Oil has plunged back to $51 as a deal is reached with Iran.

First Cuba, now Iran and we've pulled out of Iraq and Afghanistan – no wonder Fox is freaking out and calling this a complete disaster – it certainly is for the Defense Industry (ITA) (XAR). Hopefully Trump can start a war with Mexico so we can get our belligerence back on track because it's getting pretty dull out there under Obama.

We called a bottom on oil at $51 in our Live Member Chat Room this morning and already it's up at $52, which is a quick $1,000 per contract gain already. We don't think oil will come ripping back but $50 is likely to hold and $55 is probably the right price, overall. That means it's a good time, which the VIX is still high, to sell some puts on the Oil ETF (USO), which is down around $17.50 after bottoming out at $15.61 in March, when oil was down around $45.

Since we think $55 is the right price for oil (about $19 on USO), then selling the Jan $17 puts for $1.50 is a no-brainer. Selling 10 contracts puts $1,500 in our pocket and obligates us to buy 1,000 shares of USO for $17 ($17,000), which is net $15.50 on it's own and an 11.5% discount off the current price. If you are a typical consumer using 750 gallons of gas per year, that's like giving yourself a $2 per gallon discount.

What you are doing with this kind of trade is locking in the low prices on oil and gasoline while it's down and, if oil prices stay flat or go up – you keep the $1,500 and the contracts expire worthless in January. If oil prices fall further, then you are obligated to own 1,000 shares of USO but they then become a long-term hedge against rising fuel prices while your actual savings come every day at the pump.

What you are doing with this kind of trade is locking in the low prices on oil and gasoline while it's down and, if oil prices stay flat or go up – you keep the $1,500 and the contracts expire worthless in January. If oil prices fall further, then you are obligated to own 1,000 shares of USO but they then become a long-term hedge against rising fuel prices while your actual savings come every day at the pump.

This is similar to the strategy we laid out for our Members at the beginning of this year with "Secret Santa's Inflation Hedges for 2015" though, at the time, we liked the Energy Sector ETF (XLE) as an energy hedge and our trade idea on December 21st was:

XLE is the ETF for the energy market and it’s currently trading at $80.57. If you want to guard against a $1,000 increase in the price of fuel next year, you can, very simply buy 2 Jan 2016 $75/80 bull call spreads for $2.20 ($440) and offset that cost with the sale of 2 2017 $50 puts for $2 ($400) for a total outlay of $40. If XLE simply maintains $80 for the year, you make $960 (2,400%).

XLE has actually fallen further since then (now $74.01) as fuel has stayed cheap, so the hedge wasn't needed to offset price gains. That doesn't mean we lose money because we are following our core strategy of "BEING THE HOUSE – Not the Gambler" and the short $50 puts have fallen to $1 ($200 for 2 contracts) while the Jan $75 calls are still $3.15 and the short $80 calls are $1.35 for a net of $1.80 ($360 for 2 contracts) for a net of $160 from our $40 open.

That means that hedge is up 300% in just over 6 months EVEN THOUGH OUR PREMISE FAILED! That's what BEING THE HOUSE is all about – we sold the premium risk to others so we KNEW that time would be on our side – even if the actual movement of the ETF was not.

Sure we won't get our 2,400% goal but the idea of the hedge was to protect us against rising prices that never came. Now we can cash our the net $200 on that trade (or leave the short puts to get $200 more in 2017) and put it into the USO trade to protect us for the second half of the year.

Sure we won't get our 2,400% goal but the idea of the hedge was to protect us against rising prices that never came. Now we can cash our the net $200 on that trade (or leave the short puts to get $200 more in 2017) and put it into the USO trade to protect us for the second half of the year.

Meanwhile, now that the S&P is back at 2,100, we can begin to consider locking in those gains with something like the S&P Ultra-Short ETF (SDS), which moves 200% against the S&P. SDS is our primary hedge in our Short-Term Portfolio, which protects our bullish Long-Term Portfolio positions so we don't have to do anything silly, like close them out during the recent sell-off.

As you can see from Dave Fry's SPX chart, we have quickly bounced back from our 10-day drop in just 2 days so, like China, it only takes 20% of the volume that flowed out of the market to pump the market back up to the previous levels.

As you can see from Dave Fry's SPX chart, we have quickly bounced back from our 10-day drop in just 2 days so, like China, it only takes 20% of the volume that flowed out of the market to pump the market back up to the previous levels.

If that makes no sense to you – then you understand why we feel it's a good idea to hedge with SDS – just in case reality kicks in at some point.

At the moment, our SDS Sept $19 calls are back where we started, at $1.50. They topped out at $2.50 last week but we weren't confident enough that Greece and China would be fixed, so we decided it was better to keep the hedges though we should have taken Options Alpha's suggestion to sell calls against them last Tuesday. I was greedy and set a target to sell at 2,035 and we missed the mark by 5 points.

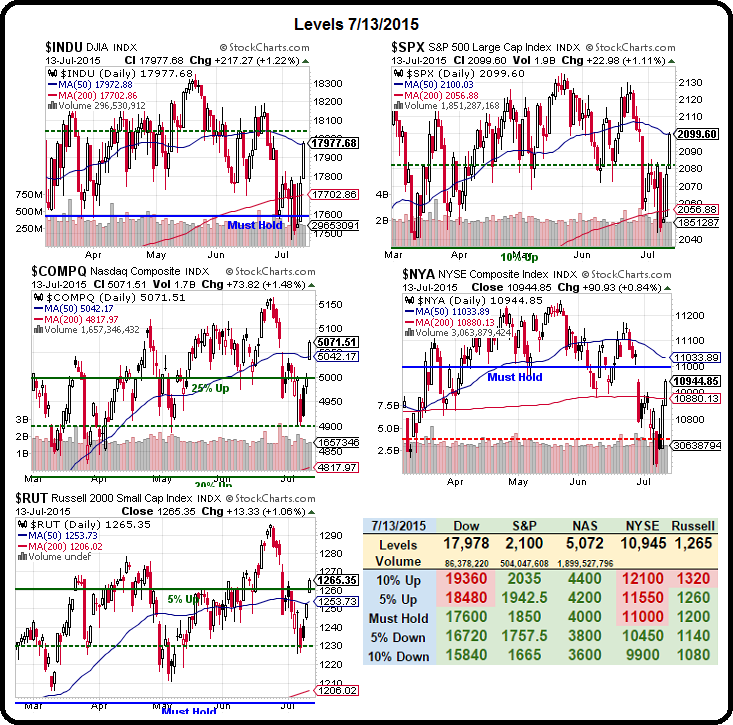

Speaking of marks, now is a good time to look at our 5% Rule™ and the Big Chart and see how our bounce lines are performing:

The bounce lines we've been expecting were:

- Dow 17,725 (weak) and 17,850 (strong) now at 17,935

- S&P 2,075 (weak) and 2,090 (strong) now at 2,100

- Nasdaq 5,025 (weak) and 5,075 (strong) now at 5,072

- NYSE 10,850 (weak) and 10,950 (strong) now at 10,945

- Russell 1,255 (weak) and 1,270 (strong) now at 1,265

So we've captured 2 of our strong bounce lines but the other 3 are all right around the line and we certainly can't call those a win. In fact, what we're going to be watching this morning is for the S&P to possibly fail 2,090, which will indicate another sell-off is likely waiting in the wings – any excuse will do.

Yellen testifies before Congress tomorrow and Thursday and Retail Sales were already a miss today (-0.3% vs +0.3% expected by leading Economorons) and that would send us lower but the markets are still being propped up (here, Europe, China) and economic data is being ignored – for now.