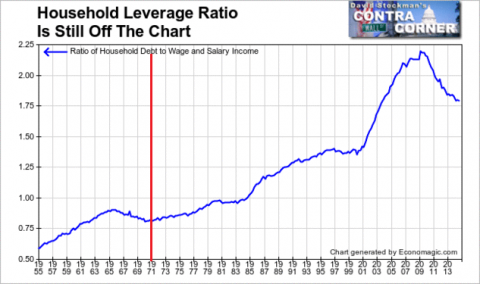

In any event, by the time of the 2008 crisis the Fed’s cheap parlor trick was over and done because American households had reached a condition of “peak debt”. The proper measure of household leverage is the ratio of debt to wage and salary income because sooner or later debt will demand a normalize interest rate that reflects an economic return; and because the Keynesian focus on “disposable personal income” (DPI) as the denominator fails to recognize that 25% of the latter consists of transfer payments including Medicare and Medicaid, and that borrowing by transfer recipients doesn’t amount to a hill of beans in the scheme of things anyway. The preponderant share of the household debt of America is owed by wage and salary workers.

Needless to say, the true peak of household leverage was reached in 2008 after nearly tripling from the pre-1970 level. It has now begun to slowly retrace, but still has a long way to go. Other than the special case of the $1.3 trillion of student loans, which are really education stipends with a lifetime lien, and junk debt financed auto loans, there has been no expansion of household leverage during this cycle.

As a matter of fundamental economics, therefore, when households don’t ratchet up their leverage ratios against income there is no Fed “stimulus”. The massive amounts of new cash that the Fed pumps into the financial system—-and the only thing it is really capable of doing is minting new cash out of thin air by depositing self-manufactured credit into the bank accounts of dealers selling securities to its open markets desk—-never leaves the canyons of Wall Street.

Instead, it ends-up bidding up the price of financial assets–that is, inflating financial bubbles. And this is exceedingly perverse because sooner or later financial bubbles burst when they reach utterly irrational levels and the last sucker is fleeced in the casino. Bursting bubbles, in turn, cause a sharp retrenchment of household and business confidence, resulting in lower spending and intense liquidation of excess inventories and labor accumulated by bullish businesses during the financial bubbles apex.

Needless to say, the central bankers and their Wall Street shills then say I told you so——claiming that the economy is now caught in a circular swirl toward the drain. It can only be “saved” if our indispensable central bankers have the “courage” to crank up the printing presses for another cycle of rinse and repeat.

By now this is getting tiresome as we tip-toe near the edge of the third central bank generated financial bust of this century. But there is absolutely no way of stopping the crash landing just ahead.

The fast money dealers and traders in the inner circle of the casino have now learned to hedge their speculations with downside insurance (i.e. S&P “puts” and like instruments) that is inherently dirt cheap owing to ZIRP and the Fed’s safety nets under the market. Accordingly, they will get out of harms’ way quickly when the break finally arrives, collect their hedging insurance gains and wait for a new round of bottom fishing 40-60% below today’s levels for the market averages and at even lower entry points for the momo names, ETF’s and sectors.

Once upon a time, the proprietors of the central bank might have taken preemptive action in the face of the absolutely lunatic speculation now evident in the stock and bond markets. Back in 1958, for example, Fed Chairman William McChesney Martin, actually began to raise interest rates and increase stock market margin requirements within six months of the recession’s end, arguing that its was the Fed’s job to lean against the wind, dampen speculation and take away the punch bowl before the gamblers got out of hand.

Needless to say, Martin grew up in the Roaring Twenties, experienced the 1929 crash first hand and ran the New York Stock Exchange during the dismal era of the 1930s when they were still trying to pick up the pieces. And on that score, even Alan Greenspan, as late as December 1996, worried in public about “irrational exuberance” and actually did make a tepid effort to raise rates and cool speculation in March 1997.

By contrast, the current Fed will complete another meeting this week without moving interest rates one iota off the zero bound. That will mark 77 straight months of ZIRP. It will occur at a time when the S&P 500 is priced in the nose bleed section of history at 21X reported earnings; when the Russell 2000 is at 70X reported profits; and when margin debt is at an all-time high in absolute terms and near the 1929 peaks relative to GDP.

You might think they would know better by now, but that fails to appreciate the true evil of the central banks’ sweeping usurpation of power. Namely, that they are so caught up in their own self-justifying group think that they are utterly incapable of seeing the massive financial derangement all about them.

A few days ago, the Boston Fed published a note that starkly reflects the intellectual enfeeblement that exists inside the politburo. The note suggested that maybe QE is destined to become a permanent tool of policy because in a world of low-inflation ZIRP is not enough.

But the argument presented as to why the world needs to be afflicted permanently by QE was astonishing. Written by a PhD economist from Johns Hopkins, Michelle Barnes, it argued the following:

During the onset of a very severe financial and economic crisis in 2008, the federal funds rate reached the zero lower bound (ZLB). With this primary monetary policy tool therefore rendered ineffective, in November 2008 the Federal Reserve started to use its balance sheet as an alternative policy tool when it began the large-scale asset purchases.

C’mon!

How do you think the Fed stair-stepped the funds rate down from 8.0% to zero between 1990 and 2008? Well, it wasn’t purely by means of Alan Greenspan’s mumbling or Ben Bernanke’s scary stories to Congressmen in the aftermath of the Lehman meltdown. No, it was accomplished in the same way central banks have always manipulated and pegged interest rates at non-market clearing levels. Namely, by buying securities and expanding their balance sheets.

During the 18 years between 1990 and the eve of the financial crisis, the Fed expanded its balance sheet from $240 billion to $800 billion or by 7% annually. Obviously, that rate is far greater than the sustainable growth capacity of the US economy.

So there is no difference in the Fed’s fundamental policy tool—monetization of the public debt and other existing assets—- before and after QE. It is only a question of magnitude and the degree to which the resulting injections of fiat credit into the financial system falsify financial prices.

Needless to say, the sweeping deformations that have now accumulated in the financial systems of the world owing to this kind of heavy-handed central bank market manipulation have reached an acute stage. Every day there is more evidence that we are approaching a blow-off top—-evidenced once again last night by the Shanghai stock market’s explosive rise on the news that the government is looking for newer and even more ingenious ways to keep it $28 trillion credit bubble expanding.

But the table below is surely the smoking gun. It shows that central bank financial repression has totally deformed the US corporate sector as represented by the S&P 500. The rewards for speculation—-including speculation in the C-suite via rampant financial engineering—-have now become so powerful and insidious that big business is consuming its cash flow and balance sheet borrowing capacity in a mindless pursuit of M&A deals and cash disgorgement to the casino in the form of share buybacks and dividends.

During 2014 virtually 100% of S&P 500s reported profits of $1 trillion were disgorged as shareholder distributions to meet the clamoring demand from the casino and the sheer greed of top executives determined to pocket maximum possible stock option winnings before the system blows.

Even Goldman has warned that this form of slow financial liquidation will not have a happy ending. As shown in one of its tables below, the S&P 500 companies have devoted $4.2 trillion to financial engineering—-M&A, stock buybacks and dividends—-during the last four years (including estimates for 2015) or almost 60% of their cash dispositions during that period.

That amounts to 160 percent of their gross CapEx during this four year period and the emphasis is on “gross”. The fact is, the S&P 500 companies’ CapEx barely equals current year depreciation. So in truth, the 500 largest US based companies are spending virtually nothing on plant and equipment expansion versus more than $4 trillion on financial engineering.

Likewise, total spending for the S&P companies on research and development over this same four year period is just $930 billion or only 22% of the outlays for financial engineering. In all, it is hard to imagine a set of figures which embodies a more perverse campaign of eating the seed corn of the US business economy.

In short, there is a reason that honest price discovery is essential to capitalist prosperity. It is the miraculous mechanism by which capital is raised from savers and investors and efficiently allocated among producers, entrepreneurs and genuine market-rate borrowers.

What the central banks have generated, instead, is a casino that is blindly impelled to churn the secondary capital markets and inflate the price of existing assets to higher and higher levels—-until they ultimately roll-over under their own weight. That is, the central banks have fostered an unstable and destructive system of speculative finance that everywhere and always is the enemy of genuine capitalist prosperity.

The Easy Button addiction of our central bankers is thus not just another large public policy problem. It is the very economic and social scourge of our times.