Courtesy of Joshua M Brown

Donald Trump’s recent rant about how we “owe” China bazillions of dollars was hilarious but completely data-free and inaccurate (par for the course).

Donald Trump’s recent rant about how we “owe” China bazillions of dollars was hilarious but completely data-free and inaccurate (par for the course).

The next time your drunk uncle brings up the topic of our supposed indebtedness to China, feel free to share the below reality, via Besi Research of Grupo Novo Banco:

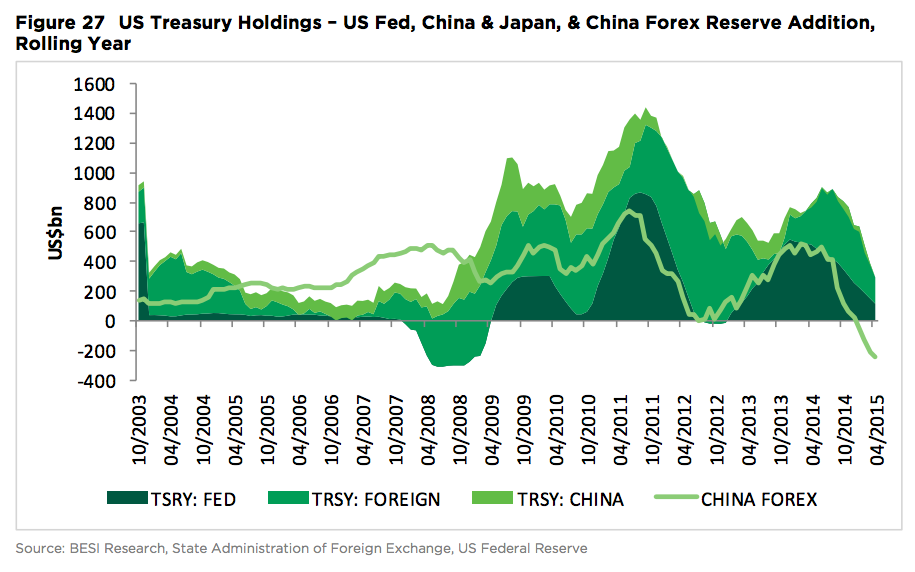

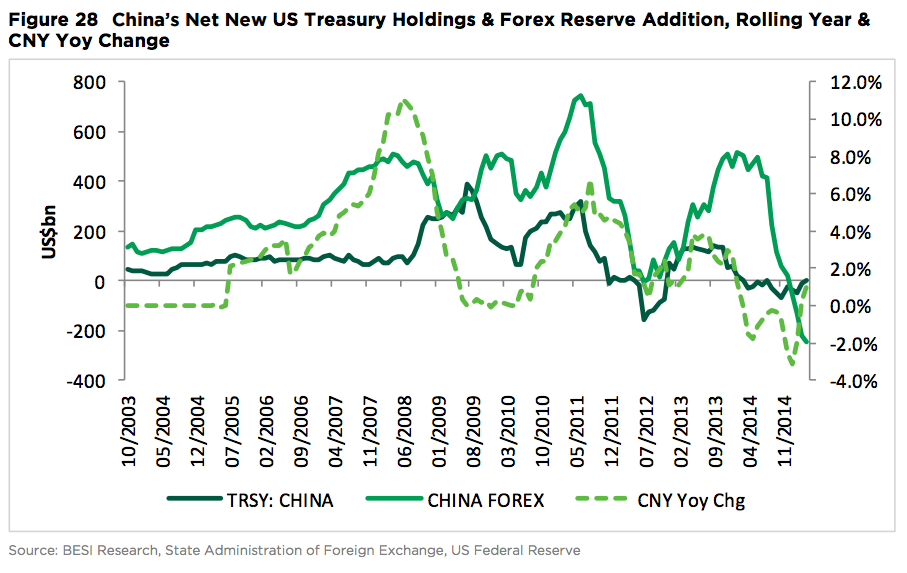

An inevitable consequence of China’s lower balance of payments and increasing use of RMB will be to lower forex reserves and therefore decrease demand for international capital investment, chiefly Treasuries. China’s long-term support for US Treasuries has already come to a halt, with SAFE (State Administration of Foreign Exchange) selling down US$25.8bn of its Treasury holdings in 2014 and US$5.7bn in H2 13, owing to capital outflows (similar to 2012, when China’s property market-induced outflows caused a US$155bn sell-down in the year to July 2012). It bought a net US$37.3bn in Q1 15 and US$2.4bn in Apr 2015, but this is seen as a temporary Greek-induced reallocation from EUR to US$ rather than a long-term reversal.

Even if the current large-scale capital outflows are reversed through capital market liberalisation and the RMB gaining reserve currency status, the fact that the RMB is no longer showing signs of overvaluation and an increasing amount of trade and investment is transacted in RMB means that the excess build-up of foreign exchange reserves is largely at an end.

The maturation of China’s domestic economy and capital markets mean less need for the reinvestment of foreign exchange. It’s a decades-long process that may have already hit a major inflection point. Narratives to the contrary become more and more comical by the day. True we’ll still have bonds to sell and true China will likely remain a buyer, but the ballooning trend that everyone likes to spout off about has reversed course – maybe permanently.

Source:

China: The Great Rebalancing

Grupo Novo Banco – June 23rd 2015