Here is a list of articles on many topics, sure to keep your weekend reading calendar full.

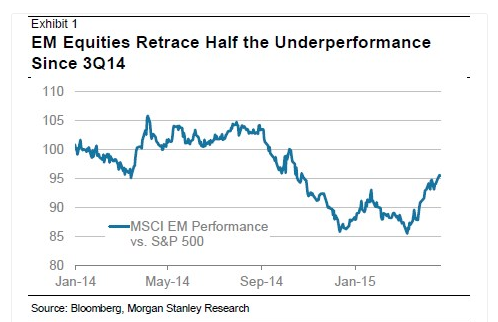

EM Equities Earnings Likely To Disappoint: Morgan Stanley (Value Walk)

EM equities have run ahead of fundamentals and earnings are likely to disappoint materially again, as has been the case in recent quarters, notes Morgan Stanley.

The business of business (The Economist)

The business of business (The Economist)

The secret of the modern company’s success is precisely that it is such an open-ended organisation. Until the 19th century companies had to pursue a public purpose (imperial domination, usually) in return for limited liability. But various governments, starting in Britain and America, swept away these restrictions and let companies form for no other purpose than to engage in business. This simple act of liberalisation did as much as anything to create the modern economy. Open-endedness lets companies evolve: startups have very different purposes to mature businesses.

Low serotonin is mythical cause of depression, says psychiatry professor (Medical News Today)

The idea that depression is caused by low levels of serotonin and that certain antidepressants raise the levels of this neurotransmitter, is a myth, according to a professor of psychiatry writing an editorial article in The BMJ.

Prof. David Healy – author of the 2004 book Let Them Eat Prozac: The Unhealthy Relationship Between the Pharmaceutical Industry and Depression – argues in the journal's latest issue that selective serotonin reuptake inhibitors (SSRIs) have never shown any correlation between a potency of serotonin effect and treatment of depression.

The cheap, convenient cloud (The Economist)

IF THERE were a prize for corporate secrecy, Amazon would have an excellent chance of winning. Interviewing its executives can be like pulling teeth. Even trivial details are not revealed, such as the approximate location of the office of Jeff Bezos, the founder and chief executive, in the company’s headquarters in Seattle. Unsurprisingly, then, its quarterly earnings calls are mostly a dull affair. But financial analysts and many in the information-technology (IT) industry will pay close attention when the e-commerce giant releases results for this year’s first three months, on April 23rd. Nearly a decade after it launched Amazon Web Services (AWS), the company will enlighten its shareholders about the size, growth and profitability of its cloud-computing business.

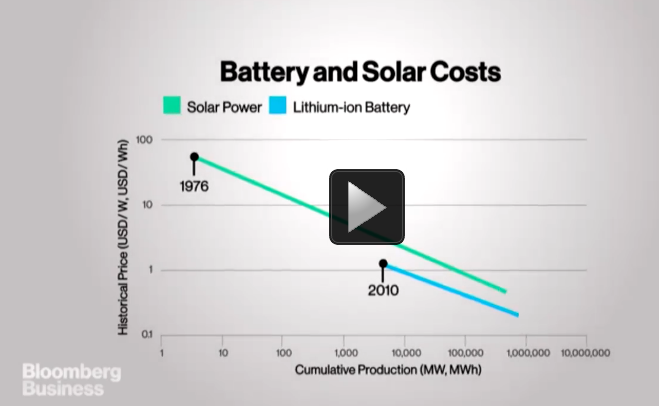

Tesla’s Powerwall Event: The 12 Most Important Facts (Bloomberg)

Tesla just gave us its first look at a new stackable battery system to store electricity for homes, businesses, and the grid. It’s a product that Tesla says will soon bring in billions in annual revenue. Here’s what Elon Musk revealed…

Profits may still boost stocks? (Fidelity)

Investors frequently ask how much longer the six-year bull market in U.S. stocks can last, and whether higher interest rates will hurt the equity market’s momentum.1 One key to answering those questions is the outlook for corporate profit margins, which measure how much a company keeps in earnings from every dollar it generates in sales. Profit margins have been a big driver of market performance, and even though profitability is near 25-year highs for much of the market, we think the U.S. bull market may still have legs, and that the drivers of profitability are still in place. What’s more, we see limited risk for corporate earnings from rising interest rates.

Gain in Orders Signals Abating U.S. Manufacturing Headwinds (Bloomberg)

Orders and production at U.S. factories picked up in April, signaling the slump in manufacturing is abating.

While the Institute for Supply Management’s factory index held at an almost two-year low of 51.5, the more forward-looking indicator on bookings reached a four-month high, according to figures from the Tempe, Arizona-based group. Another report on Friday showed consumer sentiment rose to the second-highest level since 2007.

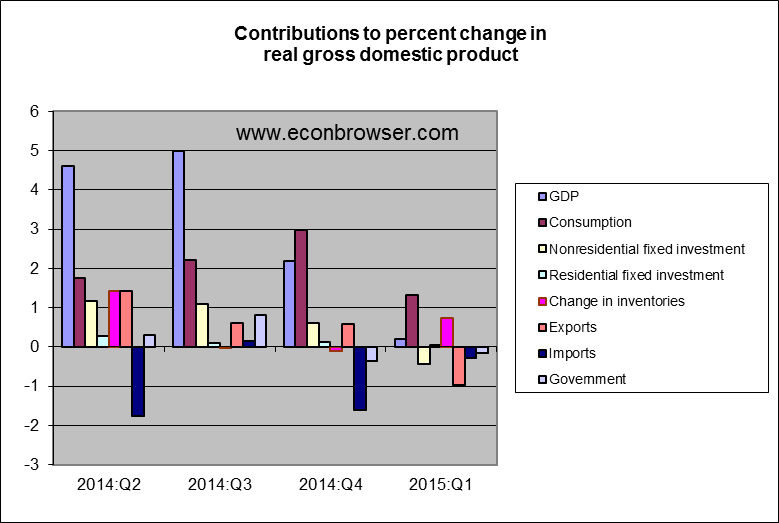

Economy stalls in the first quarter (Econbrowser)

The Bureau of Economic Analysis announced today that U.S. real GDP grew at a 0.2% annual rate in the first quarter. And that was even after a big inventory build-up from goods produced but not sold. Taking out the inventory contribution, real final sales fell by half a percent at an annual rate.

Oil Bulls Are Losing Money Even as Prices Rise (Bloomberg)

Want to capture the rally in oil futures? It's harder than it looks.

Oil futures are up 12 percent this year. Yet because of the quirky way the commodity trades, investors would actually have lost money if they bought the front-month contract on Dec. 31 and kept rolling that bet forward until now.

That's because oil prices now reflect what's known as a "contango" market, where the near-month contract costs less than those for delivery further into the future. So every month, when the most-actively traded futures expire, you have to sell one and buy a more expensive contract to keep the investment going.

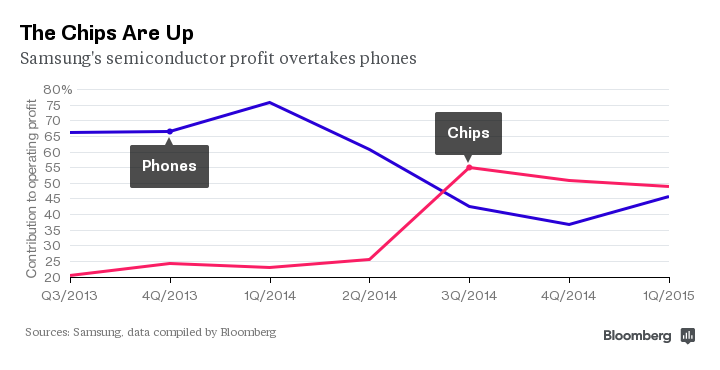

Apple and Samsung Are Friendly Again, and the Competition Should Be Terrified (Bloomberg)

The technology industry’s greatest rivalry may be turning into an unstoppable collaboration. Relations between Apple and Samsung Electronics appear to be thawing since the war waged by Steve Jobs forced these onetime corporate comrades to end lucrative supply contracts and engage in costly legal battles. In August 2014, Apple Chief Executive Officer Tim Cook agreed to begin winding down the patent suits with Samsung, and the two companies are teaming up again on new products.

Buffett Affirms Junk Food, Citing Lack of Smiles at Whole Foods (Bloomberg)

Warren Buffett, whose Berkshire Hathaway Inc. is the largest investor in Coca-Cola Co. and owns See’s Candies, affirmed his confidence in the market for sugary treats, even as the health costs of sweets become better known.

Buffett, 84, told shareholders at Berkshire’s annual meeting Saturday in Omaha, Nebraska, that happiness is important to longevity and that consumers enjoy Coke products.

Warren Buffett, Berkshire Hathaway Inc. chairman and chief executive officer, tours the exhibition floor during the Berkshire Hathaway Inc. annual shareholders meeting in Omaha, Nebraska, on May 2, 2015. Photographer: Daniel Acker/Bloomberg

Warren Buffett, Berkshire Hathaway Inc. chairman and chief executive officer, tours the exhibition floor during the Berkshire Hathaway Inc. annual shareholders meeting in Omaha, Nebraska, on May 2, 2015. Photographer: Daniel Acker/Bloomberg

How a then-24-year-old filmmaker exposed the Taser industry in a bombshell new documentary (Business Insider)

How a then-24-year-old filmmaker exposed the Taser industry in a bombshell new documentary (Business Insider)

Nick Berardini was in his senior year at the University of Missouri in 2008 and working the late shift at the local TV station when a call on the police scanner changed his life.

Berardini got word of an in-custody death by the Moberly Police Department and was one of the first reporters on the scene.

Witnesses told him 23-year-old Stanley Harlan had been pulled over by the Moberly police in front of his house. Harlan got out of his car, had a conversation with the officer who pulled him over for speeding or drunken driving (it's still not clear why he was pulled over), and was allowed to call his mother. But when other officers arrived all hell broke loose.

McDonald's is about to unveil a huge plan to save its business — here are 8 things investors need to hear (Business Insider)

McDonald's is about to unveil a huge plan to save its business — here are 8 things investors need to hear (Business Insider)

McDonald's has lost its way.

The chain is battling declining sales and traffic, a damaged public perception, and a relationship with franchisees that has hit an all-time low.

After six straight quarters of same-store sales declines in the US, the company is finally unveiling a new turnaround strategy.

McDonald’s to Reveal Comeback Recipe: What Options Are on Table? (Bloomberg)

Steve Easterbrook is preparing for his biggest moment as McDonald’s Corp.’s new leader on Monday, when he unveils a much-anticipated plan to put the shine back on the Golden Arches.

The company veteran, who was elevated to chief executive officer in March, is confronting the chain’s worst sales slump in more than a decade. And the challenges have been particularly pronounced in McDonald’s home market. U.S. same-store sales dropped 2.1 percent last year, the biggest decline since at least 2000.

Greece Races to Bridge Gap With Creditors Before Debt Bill (Bloomberg)

Greece is locked in negotiations with international creditors as the country races against the clock to avert a default as early as this month.

While talks have picked up pace in recent days, the two sides are still trying to bridge differences on stalled reforms. It isn’t yet clear that there will be enough progress to clinch a deal in time for the planned May 11 meeting of euro-area finance ministers, some officials warned.

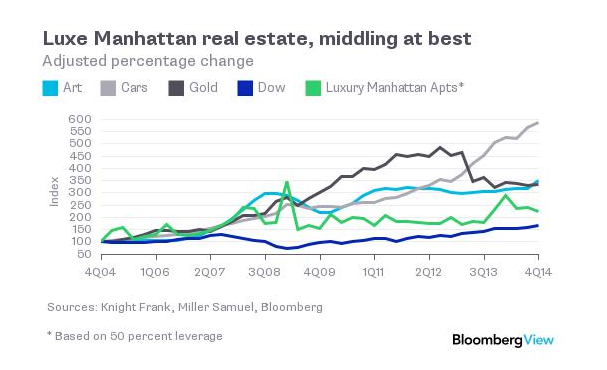

Invest in a Painting, Not a Condo (Bloomberg)

A couple of weeks ago, Laurence Fink, the chief executive officer of BlackRock Inc., observed that "the two greatest stores of wealth internationally today is contemporary art … and apartments in Manhattan, apartments in Vancouver, in London.”

Ever since the start of the financial crisis, wealthy investors around the world have sought out a variety of assets in a risk-averse, low-interest-rate environment. Collectibles such as art and vintage cars, as well as gold, have been particular favorites. Lavish new condos in tall towers and large single-family residences have also have been the beneficiaries of investor efforts to find a secure place to stash money.

Everyone's obsessed with the 'dad bod,' a specific male physique that's suddenly sweeping the nation (Business Insider)

Everyone's obsessed with the 'dad bod,' a specific male physique that's suddenly sweeping the nation (Business Insider)

Meet the "dad bod," a new way to describe that guy who has let his college-athlete body fall to the wayside.

Behind the layer of soft pudge, you can tell this dude once played lacrosse or football. It's a term that's forced itself into the mainstream in the past 36 hours. And everyone's loving it.

The dad bod was brought to light initially by Mackenzie Pearson, a 19-year-old Clemson University sophomore who wrote the premiere "dad bod" 101 about a month ago for The Odyssey — think Elite Daily meets your college paper.