Courtesy of Joshua Brown, The Reformed Broker

Jeff Kleintop puts together the latest on M&A – in both deal volume and deal dollar size – for his latest piece at Charles Schwab. He notes:

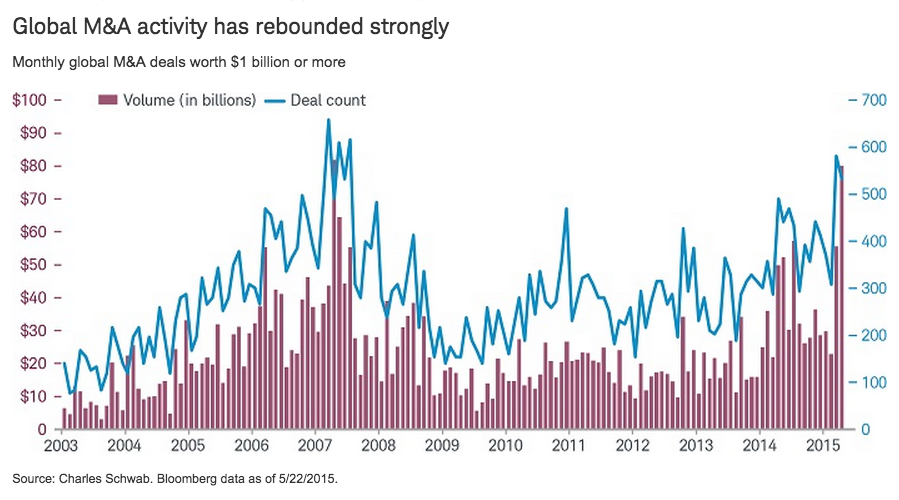

Merger and acquisition (M&A) activity of publicly traded companies around the world has hit an eight-year high, according to data from Bloomberg. Both the number of announced global M&A deals and their size in U.S. dollars in April surged to their highest levels since April 2007. March also posted one of the strongest months for M&A announcements in a decade. This surge comes after about a year and a half of rebounding global M&A activity.

Josh here – Between buybacks and buyouts, no one should be surprised that market participants are behaving as though there is a stock shortage. Because there is, as I explained here: Ladies and Gentlemen, the Stock Market is (still) Shrinking.

.jpg) People are overbidding for quality stocks right now because:

People are overbidding for quality stocks right now because:

a) they have to buy something with all the money pouring out of their asses

b) there is a perception that what they don’t buy today, they’ll be forced to buy tomorrow at a higher price

c) it feels good, so why not?

d) career risk – can’t fall behind that goddamn benchmark for even a goddamn second before the redemption requests come rolling in.

e) capital is cheap free.

f) we’re living longer, there’s a sense that we can tolerate more risk because the new endpoint is 90, not 70. And we’ll need equity-like returns to get there, so let’s take risk now – not later.

.jpg) The M&A boom just gives us one more reason. “If I sell now, chances are the buyer of my shares is either the CFO of the company executing a buyback or an activist who is about to push the stock into a buyer’s embrace.”

The M&A boom just gives us one more reason. “If I sell now, chances are the buyer of my shares is either the CFO of the company executing a buyback or an activist who is about to push the stock into a buyer’s embrace.”

There’s a very 2006-2007ish quality to the desperation to participate. For those of you who weren’t there – the gist of every investment thesis was that such-and-such company is a no-brainer candidate for an LBO and that even if the stock went down, the value of the real estate on the company’s books would more than make up for it.

Substitute M&A / Buybacks today for LBOs and Private Equity 8 years ago and the rationales are largely the same.

Source:

M&A Boom May Be Good News for Investors (Charles Schwab)